Fidelity say : crypto's are slowly being adopted by institutional investors

The recent news of Fidelity

entering the cryptocurrency space has sent shockwaves throughout the industry with many claiming this move to be a catalyst towards mass adoption. In a recent interview with Bloomberg, an official from Fidelity spoke about the company’s entry into the digital asset market and gave his two cents on the institutional investor scene in the cryptocurrency space.

The official stated that Fidelity,

which is originally an asset management organization, has been doing research on cryptocurrencies such as Bitcoin [BTC] since 2014. He was candid in stating that the company wanted to draw out a full-fledged plan before venturing into the space. According to him, Fidelity aims to provide various bodies and individuals the tools to manage the cryptocurrency space. He further added:

- “The cryptomarket had zero interest a couple of years back but now you can clearly see the boom. The scene is changing dramatically enabling an industry heavily skewed towards retail investors to be open to even institutional investors. We have served over 13000 financial institutions and the learnings from all that allowed us to create a model that was conducive for growth.”

Click ▶ Bitcoin Millionaire

Fidelity has

also stated that the entry into the cryptoverse is backed by a three-way service package. The official from the company explained that Fidelity will provide custody for cryptocurrency users, a barrier that has stopped many parties to enter the space.

The asset manager will also set up a system that will allow trade to occur with liquidity providers. The final piece of the utility trident proposed by Fidelity is a tool deck to integrate the workings in the cryptocurrency space from an accounting standpoint.

The discussion also touched upon how custody is an important topic because there has to be an enterprise approach when it comes to the security of private keys. The Fidelity official also clarified on the company’s strategy by saying:

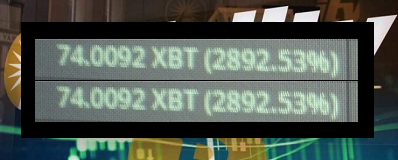

- The organization is not planning to start a cryptocurrency exchange but will act as an agent between dealers in the cryptocurrency market. Fidelity will also provide prices and listings to users so that they can get good returns on their trade. We will basically act as a point of connectivity between holders and the cryptocurrency market as a whole.”

The interview

comes in the wake of Fidelity branching off to form Fidelity Digital Assets. The limited liability corporation based in Boston will provide enterprise-grade custody solutions, a cryptocurrency trading execution platform and institutional advising services 24 hours a day, seven days a week designed to align with blockchain’s always-on trading cycle.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://crywnews.com/bitcoin/bitcoin-btc-and-other-cryptocurrencies-are-slowly-being-adopted-by-institutional-investors-says-fidelity-official/