Steem Liquidity And Demand Issues - Possible Market Crash

I'll keep this short: Steem has a liquidity problem for the amount of nominal value it is generating. I'm terrified that bots and people trading on nominally high prices without much bid depth may induce a bubble which could crash the Steem market significantly.

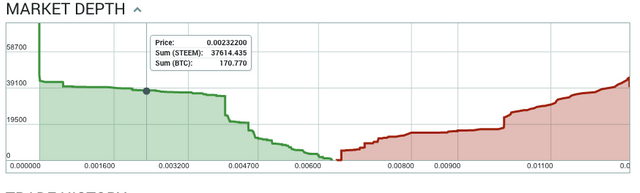

The problem arises with bid depth:

Right now a 37,614 STEEM market sale will drop the price 50% immediately. That's about $119,000 dollars a poster can exit from the STEEM market without causing a significant crash.

This post here netted $26,659 in payouts. At the time of this writing that's estimated to be 8900 STEEM (in the form of Steem dollars and Steem power). Given the 50% split in payouts, $13k of that should be immediately liquid. This is about 20 BTC worth of STEEM, thus at the time of this writing , this sale would net about 20 BTC, and bring the price down from 0.00617 to 0.00510 - a 100,000 satoshi drop in price. The fact one person has the potential to directly induce a 16% drop in the price is a problem that could create a musical chairs situation.

More Bitcoin capital needs to enter the market or STEEM speculators need to trade more rationally. The price is nominally too high, and every time I've seen this happen in crypto it's the symptom of a bubble.

I guess we all just have to watch carefully and stop the roundabout at the right time

This will change as more and more exchanges load up steem trading.

That's a decent analysis. Thanks for it.

Congratulations @thestringpuller! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes

Congratulations @thestringpuller! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!