"Blockchain too slow for banks" - Ripple!? @BlockRush

After years of promising and hyping the superiority of Blockchain technology, institutions and governments around the world finally warning up to it, the UN is experimenting with it and the World Economic Forum is positive about the transformation of Blockchain technology while financial institutions are interested in its ability to save them billions of dollars in settlement cost as well are reducing processing time.

While these development are good news for the Blockchain community, some believe that the potential of Blockchain technology has been over-hyped and banks have swallowed the hook, line and sinker! Among the people who believe that the potential of Blockchain technology has been over-hyped is Marcus Treacher, the global head of strategic accounts at Ripple.

The irony this development is that Ripple is the very company to be chosen by the bank of England to help it implement Blockchain technology into its banking operations, yet one top executive of Ripple doesn't believe Blockchain technology could help the Bank of England!

According to Marcus Treacher, Blockchain is "too slow for banks".

Is Ripple even a Blockchain?

Actually, Ripple is not much of a Blockchain, its actually more of a decentralized payment and exchange protocol which eliminates the need for middlemen but depends on third-party asset exchanges. Technically the Ripple protocol is called a RTGS; which stands for real-time gross settlement system.

The idea for the Ripple payment protocol was conceived by Ryan Fugger as far back as 2004, years before the invention of Bitcoin and Blockchain. However the protocol was only released in 2012, after years of development and possibly borrowing of a few ideas from Blockchain technology.

Ever since, Ripple Labs' "Ripple Blockchain" has been confused with mainstream Blockchain technology and its XRP tokens are also treated as crypto currency tokens.

Ripple has raised more than $70 million from investors to develop its inter-bank settlements protocol which is promised to save banks time and cost, as well as reducing the complications associated with cross border inter-banks settlements.

Ripple was partnered with over 70 financial institutions including some of the world's top banks. As of July 2017, Ripple's XRP tokens were the third largest "crypto currency" by market capitalization according to Crypto Currency Market Capitalization site.

A quick reminder: What is Blockchain technology?

Is Blockchain too slow for Banks?

Nope! "Blockchain technology" is an umbrella terms for a collection of distributed ledger systems. There is no single criteria for Blockchain and the open source nature of the technology ensures that clones, forks and updates are commonplace.

Most of the concerns raised by Marcus Treacher can be addressed:

1. Every single bank gets a copy of everything, even when it’s encrypted. That is not going to work.

A) To address the concern of all banks having access to copies of sensitive thirdparty files:

Blockchain networks could be designed to be both closed and open as proven by the University of Sydney's Red Belly Blockchain. In the case for banks, the network could be configured so banks decide which data to keep on their native systems and which ones to provide to the network. Again, the secure nature of Blockchain powered storage such as Storj coupled with torrent-like distributed file storage(files are divided into bits) would mean that at no point would a single node have a complete packages of a single file.

B) To address the issue of having the network size being bloated due to every node keeping a full copy of the entire Blockchain:

Not all Blockchain systems require that all stakeholders should hold a full copy of all blocks. Blockchain technology is flexible and can be designed to allow nodes decide whether or not to keep a full copy of the entire network. Such systems already exist for Bitcoins and other network, where not every clients/nodes keeps a full copy of the Blockchain.

2. If you have every bank on the platform and all the payments need to be updated, the system will slow down. The speed of Bitcoin is quite slow now because of the way it’s updated. The infrastructure you are using has to be able to deal with high volumes. That’s why you need to break free of this single idea of blockchain and just use the part that you need to use.

This statement is partially true however, Blockchain technology is a digital technology and the only thing that could slow down a Blockchain network is the computer resources running it, the data speed of the network and the willingness of the stakeholders to adapt to change. In the case of Bitcoins, it is the reluctance of the stakeholder to adapt to new improvement that have caused the network to remain stuck on legacy software.

Banks could implement their own private Blockchain networks which are interconnected with that of other banks. This would allow them to control over implementing new features into their native Blockchain network. Capitalism would cause other banks to be innovative too, else loose out to the innovative banks that do improve their technology and services.

3. There’s no way the world will agree on one blockchain. It’s the sheer practicality that gets in the way.

Blockchain is an open source technology that has proven to be a powerful tool in increasing efficiency, transparency and decentralization. Naturally, every business or institution with the resources to build its own Blockchain network will opt to do so instead of joining one built by a thirdparty.

However in time, when more and more banks adopt Blockchain technology and with the increasing calls for cohesion among the Blockchain community, eventually Blockchain networks will learn to connect with each other.

Just as it took Microsoft years to develop cross platform apps and the invention of the computer compiler allowed for cross platform apps to be build, so will a cross platform system evolve to meet the demands.

Necessity is the mother of invention they say, and with the rising calls for standardization among Blockchain networks, it would not be long before we see a cross Blockchain compiler that allows #Ethereum built DApps to run on #EOS and others.

While we may be disappointed with Marcus Treacher's comment on Blockchain technology, we must understand that they do not represent the views of the entire #Ripple community; like anyone else he is entitled to his own opinion.

Steemit talk

- What do you think of Marcus Treacher's comment on Blockchain technology?

- What is your answer to the shortcomings of Blockchain as proposed by Marcus Treacher?

Let us know by commenting below! Follow @BlockRush for more reports on #Blockchain!

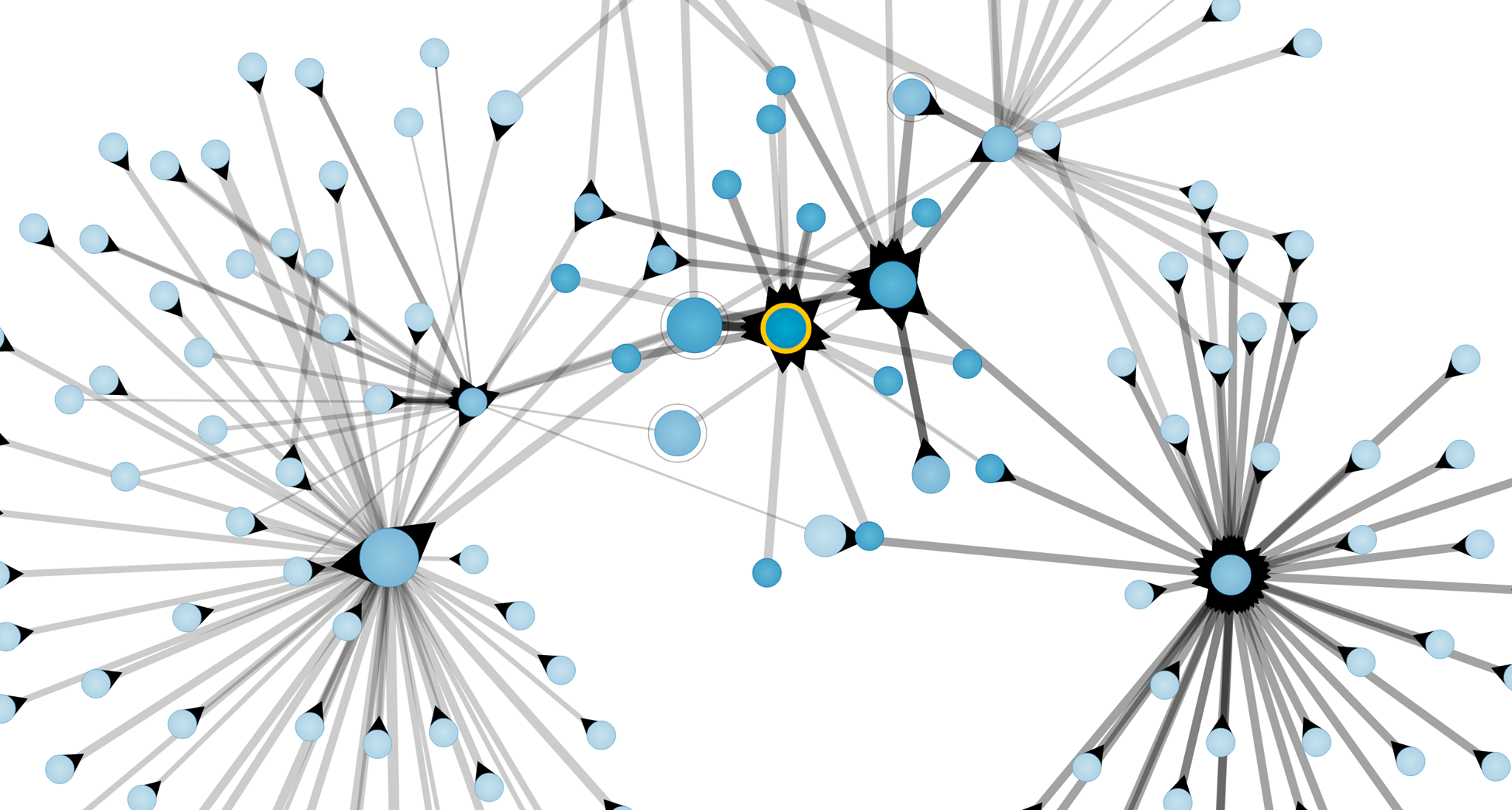

Image credit: Ripple.com

Recommended post: Is Wildspark the Steemit killer?

To be honest, involvements of the banks in the blockchain would be for efficiency of price (for them), not for decentralization or speed. For this reason it could be deduced that this would not be a factor in its specific form of viability.

On the other hand, for transactions, you would look at coins that would utilize Graphene technology which is practically instant. Graphene which will be available for coin developers 8 months from now with EoS, will be able to take advantage of such technology. Until then, all blockchains that do not utilize graphene, are left in the dust. A list of ones that currently do utilize it include, Steem, Bitshares (eos, though no function right now) and Peerplays.

I hope this was informative! Follow if you enjoyed this type of response. Regards.

thanks @extrospect. what do you think of our report on how Russia could save itself and Ethereum > https://steemit.com/steemit/@blockrush/8-compelling-reasons-why-russia-must-legalize-bitcoin-and-icos-blockrush

I really can't understand why this guy comes to this conclusion. If a blockchain can handle more than VISA and Mastercard and NASDAQ volumes combined with a few seconds confirmation time, why would it not be fast enough for bank's interpayments? Especially considering that today the confirmation time is usually between 3 days and a week.

I think he's just trying to use Bitcoin/Ethereum as a straw man to discredit all blockchains and to justify their non-blockchain thing as the real solution.

thanks @idealist. what do you think of our report on how Russia could have Ethereum and itself? https://steemit.com/steemit/@blockrush/8-compelling-reasons-why-russia-must-legalize-bitcoin-and-icos-blockrush

I would say he is not purely trying to discred, but instead he is using the mainstream news about blockchain technology and the current fights over protocols to get a chance to promote his product. In this way, he also distracts the possibility of creating alternative chains, which would be the competence

Well Ripple right now could be faster compared to the other cryptocurrencies and crypto assets but after implementing second layer scaling solutions like the lightning network and the related channels in bitcoin, or raiden in ethereum, there will be no problem to handle this sort of transaction volume.

Furthermore there could also be a private chain on the ethereum network if if they really fear about transparency...

Even NEM could come up with a proper solution for the banking industry... but I guess some banks are just heavily invested into Ripple and want to push it to the top spot!

me too

Not sure if blockchain is too slow, but banks are inherently slow to implement major changes like this. And they tend to look at many options, then test more than one, then maybe do a slow roll out. Based on that and the hype ripple does saying it has signed this bank or that, I think it's sooo over priced. Also banks tend to want to keep private who they work w for security. So I see the Factom type of approach (zero hype) working better w banks.

thanks @financialcritic, like you pointed, its about the type of Blockchain network you adopt and the willingness of the stakeholders to adapt to change that determines whether or not a Blockchain consortium for banks would be either be fast or slow. if either banks are slow in adapting to change or the ripple network is slow in processing speed, it does not mean that every blockchain network is slow

Yo I appreciate this article. Informative 🤙🏾

@popolo9thisland, what is your comment on our report on how Ethereum could save itself and Ethereum? > https://steemit.com/steemit/@blockrush/8-compelling-reasons-why-russia-must-legalize-bitcoin-and-icos-blockrush

Very informative and interesting article thanks . Not sure was ripple invented for the banks or by the banks? Cheers mike

thanks @mikenevitt

Blockchain tech is not too slow. Ripple is centralised and basically central banking 2.0. as far as I'm concerned.

The banks are only interested if they can control the blockchain network and token. The problem is, once there is a public blockchain out there, it will probably out compete most private blockchains. The owners of private blockchains then tie themselves into knots trying to attract network participants............

Thanks @benjojo, have you read our report on how Russia could save Ethereum? > https://steemit.com/steemit/@blockrush/8-compelling-reasons-why-russia-must-legalize-bitcoin-and-icos-blockrush

PoW is slow, but we see Steem and many others blockchains aren't. However the main reason of inventing Blockchain was not to use banks, which a centralized.

Congratulations @blockrush! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP