Steemit Tax Calculation and Payment System

What is the easiest way to calculate and pay taxes on our Steemit earnings? Will you read this post to see the system I am using based on my research into cryptocurrency taxation to pay my taxes on the Steem, SteemDollars, and Steem Power I earn through rewards and interest on Steemit? If you are receiving rewards from posting, curation, mining, nodes, or any other cryptocurrency payment system, this post might help you a lot too! If the IRS comes out with new rules for cryptocurrency taxation after I write this, I will put a link here to my updated post.

Writing this post has been very exciting for me because of thinking about how much money, time, fear, and frustration reading it might be able to save you over the next several years! For a faster read, go through just the executive summary below to learn the entire system in about 5 minutes. For the research, discussion, and screenshots, will you continue reading after the executive summary because I have cited my sources and provided further explanations for review including a full tutorial via screenshots of each step? To help others reading along with you, would you make a comment below sharing your experience and ideas on cryptocurrency taxation especially for Steemit rewards because you might help another reader more than this post?

One Sentence Summary: I use a spreadsheet on Airable to record and calculate the Steem and SBD combined with QuickBooks Self-Employed to track income from all of my rewards redeemed from Steemit because according to my research we need to pay both income tax on our Steemit rewards as soon as we redeem them into our wallet in most countries and, if we are in the US or a country with capital gains, we also need to pay tax on the difference when we sell to USD or fiat currency at a higher rate than what we received at.

Executive Summary followed by discussion and links to read more.

- Rewards earned from Steemit are most similar to mining rewards which, according to the US IRS and probably most governments, are taxable income to be reported on the day they are received at the USD or current fiat market rate. While other Steemit users have created well researched posts clearly explaining reasons for not paying tax on Steemit rewards right away, the safest approach for most of us that are not paying for an accountant or CPA to file all of our taxes seems to be simply paying the tax immediately upon receipt. The worst offense that we can commit with taxes is not reporting income and I personally have no interest in being in fear for years of getting an audit because of not reporting my Steem rewards.

- When I click the "redeem rewards" button in my Steem wallet, I count this as beginning the taxable event because prior to redeeming the rewards, I have not taken possession of them. Imagine if UPS tried to deliver a box to my door. Until I sign for it, UPS possesses the package. After I redeem my package, I have the ability to begin further transactions with it such as selling it.

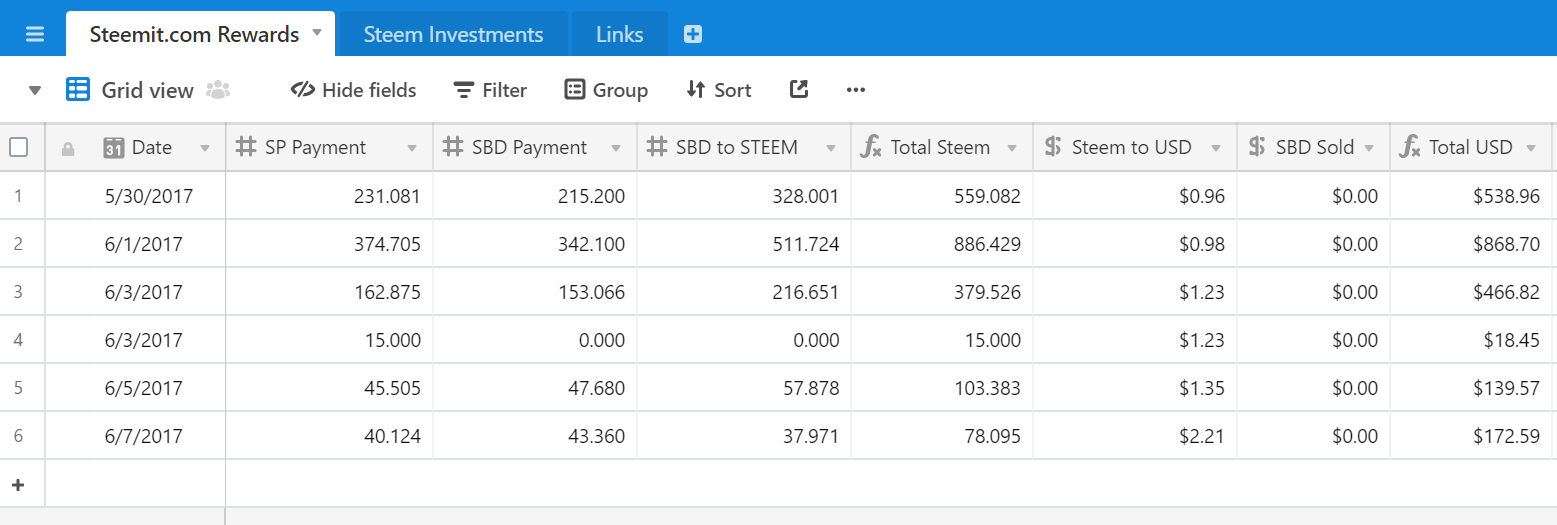

- Using an Airtable spreadsheet with formulas which calculate the USD value of Steem automatically, I input what I received in Steem Power and SBD as outlined by the rewards. For simplicity, if I receive small tips in Steem I just add these to the rewards total. If I receive a larger tip such as $25+ I enter this as a separate transaction on the day it was received.

- Immediately upon receiving SBD I choose one of two actions. Usually I change all SteemDollars to Steem using the marketplace or BlockTrades. With this approach, I then enter the final amount of Steem received from the SBD trade into the spreadsheet. Alternatively, I can cash SBD to any cryptocurrency on Bittrex or to Bitcoin, Ethereum, or Litecoin on BlockTrades on Coinbase which allows me to sell to USD and withdraw to my bank account. In this case I enter the final USD amount cashed out in Coinbase in my spreadsheet.

- To calculate the Steem price, I use http://www.coincap.io/ by entering the 24 Volume Weighted Average Price or VWAP for Steem which then multiplies the amount of final Steem via Steem Power and SBD I received to a total USD I received that day.

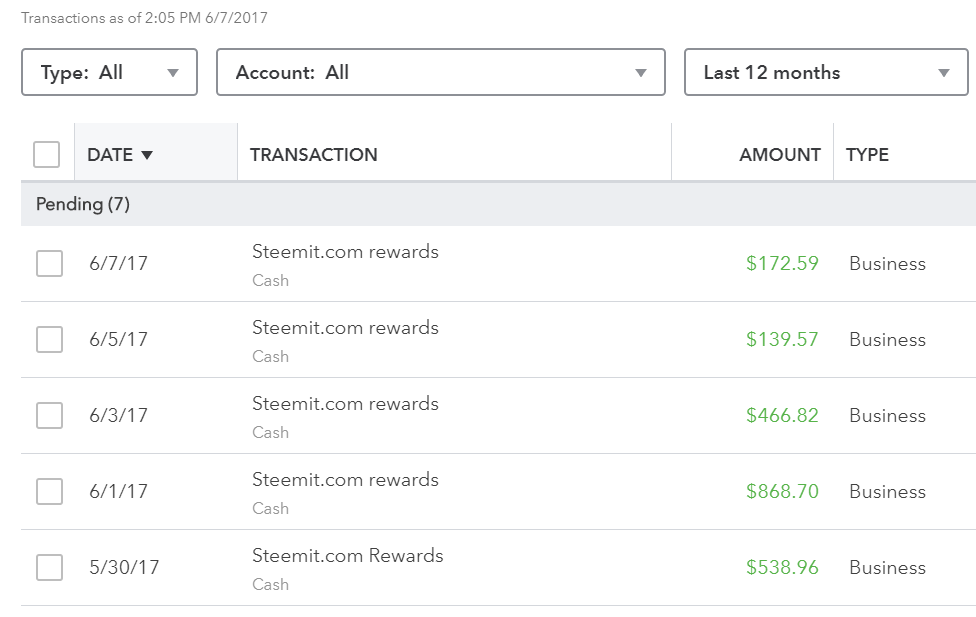

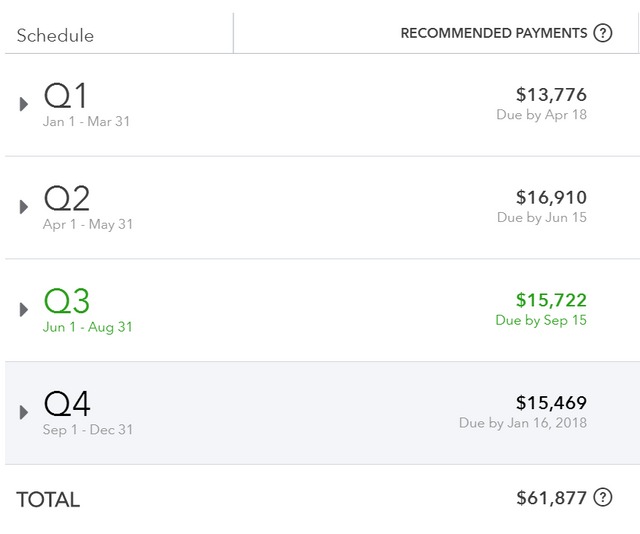

- Using QuickBooks Self-Employed, I enter a transaction that day for the total USD value into my business income for the day which then gets hit with self-employed tax plus income tax adding up to almost 35%. QBSE then tells me exactly what to pay in estimated taxes each quarter based on my total business income including my Steemit rewards which helps me greatly in my planning and removes most of my anxiety.

- If I ever decide to power down and change my Steem Power to Steem and then to sell my Steem to USD, then in addition to the taxes I paid for receiving the income, I also have to pay capital gains based on the difference in what I received it at versus the price the day I sell it. For example, if I earned and powered up a total of 1000 Steem in rewards at an average of $1 per Steem for a total of $1,000, I would follow the first six steps and pay tax on $1,000! If I then powered it all down and received 1020 Steem out from the 2% interest and then sold it for $2 per Steem, I would receive a total of $2,040 out of which I already paid tax on $1,000. The remaining $1,040 would then be taxed as capital gains on the initial $1,000 which is at the standard income tax rate if I held the Steem less than a year from when I received it or 15% currently in the USA if I held it longer than a year.

Would you prefer a walkthrough with screenshots? Let's get started!

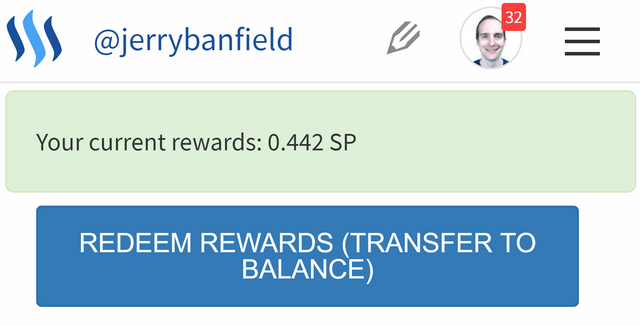

First, using https://steemit.com/@jerrybanfield/transfers I find my current rewards. Switch your username for mine to see yours.

BEFORE I click the redeem button, I record the numbers in my spreadsheet in the SP Payment and SBD Payment columns using Airtable. If you would like to join Airtable, would you use my link at https://airtable.com/invite/r/qGLfO5Yn because Airtable will give me $10 off my bill when you signup through my link? Airtable is free to use and I find it a lot easier than trying to make a bunch of Microsoft Excel spreadsheets.

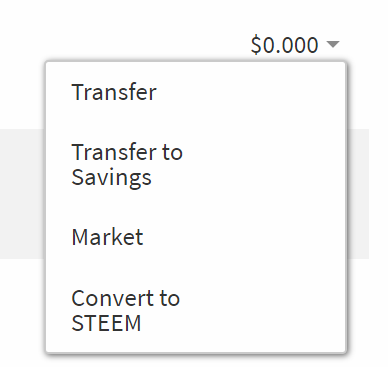

With my SteemDollars or SBD I usually go to the market option and then sell to Steem. https://blocktrades.us/ also allows for a direct SBD to Steem Power conversion which I used today to earn 1 more Steem than I would have got going through the market.

After converting to Steem Power, I enter into Airtable the extra Steem I got from SBD and use http://www.coincap.io/ to find the 24 VWAP for Steem which I also enter to get the final USD value. Alternatively, if I sell my SBD to USD, I enter in 0 for SBD to STEEM and instead enter the total USD I sold for into SBD Sold. My spreadsheet formula then adds and multiplies everything together to produce one USD number reflecting my total earnings that day as seen below.

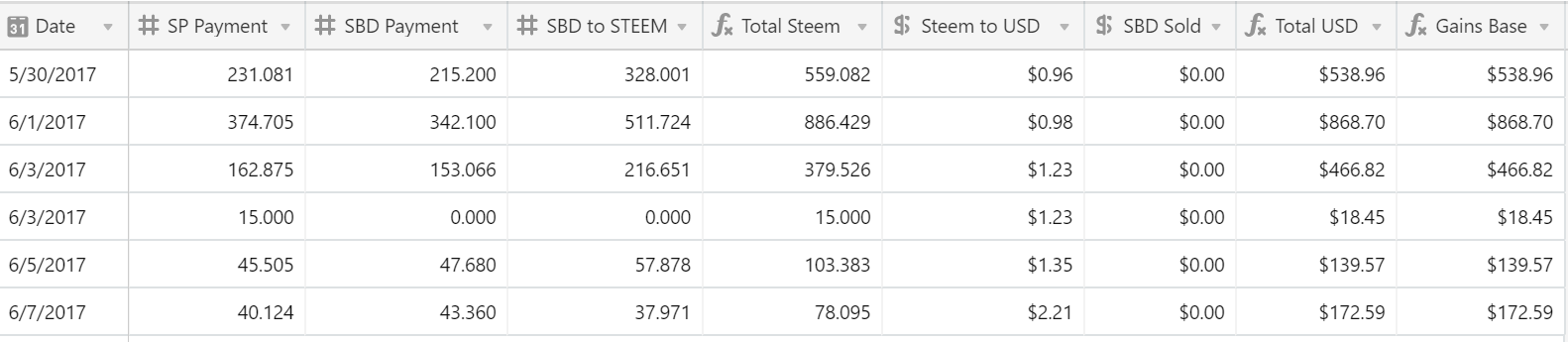

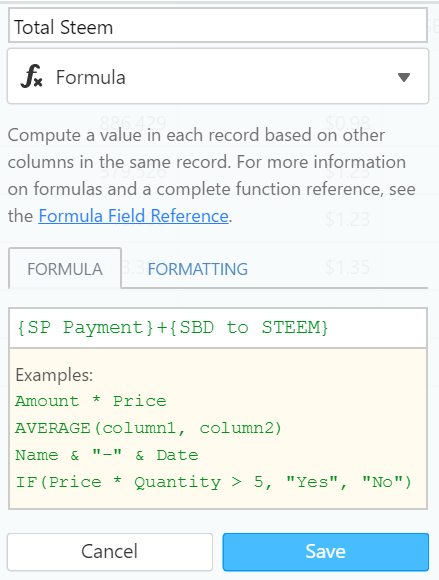

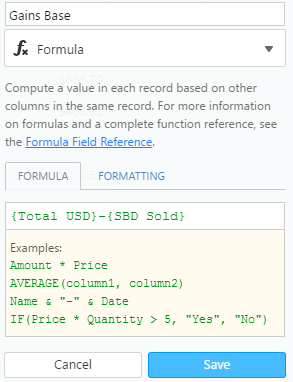

Note that the final column includes a tab I just added named "Gains Base" which reflects my total for calculating capital gains on the Steem later sold from powering down Steem Power. For powering down in the future, my ideal solution is to take the power down payments and add in columns showing how much I sold the exact amounts for compared to the base amount of gains net of any immediate USD sales. Therefore, this last column subtracts any immediate sales from the gains base. So far I have not made any but if I sell some SBD immediately to USD in the future, this will eliminate the need to pay capital gains on the SBD because I will have sold it at the same price I earned it. Here are the screenshots of my formulas which are just names of the columns. Any screenshots not posted reflect that I am just entering numbers into the column. Note that the SBD to STEEM column is manually entered using the value I get from selling my SBD directly to STEEM.

The formula above in the Total Steem column adds the Steem Power or SP payment I received to the final amount of Steem I received from my SteemDollars exchange to Steem. This will be 0 if I sell to USD immediately regardless of whether I trade to Steem first.

The Total USD formula above multiplies my Total Steem times the Steem to USD price to get the total value that day of the Steem I received. If I sold any SBD to fiat, the formula finishes by adding the SBD I sold to the total to report on my income.

The gains base formula subtracts the SBD sold from the Total USD because this then is my foundation for paying capital gains. If I sell the Steem later by powering down, I only pay capital gains on the Steem Power reward I received based on what is was worth that day. If I were to power down my entire account, I would also have to pay capital gains on anything extra in full because of the Steem Power interest. Using a First In First Out or FIFO formula here seems ideal to pay capital gains on the oldest asset first if they were held over a year.

Armed with my USD total, I go to QuickBooks Self-Employed to report the income as part of my business. If you are self-employed and would like to make your taxes easier the way I do with QBSE, will you please sign up using my link at http://fbuy.me/dGXHJ because you will receive 50% for the first 6 months and Intuit will give me a $30 Tango gift card which I usually give to my wife?

To pay my taxes, I then make the recommended quarterly estimated tax payments that QBSE suggests using the Electronic Federal Tax Payment System or EFTPS because this is calculated using all of my self-employed business income.

Would I love to just pay less tax by doing this some other way? Sure and here are my choices. Paying less by doing it some other way guarantees I get to worry about it and be afraid that I should be doing it this way which the way I see it follows the common sense of "I earned money and I need to pay tax on it." Worst case scenario doing it as a trust fund or waiting to pay until I sold it or any other "well here's why I do not have to pay tax on it today" could involve a huge difference in income during an audit resulting in a painful combination of extra tax payments, fines, backup withholding requirement, and possibly even jail or prison time. Forget that.

Performing the steps in the system I show here ensures I sleep soundly at night because the worst case scenario this way involves the Internal Revenue Service deciding that I needed to use a different daily average value or needed to report the rewards the day I earned them instead of when I redeemed them. At most, this would be a small difference in the amount of tax I should have paid up or down. No big deal. No fines or maybe very small ones at most. No backup withholding requirements. No potential jail or prison sentence. No sleepless nights in fear.

Where did I find the information which formed the key assumption for this system? The key assumption I make here is that Steemit rewards are very similar to Bitcoin or any altcoin mining rewards. Taxation on mining rewards is answered at on Intuit's Turbotax help website and I made a shortlink for you to read it at http://jerry.tips/btcming. See the screenshot below for the key paragraph.

After reading those two paragraphs, I feel certain that Steemit rewards would be viewed by the IRS exactly the same as Bitcoin mining because of the phrase "whether in the form of Bitcoins or any other form." Given the instructions which follow, it seems clear to me that I am responsible for paying taxes on Steemit rewards as soon as I receive them. See similar articles for future reading below.

http://www.coindesk.com/irs-bitcoin-tax-guidelines-mean/

The CoinDesk article emphasizes the same points I shared here plus alternative viewpoints taken by miners suggesting all rewards are capital gains and no tax needs to be paid until sold. Personally I like that better for making an excuse to not pay tax at all now but not enough to be willing to face the consequences if the IRS disagrees because ultimately they make the rules regardless of my personal opinion. Better to pay more and maybe get a refund instead of less and getting the penalties.

https://en.bitcoin.it/wiki/Tax_compliance

Bitcoin Wiki's tax compliance provides similar information as to what I shared here under the "How are Bitcoins that I have mined treated for tax purposes?" along with helpful links to other websites which might help with accounting. Given I have not used any of them myself, I leave it up to your judgement if you want to view the links yourself on Bitcoin Wiki's website.

https://bitcoin.tax/blog/filing-your-bitcoin-taxes-income-spending-mining/

One of the links from the Bitcoin Wiki was the article on Bitcoin.tax which has more insights into most every tax scenario we might face in making transactions with cryptocurrencies. Here is the paragraph below about mining. Notice that there is no current established formula still for providing the final solution in determining exactly what the "fair value" is on the day received. I just use whatever I see on http://www.coincap.io/ under the 24 VWAP because this includes one day worth of data on the average price and is a simple standard I can use over time.

If you are in the US with me, you will be using a 1040 to report these taxes under both income for when the rewards are received and then under capital gains for differences in the selling price versus the price your Steem was received at as shown in the paragraph below. If you get someone to do your taxes, they will need all the records you will probably need to create and have a good reason to charge you more for completing your taxes given these additional steps 😒

Does the taxable event start when we receive the rewards or redeem them? Ideally we might redeem our rewards daily or weekly to minimize differences in price between actual time received and redemption in case the government prefers treating the day the rewards were available to be redeemed as the taxable event. Currently it could easily be argued either way because in my package delivery example, it is as if the rewards are being laid on our doorstep. Do we "possess" them because USPS dropped the box on our welcome mat or only when we actually pick up our package and take it inside? I think less frequently also might be completely acceptable because the differences are likely to be small anyway and all the income is being reported at the time when it is possible to begin transacting with it. I try to do every day or two with a once a week minimum.

How are the tax rules different in the United Kingdom, Canada, Australia, Korea, China, Russia, India, Brazil, and other countries where Steemit is popular? I have no idea and would guess that most would like you to report the income when you receive it in terms of its value that day in the currency of your country! If you are living in a different country, would you please share guidance below for users in your country because you then might be able to help more than I can?

What if ... For more what if questions, would you contribute to the discussion below and read the top comments to see if another reader has already answered your whatif question?

Am I an accountant or CPA or attorney or a financial professional or God? Maybe God if you are too but not any of the others. I have a master's degree in criminology and nothing else which I hope is helpful for each of us reading to understand that what I have shared is not the only opinion on the subject of taxation on cryptocurrencies especially rewards received from Steem. The system I show here is one I created out of my own necessity to fall asleep at night based on the best information I could find and the easiest way to accurately report my income.

Thank you very much for reading this post about taxes with cryptocurrencies online especially in regards to Steemit post and curation rewards! If you found anything helpful in this post, would you please upvote it because then I will have to pay even higher taxes on the income I earn from this post? If you would like to continue reading my newest posts, would you please follow me at https://steemit.com/@jerrybanfield where I try to make at least one post every day like this?

Love,

Jerry Banfield

https://jerrybanfield.com/freecourses/

I enjoy your work and you did a great job breaking this down, but all I really have to say is...

Taxation is theft.

Absolutely. Taxation is Theft

If ever we had an opportunity for civil disobedience to change things, now is the time. And he's publishing guides on how to cooperate with the thieves. I'm following you friend.

You are right and all we need to do to stop it is convince the people going to work for the IRS who are trying to do a good job just providing for themselves and their families to stop going to work!

LOL...IM TELLING YA!

Yes.

I hear you. The government not only derives its power from those it takes from, but those it makes dependent upon it. Government takes more of our money, more people need to work, government grows bigger and hires more people, people got to work for the government. When the government is the biggest employer, it establishes an inertia of dependency.

The great news is we have this new freedom fighting tool called cryptocurrency. If we all do our part to support its goal of eliminating government and banks from our financial lives, we can help overcome that inertia.

On a side note Jerry, your enthusiasm, honesty, and prolific nature are amazing. I love (almost) all your work. The tax stuff, not so much ;)

I agree, it's like a government-feeding-frenzy...

Have you gotten professional opinions on the assumption that Steem is legally closer to bitcoin, a now legally recognized currency, than it is to say, Reddit karma (prior to cashing out and realizing an actual gain at an exchange rate, that is)? I would be curious to see a legal argument from an expert in this area, should one exist.

Also, the IRS was criticized for it's guidelines on Bitcoin and is due to make some sort of follow-up in the very near future, which will clearly impact this discussion directly:

http://www.coindesk.com/us-congressional-group-calls-on-irs-to-clarify-bitcoin-tax-guidance/

They'll stop going to "work" once their paychecks are worthless.

Amazing points, we all want the same thing. <3

Well taxation is only partly theft in my eyes. Hospitals, schools, etc don´t build themselves and don´t pay for themselves. But expenses like Politicians, Military, etc etc could be cut completely imo. Problem is we can´t choose what we wan´t to pay for and what we don´t want to pay for. I also do feel overcharged by my government. It taxes my income, it taxes my day to day grocery shopping, it taxes me if i buy something and if i sell something or if i win at gambling. They tax my "wealth" even after I died.

So yes taxation is theft, but it the same way SOME taxation is necessary. But not the whole life should be taxed by our governments! I´m sure blockchain technology will change that!

I did a video on this not too long ago. Check it out:

You and I would get along quite well.

lol I'm sure we would!

By the way, here are 75,000+ reasons why

Taxation Is Theft

Reminds me of James Madison: "It will be of little avail to the people that the laws are made by men of their own choice if the laws be so voluminous that they cannot be read, or so incoherent that they cannot be understood."

Things evolve, just look at how many words are in the English language compared to 1913.

can you hear me @yoganarachista & @sature ?

It would be nice if we each had the choice as we do on Steemit where to send our taxes!

Ha! Yeah, if that were the case, I'd stay powered up and not send them anywhere. LOL.

To some degree you do. Many corporate entities completely eliminate their tax liability through reinvestment, job growth, charity, foundations, and other deductions that are there for the proposed purpose of benefiting the common good.

I follow you're argument. I've heard it before. I disagree completely, but I don't think now is the time to get into a long discussion. I just suggest you ponder for a while a world without government (Anarchy), or at least a government limited to just protecting individual rights (Minarchy). I mean really think about it. Do you really think schools and hospitals wouldn't be built? Does man require other man to tell him what to do, or would he just sit there in the dirt crying for want?

I can imagine the farmer coming to you, saying infinite-monkey! I need a road and a harbor and some ships to export my potatoes!

Can you build it for me? I will pay you in potatoes for about... uh... 716 million years? That's ok for you?

And I would tell the farmer he shouldn't have built his farm in an area that couldn't produce enough value to warrant the free market investing its money in building a road and harbor to help him export his potatoes.

😂

Excellent response.

taxes dont pay for hospitals etc, printed federal reserve money pays for those things

all taxes in the US go to paying off the INTEREST o the debt to the federal reserve private central bank that prints up dollars out of thin air

If I make Ice cubes with my electricity and my water that I paid for with after tax dollars and sell them on the internet, you would also have to tax businesses doing business on the internet that are not taxed now the same way. I don't have a physical store or a factory, just me and my ice cube trays. My ice cubes are $10 each. btw if you want one please reply.

I will take 2 ice cubes ....but I demand they arrive in the Ice Cube State( ie. frozen not liquid)...are you sure you don't want to add something for shipping? :P~

NWA! ✊🏾

Its posible in Spain we stand 1 year whith no government and the PIB grow more.

We have a corrupt sistem jajaja

pd: Never believe in PIB, is handled

I can't quite fully understand what you're writing. But my understanding is that due to financial hardship Spain hasn't provided government services in quite a while and the Spanish people are doing just fine without them. It's a great example showing what people can do without government. What is the PIB?

Sorry my english is poor . this year the pib grow 3,2% but Economic recovery is false.

The media say that debt is stable at 100% but in real terms is Growing.

why support a system that uses your tax dollars to fund overseas wars and pay overpaid govt ceos that do nothing siting on major govt agencies wasting your money within a failing system ..to what end..

EXACTLY and hey i like jerry and i am not trying to crticisize him, hes doing "the right thing" lol but ya he is also reminding us that we can use tax loopholes the rich use to avoid paying taxes! the rich avoid paying taxes we are the rich we shouldnt pay any taxes! taxes are for the poor! its true!

and yes we have an OPPORTUNITY to NOT pay taxes here so why would we? LOl its like with coinbase, u can keep all urmoney with coinbase and have all ur profits reported to t he IRS, or u can keep ur bitcoins on a trezzor and have all ur profits kept to yourself! or keep ur money in monro or bytecoin, and have an anonympus ledger! sure its not bulletproof but id like to see the irs try and track down all the drug dealers making Monero profits and make THE pay taxes

YEAH hey if darkney drug dealers dont pay taxes with Monero and bitcoin they earn, why should we? lol

And your detailed strategic roadmap for how “things can be changed” without putting our families’ security at risk through non-compliance?

Change would be lovely. But I’m not exactly prepared to be inflexible with a moral philosophy at the risk of having to explain to my future children why daddy’s in jail because he wasn’t willing to humble himself and slice a sliver of his abundance to give back to society for the security of being present to raise them.

However, if you have a viable plan, I’m all ears...

Agreed fine Sir!

The break down and efforts presented are legit. Jerry has skills, no doubt.

However it does not negate the fact that 100%,

TAXATION IS THEFT :-}

Taxation is extortion

image source

lol yes, but extortion is a form of theft so while I get the argument, the argument is in the end synonymous.

Bitcoin and Crypto have the power to kill government - embrace them.

I'd like to encourage everyone to vote up this comment so it can be the top comment on this post. Can't sit through 10 pages of compliance without saying "What the hell are we doing????"

I think it's been said a few times that only about 2.5% of Bitcoin users actually declare it on their taxes. One shouldn't be looking for more ways to be extorted.

First of all, it's a capital gains tax really and one shouldn't be taxing the rise of value, it's kind of an insane notion.

Second of all, no one should be taxed period. The point of cryptos is a competing currency, free market and free monetary alternative. Taxation shouldn't be involved.

You're preaching to the choir. I was writing my own Taxation is theft comment when I saw yours. You beat me too it! This is the second "comply with the tax man" post I've seen today. The other was on Craig Grant's page. At least just he said to pay your taxes and didn't post a how-to-guide. I still love your page Jerry.

I agree, taxation is basically what all these TV high school bullies do, they ask the weaker students for their lunch money :^)

So yeah, taxation is theft!

Move to Russian or China and then you will see what taxes pay for. If you like to drive, taxes pay for the roads. If you like to go to national parks, taxes keep in them in tip top shape. If you don't like to work, taxes keep you off the streets. I pay more taxes than the average minimum wage person made last year and I have no issues with it.

If something can't exist without being funded voluntarily then it doesn't deserve to exist it all. Theft is theft no matter what good cause the stolen money might be going to.

Most people do not want to voluntarily fund mental health wards unless they directly affected by mental health related issues. So are we to say that we should kill the mentally ill because they are stealing our money? Many people don't want to fund abortion clinics, so are we to say that all rape victims should be forced to keep their babies ? What you are purposing is fundamentally flawed. Paying your fair share of taxes isn't theft, it is your constitutional obligation. Yes I do agree that the tax schemes of many countries are unnecessarily high, however in the same breath, without taxes mainly critical and life saving service simply would not exist. If the average human wasn't a greedy piece of thrash, I would whole heartedly agree with you. But if the average person was left to make the decision on what they wanted to pay for, most would elect to pay for as little as possible.

You are dead wrong my friend. There is no fundamental reason why the private market can bring us shoes and pizza but somehow can't deliver other things that people want and needs such as roads and hospitals.

Taxation IS theft plain and simple, there is no way around it. I still pay my taxes however, for the exact same reason I would hand my wallet over to a mugger, because there is a gun to my head. It's completely immoral no matter who is holding the gun.

Because the "private market" is inherently greedy. Look at all the price fixing that goes on when the "private market" is given free reign. Do you really want to see restricted access to cancer medication or MRI's because the private market decided it was in their best interest to fix prices?

Awesome perspective.

Amen.

I left Canada with a lot of resentment towards governments, spent 5 years in Bali. Oh boy, did I ever come back with a new appreciation for my home country!

People think government in first world is bad... go live in the third world for a while, experience the chaos and corruption there, and then come back and bitch about how bad we have it.

Yes, but...

Haha. Absolutely!

Amen! Our Founding Fathers would already be shooting by now! Following.

you got that right..

I upvoted this because, despite my personal opinion, this is a great, well formed and presented post that delivers value.

Beyond that, the bastards will have to chase me down and put me in a metal cage before I pay them taxes on crypto. If you never convert the smart money to fiat, how would they even know anything?

Taxation is theft.

They can read the blockchain, that is how they will know. I am amazed how all the transactions here on steemit are public.

LOL

@Jerrybanfield, you helped me invest, let me help you: watch Amanda B. Johnson: notice her different costumes and appearances. Be like her! It would totally blow people's minds. Try it.

@crypto-p thank you for the recommendation to have more fun with what I wear I will keep that in mind!

Great work. I am going to resteem this as I think I'll need to refer back to this now and again.

One thing I do want to state. Steem Power is not actually considered currency according to what people at Steemit Inc. have been saying for some time. It is actually a little accounting magic, it is a number.

Is it an investment? In some ways yes. Though not as you would normally see one. It is not liquid. You cannot cash it all out whenever you want.

It is only when converting it to Steem that it actually becomes SOMETHING.

Therefore, I'd think the capital gains and all of that are not really applicable. I am no accountant though. I'd believe that the time you power it down to steem that at that point it becomes something taxable.

It is murky.

I am not an trader who tries to hold a bunch of crypto. I tend to leave my steem power alone for now, and I convert my SBD and STEEM into fiat that I use to buy various things fairly quickly. I do need to keep better track of this and that is partially why I find your article valuable.

I agree with you, I'm leaving everything in Steem power for as long as I can.. I don't think it should be taxable in Steem power

I don't want to add to the taxation is theft crowd though that is my opinion. It's nice that you put this together for those who want to comply. One has to wonder though, why should govs get anything from what is distributed here? If they want Steem they can create an account to post and vote just like everyone else :p

But really, I understand why you are doing it. With so many followers I can see why you'd want to cover your back, so they don't make an example out of you as they've done with others like Pirate Ross.

A lot to get through there, thanks for the link to Airtable.

@jerrybanfield. I made a copy of the Airtable in Jerry's example for everyone! Here is the link: https://airtable.com/invite/l?inviteId=invgbaAaidhSvcPIo&inviteToken=3e85fd4207ff7659080036e5b59dac3c

Also: Here is my Airtable affiliate link that you can use if you are new to Airtable: https://airtable.com/invite/r/rnwPlJ6I

I used Jerry's affiliate link which is again: https://airtable.com/invite/r/qGLfO5Yn

Again, a Big Thanks to @Jerrybanfield who definitely deserves his due credit for the contribution!

EDIT*: I added columns to account for Power Down Payments!

Jerry, This is a very clear explanation of how one can track income earned on Steemit. I will follow and upvote you. I wonder if your post has been over 7 days old, the upvote still would help earning you steem income.

Another great vid.