Science says: Blog when there's blood in the street

A recent PLOS ONE article about Steemit and the Steem blockchain implies strategies for success in the Blockchain-based online social network (BOSN)

Pixabay license, source

Introduction

The other day, I posted the Steem Links post, The role of cryptocurrency in the dynamics of blockchain-based social networks: The case of Steemit - PLOS ONE. At the time, I hadn't had time to read the source link, but last night I managed to read through it.

In the article, the authors divide their analysis into three spheres: (i) social media transactions on the Steem blockchain; (ii) Financial transactions on the Steem blockchain; and (iii) Changes in price for STEEM on the external exchanges. With that framework in mind, they ask how the different areas are interrelated. Among other questions, they address the following questions:

- Does cryptocurrency price affect social media behavior?

- Does social media behavior affect cryptocurrency price?

- Does cryptocurrency price affect financial behavior?

The authors summarize it like this:

The true pivot of BOSN is the introduction of a cryptocurrency that shifts the paradigm of online social network from being purely social to economic-social: in the traditional approach, users are engaged with social interactions, while economic ones are prerogative of platform ownership; while in BOSN users are got dragged into social-economic actions. Thus, the way to understand the BOSN in-depth passes through the investigation of the relations between the economic and social actions carried out by users and how both relate to the value of the cryptocurrency.

In addition to the questions above, the authors also studied the behavior and strategies of "central nodes" -- highly rewarded participants on the Steem blockchain.

The article is interesting on its own merit, but it also provides some information that can be used by Steemizens to guide our own decision making. In the following sections, I'll discuss my own understanding of how the study was conducted and what it found, and then I'll go on to discuss the implications for the current generation of Steemizens.

Pixabay license, source

Study set-up

In seeking to understand the Steem ecosystem, the authors used selected data from the period of December 6, 2016 through March 20, 2020, and they partitioned it in three categories, social media transactions, financial transactions, and cryptocurrency prices. These were drawn from "internal" (on-chain transaction records) and "external" (coinmarketcap.com) sources and passed through some statistical analyses. The statistical analysis included a measure of lag time in order to determine the direction of any correlations.

Social transactions

Analysis of social transactions included "vote", "comment", and "custom_json" operations.

Financial transactions

Analysis of financial transactions focused on claim_reward_balance, transfer, transfer_to_vesting, withdraw_from_vesting, delegate_vesting_shares and convert.

Cryptocurrency price

As previously noted, the cryptocurrency price was drawn from CoinMarketCap. Since STEEM is the foundational token, that is the price that the authors used for their analysis.

Central Nodes

For the identification of the central nodes, or highly rewarded users, the researchers measured rewards_sbd, rewards_steem, and rewards_sp. They matched that up with the "curation" and "creation" activity of the highly rewarded users.

Findings

Summary

After completing their analysis, the authors reported several findings of interest. Here are the ones that caught my attention:

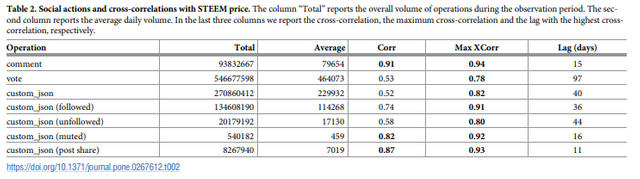

- Social transactions tend to follow price changes. Comments, for example, saw a 0.94 correlation with market prices after a lag time of 15 days. Similarly, voting saw a 0.53 correlation with price after a lag of more than 90 days. In this context, an exact correlation would be 1, and a completely random relationship would be 0.

Here is their full correlation analysis:

According to the authors,

This represents a first evidence of a possible influence of economic and financial factors on the structure of the social graph supported by blockchain-based online social networks.

- The authors didn't find evidence that prices followed social activity.

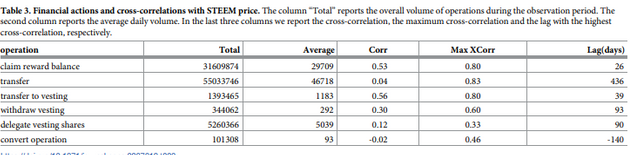

- The authors found some correlation between prices and financial transactions, but they suggest that the relationship is complex and needs additional study.

Here is their full correlation table:

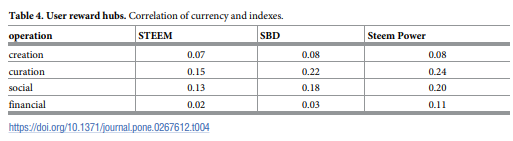

- Finally, the authors observe that highly rewarded accounts tended to engage more in curation than in content creation. This can be seen in the following table:

Commentary

It must be recognized that the Steem blockchain of March 2020 was very different from the Steem blockchain of today, so it is hard to know how much these findings apply to today. For example, the authors attribute many of the custom_json transactions to Splinterlands, which is no longer riding Steem.

Additionally, the article didn't study any dynamics relating to Steem's communities, beneficiary reward settings, or post promotion.

Further, the powerdown period has now changed from 91 days to 28 days, so I suspect that the lag time between price and voting might have been reduced.

However, even with all those limitations, the correlations on comments and votes lagging behind price definitely align with my own subjective observations. When the price goes down, so does usage, and when the price goes up, usage follows. So I would argue that this is the key finding from the paper, and it has implications for Steemizens today.

Implications for Steemizens

Pixabay license, source

If usage follows price, what does this mean to the Steemizen? It must be remembered that payout is done in Steem-related currencies, so internally the blockchain doesn't care about prices (except for SBD conversion rates). This means that when external prices go up, competition for rewards gets higher, but when external prices go down, so does competition for rewards.

This reminded me of an old quote about investment:

"Buy when there's blood in the streets, even if the blood is your own.", Baron Rothschild

In short, the time to accumulate STEEM is when it's (relatively) easy to get it, not when it's hard. So, for bloggers who want to accumulate STEEM, it's more important to participate in the ecosystem when prices are low than when prices are high.

Here's the catch, however, how do we know when prices are low or high? I remember times when $1 per STEEM seemed low, and I remember other times when $1 per STEEM seemed high. We only know whether prices are high or low when we look in the rear view mirror. So, my thinking is that the ideal strategy is something like "dollar cost averaging", where you blog regularly - no matter what the price is.

Conclusion

So that's a whole lot of words to say something that we probably already knew, intuitively. I'm not always a person to trust my intuition, though, so I'm glad to see some real research to support the ideas.

Hopefully, we can look forward to future research that incorporates the impact of communities, post promotion, beneficiary settings, and other present and future innovations.

One additional point that I'd like to make has to do with this question: "Does social media behavior affect cryptocurrency price?. As already discussed, the authors found no evidence that it does. To me, this is the inflection point that we will need to see in order to declare Steem an unambiguous success. Right now, it seems that prices are buffeted about by speculators and traders - and this is true of most (all?) cryptocurrenices. When we, eventually, invert the relationship between social transactions and cryptocurrency price, that will mean that the blockchain has obtained control of its own destiny.

All figures from PLOS are published under a CC attribution license

All PLOS content is at the highest possible level of Open Access, meaning that scientific articles are immediately and freely available to anyone, anywhere, to be downloaded, printed, distributed, read, reused and remixed (including commercially) without restriction, as long as the author and the original source are properly attributed according to the Creative Commons Attribution License (CC BY).

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

I just finished reading the article and found the same two things to be the interesting takeaways as you did: 1) token price affects the social interactions on chain, but the social interactions on chain don't affect the price, and 2) more people interact here when the prices are high.

It's a little depressing to think that the actual use of the token seems to have little impact on the price, but I guess not completely surprising. Speculators probably don't care much about any underlying value, they just want small, high-volatility assets.

I agree. I notice the same thing with BAT and PRE, too. Both of those have real utility and sizeable user bases, but still not enough to reduce the price swings.

I've been looking for a study like that since I've started blogging consistenly in Steemit. I'm gonna check it later but the results you highlight are similar to the ones I've reached from my own subjective observation.

Also, there's something I constantly think of: how to increase its market cap. According to Coinmarketcap, Steem capitalization is just 83M. That's nothing! I mean, I know the coin is in an historical low, but still... TRX in comparison is 5B.

I've thought of using it as a currency outside of the platform, but still not sure how -- and I have a small amount, so... Anyways, that's a topic for other time.

Good entry.

Btw, is @penny4thoughts or you receiving delegations? I'd like to thank you, investing some of my sp. It's not much, but as the meme says:

S.

Basically, at $83 million, Steem is equivalent to a fairly small "microcap" stock. At $5 billion, Tron is in the "mid cap" range. Which, actually, sort of makes sense to me, since Steem has sort of a niche use case, whereas Tron is much broader.

For a while, my opinion has been that to really increase the market cap, we have to see a really large increase in organic use. And that means diversifying from the "Medium"/"Blogger"/"Wordpress" style blogging. In Web 2.0, I think that blogging sites see much less traffic than microblogging/photo sharing. This is why I've been experimenting with Steem Links and the word search puzzles.

This also ties to your post on memes. I agree with you that something like that is needed, but it's also a fairly hard problem. As you alluded to, it's a grey area for copyright. Also, meme dapps on Steem have already been tried twice that I'm aware of, and it didn't pick up. (apps like that are the original reason why I created the remlaps-lite account) Whether it's memes or something else, though, I think we need to find a way for large numbers people to use the platform in a productive way without spending half their day writing and proofreading.

Of course you're welcome to delegate to @penny4thoughts - and it would help the account to reward engagement from participants, but it doesn't have any capability to share curation rewards with delegators, and it's totally not necessary. The account keeps the SP portion of the beneficiary rewards that it receives and distributes the liquid portion (STEEM and/or SBD), so it's chugging along, growing one day at a time ;-).

People in general like sports, entertainment, sex and politics. I'm not sure any of those topics are welcome here.

You're right that the whole format is antiquated... or maybe Steemit should target a particular niche first (a "beachhead" as Bill Aulet says in Disciplined Entrepreneurship) and then expand. Idk...

Who runs the platform, btw?

Sorry, I forgot to answer this. By "the platform", you mean penny4thoughts? I run that. It's basically just a hobby project for now.

It's funny how this ties into your other reply about funding coming with strings attached. I think it's not that these topics are unwelcome here, but rather that they're not actively supported by curators.

We think that the authors choose the topics, but really it's the high-value voters who drive a lot of it. The old adage about, "he who pays the piper calls the tune" comes to mind. I think web3 can connect funding and content creation more efficiently, but I think the funders will always want some measure of control.

I think they have done that with their steemit crypto academy, "the diary game", and their other community support programs. But growth happens slowly, especially in a down crypto market. What I would really hope to see is for other possible investors to see how Steemit is able to shape activity with their stake and realize how an investment here can be used to establish new "beachheads" in their own areas of interest... "Let a thousand flowers bloom," as they say. ;-)

You're right. The ones with power decide what's best and what not. I was reading the other night that some witness were even downvoting the pictures guy.

Once I have a larger audience, I'd like to try some new risky things; but I'll see.

I think that the price of the currency in a certain social network has a great influence, I explain myself: I enter a panel, start my work and see my wallet, the price is adequate, then the price goes down, I look at my wallet, if before I received 2 steem for example and its value was 1 dollar, then I receive the same 2 steem, but its price is 0.30, the wallet is affected and so am I haaaaaaa I'm not so motivated but I continue, other people move away, it's an individual issue , this is what happens when we receive payments in cryptocurrencies

Steemit is frequently advertised as "blog and earn", so it is logical that there is strong correlation between activities on the platform and the economical state of its crypto.