Bitcoin analysis: ANALYSIS for all to review: You decide where the currency goes from here...

Hi everyone.

So today Bitcoin saw a minor correction. This was not a crash BTW. A crash would be beyond 50% drop in price.... However for some, this would be a buying opportunity. :)

SHOUT OUT TO GREGORY MANORINO.

MY BRO!!!

OPTIONAL: Music for suspence

I will be using my knowledge of the stock market as a reference point and also to be better explain what I see happening here.

HOWEVER.....Please consider the following..... NOTHING goes up for ever... Everything needs a correction and a fair market value. Since BITCOIN is not mainstream yet, except if you are involved in the community, the real price movement has not even begun. Right now, what we see is hype movement.... Let me repeat, the real price movement has not BEGUN!!!

.

.

People who don't want to feel FOMO---(fear of missing out) are jumping in and riding shit, then jump ship with a little profit. Expect this to happen more and more as the currency goes mainstream.

.

.

The currency has fully crashed before, but even if this happens, you need to be able to ride the volatility... In other words, in the stock Market, I have ridden stocks that explode in price and also ridden stocks that go down.... Do I panic or shit bricks... Hell no... The difference here is that Banks and institutions can't short Bitcoin.

I myself am not a big fan of the ETF of bitcoin because we would be giving the banks a potential way of shorting the currency...but nobody talks about this.

.

.

Those who study the past, can gauge into the future....I am of course being dramatic here, but consider this...

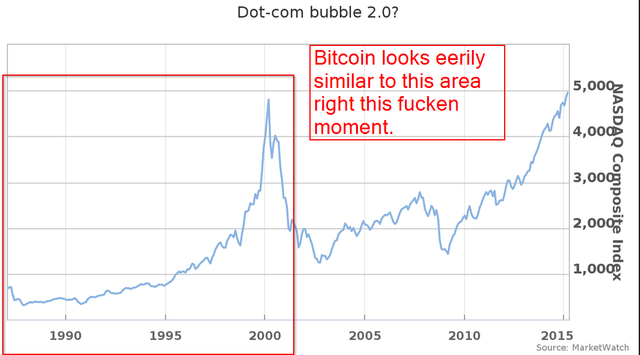

The dot.com bubble----

During the dot.com bubble, many MANY people felt the FOMO and jumped on the bandwagon to get in on the action, and then the hammer hit, that SHIT HAMMERED THEM SO BAD, THEIR ASSES WERE SCORCHING RED and some people Lost everything... The chart below is the DOT.COM bubble from the past, but given the fact that most Americans have such fucken short term memory loss, this is considered ancient history, but still worth mentioning...

.

This chart shows several things... It shows that even if the price dramatically drops, you should not pussy out. Now, I am not trying to tell you GTFO of cryptos, but what I am saying is this... DO NOT PULL ALL YOUR EGGS\BALL\TESTIS whatever you call it INTO THE SAME BASKET.

.

.

If you missed the rally, so what, just expose yourself in, but don't fucken re-mortage your home just to ride the wave... If you got in at 200-1000, congrats to you. If you got in at 1000-1600, congrats to you too, BUT if you are just getting in now at 2000+, go in with a steady mind, don't let your FOMO take over....

.

.

You can always buy Etherium, which is $180-200+ range, or Litecoin, which is 28-30's range. This is why in one of my previous posts, I mentioned to be diversified. Have Cryptos, gold, silver, dollar, guns, hobby for making money, and good education to adpat to diff jobs. https://steemit.com/money/@darionxp/how-to-diversify-gold-silver-crypto-commodity-stocks-bonds-options-firearms-cash-education-degree-sources-of-income

.

If you missed the big rally, fuck it, move on...go to the next big rally, which seems to be Etherium and maybe Litecoin. These two other currencies have much room left in them. Etherium is STILL IN ITS INFANT STAGES..... ETHERIUM is being adopted by COMPANIES AND BUSINESSES GLOBALLY, so if you feel FOMO... which you shouldn't, then add Etherium and litecoin more so than Bitcoin to your portfolio.

.

.

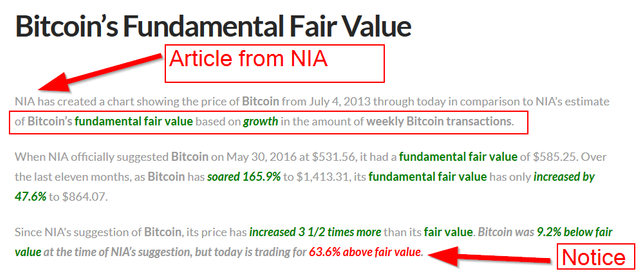

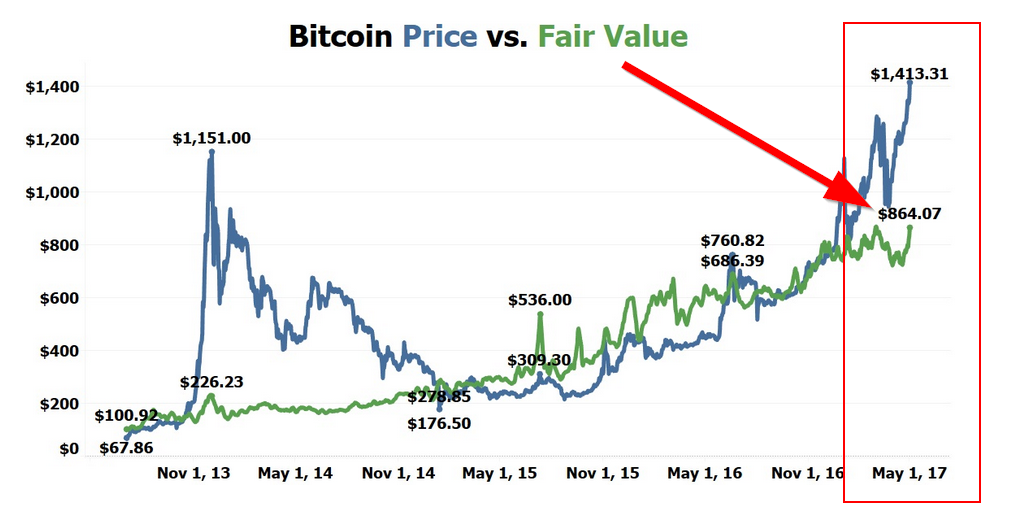

ANALYSIS from other people point to the same thing, that Bitcoin is in overbought territory..

Then to support their work, they also add the following chart.

Again, although this is one reason some investors are worried, I am worried from a different area.

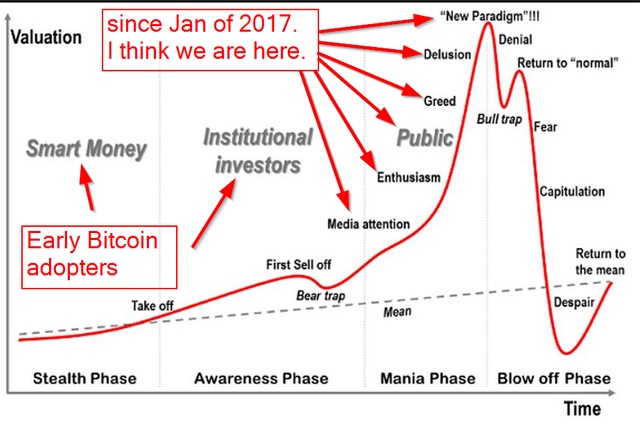

As a hobby, I buy and sell in the stock market and I also buy in the options market, so this means I am not a pro, but I do see things.... that maybe the avg joe on the street does not. To illustrate what I see... I found a chart of what I think might be happening. Again, if this turns out to be accurate, you have to be able to stomach the volatility...

Even if this happens, Bitcoin WILL NOT DISAPPEAR, but many people may who do not diversify. The idea behind diversification is for other assets to save your ass should others drop in price.

.

.

There is what I also use called the bollinger band. This allows one to pinpoint where a stock should be trading and helps you pinpoint what the price can land on. See chart below from today. :)

.

.

When it come to Bitcoin, that modafuka BLEW!!! OUTSIDE of this purple area and this is why I AM WORRIED. ....

.

.

My final thoughts are, I am comparing this as a stock, so there is a chance, a high chance I am wrong, but if my fears turn out to be true, then a buying opportunity for everyone is coming up. :) I still own bitcoin and contnue to steadily add to my position, but I am treating it like a stock, not actually buying stuff with it, but converting it back to cash to pay off debt of buy stuff like GOLD\SILVER. :)

.

.

Hope you enjoyed my post. weather it drops in price or not, BITCOIN is here to Stay.

Stay sharp people and do your own fuken HW before investing....

Thanks for the analysis, pep talk and reality check.

Glad it was helpful. :)

That was no crash, rather a takedown... selloff started @ exactly 9:00 am... a signature orchestrated event. Still see a run to $3k before another correction.

I agree of another small run before another correction.

With one wallet willing to dumping 20,000 BTC you would see the market cap drop by $56 Million for the high around $2800.

I agree. It only takes a handful of people to sell off entire Bitcoins, not just parts of one and here we go. The buying opportunity many have been waiting for. :)

No doubt @darionxp,

Time will tell. I feel most people are selling BTC because they have to not because they want to.

Most miners have a lot of expenses to keep those miners going.

Best,

Isaac

This post has been ranked within the top 80 most undervalued posts in the second half of May 25. We estimate that this post is undervalued by $13.65 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: May 25 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.