STEEMIT: A Book Summary of Rich Dad, Poor Dad Business Book

This book, Rich Dad, Poor Dad by Robert Kiyosaki, is the first business book that I read. It really influenced my business decisions nowadays and how I perceive if my new venture will grow or not. So, I want to share with you the book’s summary for your own use and reference. Enjoy reading! @joemz

What the Rich Teach Their Kids About Money- That the Poor and Middle Class Do Not!

By Robert T. Kiyosaki With Sharon L. Lechter, C.P.A.

The Big Idea

FINANCIAL LITERACY = FINANCIAL INDEPENDENCE

A true tale of two dads— one a highly educated professor, the other, an eighth grade dropout. Educated dad left his family with nothing, except maybe some unpaid bills. The dropout later became one of Hawaii’s richest men and left his son an empire. One dad would say, “I can’t afford it” while the other, asked, “How can I afford it?”

Rich dad teaches two boys priceless lessons on money, by making them learn through experience. The most important lesson of all is How to Use Your Mind and Time to create personal wealth. Free yourself from the proverbial “rat race”. Learn to spot opportunities, create solutions and “mind your own business”. Learn to make money work for you, and not be its slave.

Rich Dad’s Words of Wisdom:

• You are what you Think.

• A job is a short-term solution to a long-term problem.

• A highly paid slave is still a slave.

• Why climb the corporate ladder when you can own the ladder?

Good Thinking:

“Two roads diverged in a wood, and I— I took the one less traveled by, And that has made all the difference.”

Robert Frost, from ‘The Road Not Taken’

Overview

There is a Need.

The rationale for teaching people financial literacy comes from the fact there is no real job security these days. Even after years of toil, the poor and middle class may find they do not have sufficient funds for their children’s college education, or their own retirement. Why work for a corporation, the government, and the bank all your life? Awaken your financial genius and gain financial independence and freedom!

Lesson 1: The Rich Don’t Work For Money

At age 9, Robert Kiyosaki and his best friend Mike asked Mike’s father (Rich Dad) to teach them how to make money. After 3 weeks of dusting cans in one of Rich Dad’s convenience stores at 10 cents a week, Kiyosaki was ready to quit. Rich Dad pointed out this is exactly what his employees sounded like. Some people quit a job because it doesn’t pay well. Others see it as an opportunity to learn something new.

WORK TO LEARN

Next Rich Dad put the two boys to work, this time for nothing. Doing this forced them to think up a source of income, a business scheme. The opportunity came to them upon noticing discarded comic books in the store. The first business plan was hatched. The boys opened a comic book library and employed Mike’s sister at 1$ a week to mind it. Soon they were earning $9.50 a week without having to physically run the library, while kids read as much comics as they could in two hours after school for only a few cents.

Lesson 2: Why Teach Financial Literacy?

They don’t teach this at school.

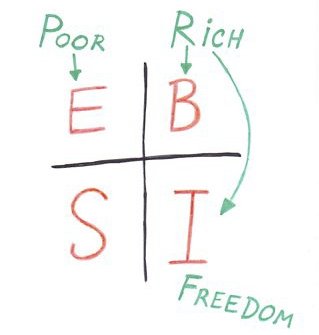

The growing gap between rich and poor is rooted in the antiquated educational system. The system trains people to be good employees, and not employers. The obsolete school system also fails to provide young people with basic financial skills rich people use to grow their wealth. Know your options and use this knowledge to build a formidable asset column.

In an age of instant millionaires it really isn’t about how much money you make, it’s about how much you keep, and how many generations you can keep it.

Steps to get out of the proverbial rat race:

- First, understand the difference between an asset and a liability.

Assets

• Real Estate

• Stocks

• Bonds

• Notes

• Intellectual Property

Liabilities

• Mortgages

• Consumer Loans

• Credit Cards

The poor have day-to-day expenses, the middle class purchase liabilities that they think are assets (i.e., a home or a car), and the rich build a solid base of income-generating assets.

The middle class finds itself in a constant state of financial struggle. Their primary income is wages, as wages increase, so do their taxes. Expenses increase as wages increase. Hence the phrase “the rat race.” They treat their home as their primary asset instead of investing in income generating assets.

The rich get richer because they keep acquiring more assets and investments to generate more income, which far exceeds their expenses.

Reasons why the home is not an asset but a liability:

- People work almost all their lives to pay off a home (30-year loans)

- Maintenance and utilities expenses.

- Property tax

- House values can depreciate.

- Instead of investing in income-earning assets, your money goes out to payments for the house.

Your losses:

- Time that could have been used to grow value in other assets.

- Capital which could have been invested rather than paying home-related expenses

- Education that makes you a Sophisticated investor

If you want to buy a house, first generate the cash flow by acquiring assets, which bring income to pay for it.

Examples of real assets are:

• Apartments for rent

• Real estate

• Businesses that do not require your physical presence. You hire managers.

Average time of holding on to an asset before selling it for a higher value:

1 year

• Stocks (Startups and small companies are good investments)

• Bonds

• Mutual funds

7 years

• Real estate

• Notes (IOUs)

• Royalties on intellectual property

• Valuables that produce income or appreciate

In summary, the key steps to getting out of the rat race are the ff:

1. Understand the difference between an asset and a liability.

2. Concentrate your efforts on buying income-earning assets.

3. Focus on keeping liabilities and expenses at a minimum.

4. Mind your own business.

Lesson 3: Mind Your Own Business

KEEP YOUR DAY JOB BUT START MINDING YOUR OWN BUSINESS.

Kiyosaki sold photocopiers on commission at Xerox. With his earnings he purchased real estate. In 3 years’ time his real estate income was far greater than his earnings at Xerox. He then left the company to mind his own business full time. He knew that in order to get out of the rat race fast, he needed to work harder, sell more copiers and mind his own business.

Don’t spend all your wages. Build a good portfolio of assets and you can spend later when these assets bring you greater income.

Lesson 4: The History of Taxes and the Power of Corporations

Income tax has been levied on citizens in England since 1874. In the United States it was introduced in 1913. Since then what was initially a plan to tax only the rich eventually “trickled down” to the middle class and the poor.

The rich have a secret weapon to shelter themselves from heavy taxation. It’s called the Corporation. It isn’t a building with the company name and logo in brass signage out front. A corporation is simply a legal document in your attorney’s file cabinet duly registered under a government state agency. Corporations offer great tax advantages and protection from lawsuits. It’s the legal way to protect your wealth, and the rich have been using it for generations. Do your own research and find out what tax laws will bring you the best advantages.

The Golden Rule: PAY YOURSELF FIRST.

Rich dad says paying yourself first forces you to create more sources of income to cover your expenses. It’s a simple rule that works like this:

The Rich with Corporations

Earn

Spend

Pay taxes

People who work for corporations:

Earn

Pay taxes

Spend

Key Financial IQ Components:

It helps to take some courses to gain financial literacy; rich dad stresses the importance of learning –

Accounting. It pays to know how to read financial statements. When acquiring businesses or assets you need to quickly see the financial standing of the company you are acquiring. Many grown adults do not know how to balance a balance sheet. In the long term, this knowledge will pay off for you and your business.

Investment Strategy. This skill will sharpen with experience. Talk to investors and observe how they play the game. Kiyosaki and Mike spent many boyhood hours sitting in on Rich Dad’s meetings with brokers, accountants, and attorneys.

Market Behavior. Know the laws of Supply and Demand. No business owner can do without understanding these basic principles of the market. Bill Gates saw what people needed. Open your eyes to opportunities. Look at what sells and who buys.

Law Kiyosaki recommends doing everything you can to grow your business within legal boundaries. Know your corporate, state, and accounting laws.

Lesson 5: The Rich Invent Money

Self-confidence coupled with high financial IQ can certainly earn more for you than merely saving a little bit every month.

Make good use of your time and find the best deals.

An example: In the early 90’s the Phoenix economy was bad. Homes once valued at $100,000 sold for $75,000. Kiyosaki shopped at bankruptcy courts and bought the same houses at only $20,000. He resold these properties for $60,000 making a cool $40,000 profit. After six more transactions of the same manner he made a total $190,000 in profit and it only took 30 hours of work time.

Rich Dad explains there are Two Types of Investors:

1. Buyers of Packaged Investments.

This is when you call a retail outlet, real estate company, stockbroker or financial planner and put your money in ready-made investments. It’s a simple, clean way of investing.

2. The Professional Investor

Design your own investment. Assemble a deal and put together different components of an opportunity. Rich dad encourages this type.

You need to develop three main skills to be this type of investor, namely how to:

o Identify an opportunity everyone else has missed.

o Raise capital

o Organize smart people

Identify an opportunity everyone else has missed.

Learn to identify hidden Freebies in business deals. For example: The real business of McDonald’s isn’t hamburgers. It’s the free real estate underneath each franchise, on every important intersection, in cities all over the world that is the real wealth of its owners.

THERE IS ALWAYS RISK. You need to learn how to manage risk and not avoid it.

Lesson 6: Work to Learn –Don’t Work for Money

The Author’s Odyssey

After college graduation Robert Kiyosaki joined the Marine Corps. He learned to fly for the love of it. He also learned to lead troops, an important part of management training. His next move was to join Xerox where he learned to overcome his fear of rejection. The thought of knocking on doors and selling copiers terrified him. Soon he was among the top 5 salespeople at the company. For a couple of years he was No.1. Having achieved his objective – overcoming his shyness and fear—he quit and began minding his own business.

Learn skills like PR, marketing, and advertising. Take a second job if it means learning more.

A Difference in Education

Schools train professionals. Professionals become so specialized they cannot apply themselves in other fields and need to form unions to protect their jobs. Remember you can have a profession, say, learn to be a pilot if you want to learn how to fly, but at the same time mind your own business.

The rich “groom” the next generation by training the heir in all aspects of running the business. They move him from department to department so he learns how each one relates to the other. Specialization is not the key here, but picking up important lessons from each area and seeing the business as a whole.

Rich Dad groomed Kiyosaki and Mike in the same manner. Mike would later take over Rich Dad’s empire, which included restaurants, convenience stores, and a construction company. Kiyosaki created his own empire with real estate, new products and educational materials.

Three Main Management Skills

- Management of Cash Flow

- Management of Systems (Includes Time with family and time for yourself)

- Management of People

Five Obstacles to Financial Independence

Fear. Don’t play it safe and cling to what you think is secure. If you don’t go for it and think big you won’t be able to earn big.

Cynicism. Don’t listen to advice of others who are not doing what you intend to do. Listen to yourself and those who are doing what you aim to do.

Laziness. Greed is good and fights laziness. Think about the freedom and money you’ll have and you will put in those extra work hours. Change your thinking. Instead of saying “I can’t afford it.” Ask yourself “How can I afford it?” Challenge your mind to create solutions.

Bad Habits. Spending habits should turn into saving and investing habits.

Arrogance. Don’t think you know everything there is to know about money. Listen to others. Enroll in useful seminars.

Ten Steps to Awaken Your Financial Genius:

Find a reason greater than reality, a big dream. Think of the freedom, the lifestyle wherein you control your own time. Think of what you don’t want, i.e. “I don’t like being an employee”.

Use the power of choice, daily. You can choose to watch MTV, or watch CNBC. It’s how you choose to use your time and energy everyday that brings financial success in the long run.

Choose your friends carefully. It pays to have friends who are focused and achieving their goals. Surround yourself with friends you can learn from.

Master a formula. Learn a new one, and learn fast.

Pay yourself first. Practice self-discipline by keeping expenses low. Tenants can pay for your expenses if you rent out apartments or ministorage, for instance. Savings are used for investing and creating more money, not for paying bills.

Pay your broker well. Attorneys, accountants, stockbrokers, and real estate brokers will have more incentive to work harder for you. If they make more money, it means you make more money as well. 3-7% is a good incentive.

Be an Indian giver. It’s the concept behind ROI. (Return on investment) Invest and then take the initial money out after a time when the investment has earned for you.

Buy luxuries last. Let the income from your growing assets afford you the new car. Wait for your asset base to grow first. Middle class people buy luxuries first, on credit.

Find yourself a hero. When you play golf you can imagine you are Tiger Woods. When you do business, you can ask yourself, “What would George Soros have done if he was in my place right now?”

Teach and you shall receive. As in money, love, or friendship. If you give without expecting anything in return, you receive more.

Im flagging not beacuse this is a vulgar copy and paste from google, but because you didn't even left the link from where you got it.