Steem price analysis October 04,2025

Spot STEEM Insights 20251004 01:00 UTC

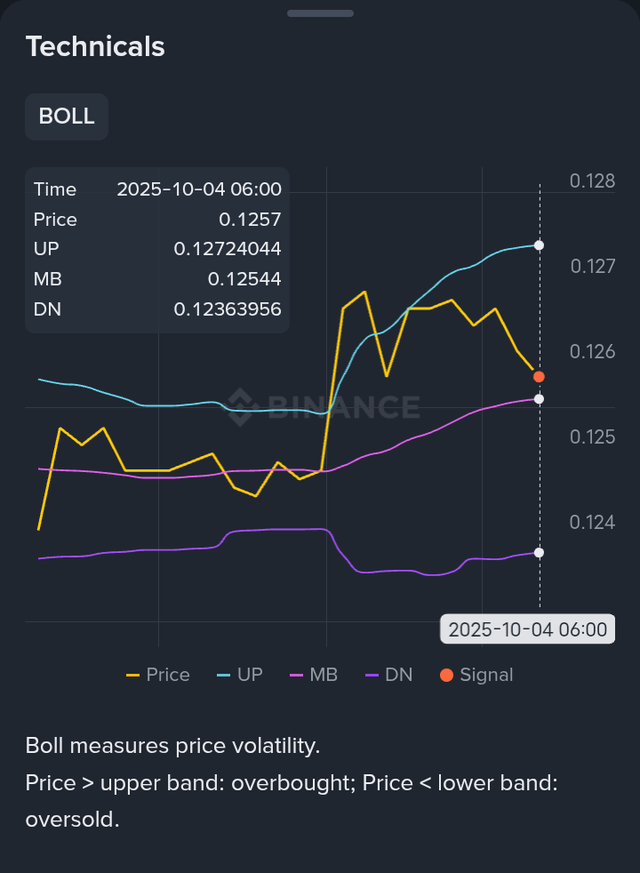

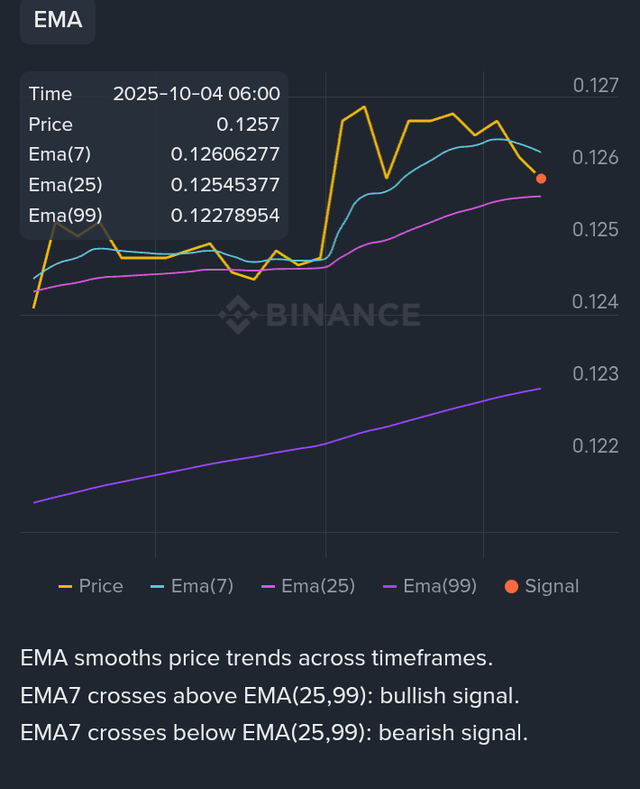

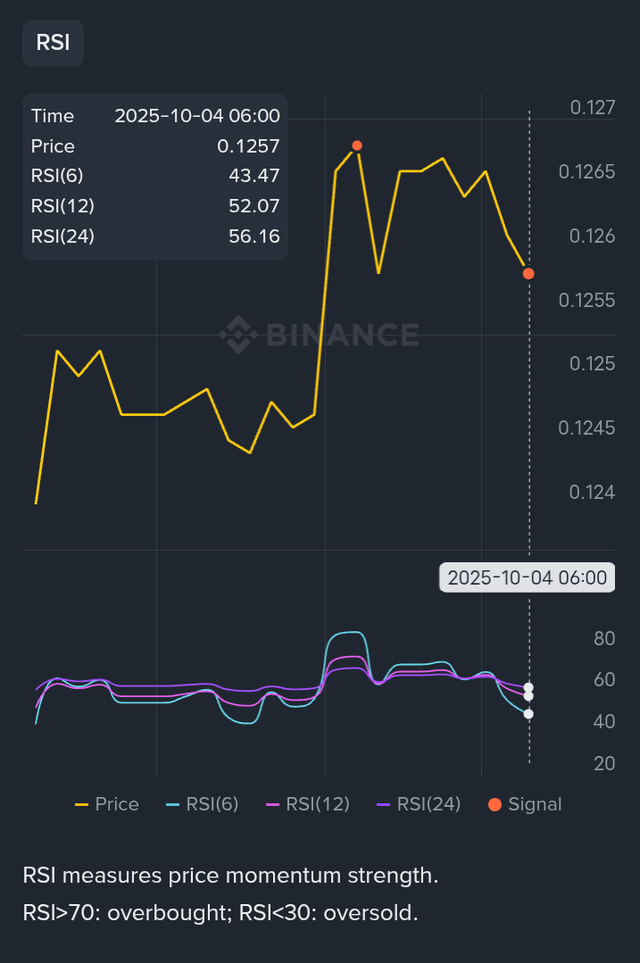

- Technicals: STEEM shows bullish EMA trends but recent MACD and RSI signals point to potential shortterm price consolidation or a slight pullback.

- Money Flow: A significant large inflow of 105,661.27 USDT on October 3rd highlighted strong buying interest despite recent mixed flow.

- Community: Sentiment remains optimistic, with discussions from late September anticipating further price increases.

Spot STEEM Insights 20251004 01:00 UTC

Positives

EMA Crossover: The 7period EMA (0.12606277) is consistently above the 25period (0.12545377) and 99period (0.12278954) EMAs, with all EMAs showing an upward trend, indicating sustained bullish momentum for STEEM.

Significant Inflow: A substantial large inflow of 105,661.27 USDT was observed on October 3rd at 14:00 UTC, representing 62.18% of the total inflow, suggesting strong buying interest in STEEM.

MACD Bearish Cross: The MACD line (0.00049131) has recently crossed below its signal line (0.00049360), resulting in a negative MACD histogram (0.00000230), signaling a potential shortterm bearish reversal for STEEM.

Spot STEEM Insights 20251004 01:00 UTC

RSI Overbought : The 6period RSI has dropped to 43.47 after previously reaching overbought levels above 80 on October 3rd, indicating a coolingoff period and potential for further price correction in STEEM.

Spot STEEM Insights 20251004 01:00 UTC

Community Sentiment : Bullish dominance: Community discussions from late September indicated a strong bullish sentiment for STEEM, with users anticipating higher price targets and advocating for long positions.

| All screenshots taken from my phone. |

|---|

🎉 Congratulations!

Your post has been upvoted by the SteemX Team! 🚀

SteemX is a modern, user-friendly and powerful platform built for the Steem community.

🔗 Visit us: www.steemx.org

✅ Support our work — Vote for our witness: bountyking5