Launching A DeFi Project : A Deep Dive into DeFi

Can You Launch a DeFi Project?What does it take?

October 9th, 2020 #Steemcryptochallenge Week #2 Diving into DeFi by @steemitblog

Launching DeFi projects or DeFi tokens can be an extremely challenging task due to the limited information available about decentralized finance. When Bitcoin was launched in 2009, its worth was negligible. However, over the years the popularity of using Bitcoin as a payment method grew exponentially. During this period, other cryptocurrencies began to emerge, the most important of which was Ethereum, launched in 2014, with an initial coin offering (ICO) that raised $18 million. Ethereum brought us one step closer to building a truly decentralized financial ecosystem.

In 2020, the need for such an ecosystem has become greater than ever before. The COVID-19 pandemic has led to a major economic crisis all over the world. Financial systems are being challenged with severe issues that could cause devastating losses to governments, organizations and the general public. In order to combat these problems, several countries have applied monetary policies of quantitative easing, which has led to a decrease in the value of fiat currencies and a loss of public confidence in them. Consequently, the profitability of bank deposits has experienced a major dip as well.

In this scenario, alternative solutions are gaining much more attention. Among them are decentralized finance products: cryptocurrency exchanges, wallets, and lending, trading and deposit services etc. The primary motivators of DeFi adoption include high-interest deposit rates, which can bring holders massive profits in just a few months, and instant loans that can be borrowed with no documents or Know Your Customer verification.

Despite the growing demand for DeFi products, the concept remains a mystery for many. If you are not familiar with DeFi, you can read our article on the introduction to Decentralized Finance.

Launching a DeFi product

The wide array of products involved in DeFi are also collectively referred to as open finance since it’s an ecosystem where blockchains and digital assets are integrated with conventional financial structures.

DeFi products are characterized by their decentralized nature. They are not managed by an institution and its employees, instead the rules of operation are written in code (or smart contracts). This code is completely transparent on the blockchain for anyone to audit. This leads to a trustless system, where everyone can view the details of the transactions that take place. DeFi products can be used by anyone and are often composed by combining multiple products.

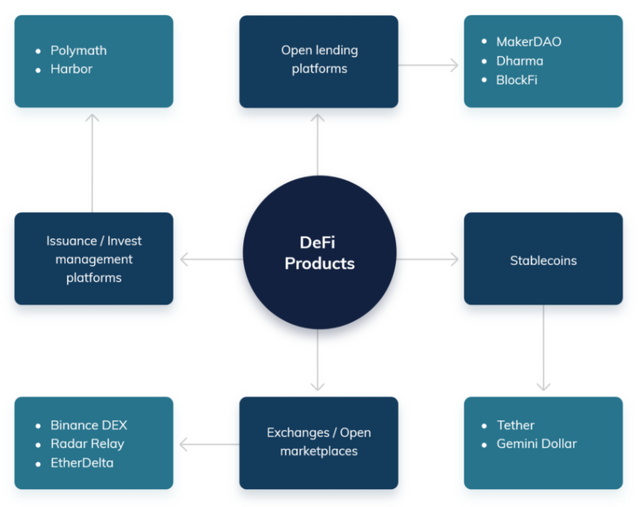

A few commonly used examples of DeFi products include:

1)Open lending platforms like MakerDAO, Dharma and BlockFi

2)Stablecoins like Tether and Gemini Dollars

3)Exchanges and open marketplaces like Binance DEX, Radar Relay, and EtherDelta

4)Issuance and invest management platforms like Polymath and Harbor

https://twitter.com/KidoDecent/status/1314449322847678470

Yes i agree,launching new defi platform not so easy,need to face huge struggles too.

But its a open source so any one can access very easily.

Nice post from you. Have a great day ahead.

#twopercent #india #affable

Yes, being open source makes it a whole lot better.