Steemit is a Ponzi ??

A lot of things in Crypto land are Ponzi’s, Pyramids, Speculative Bubbles or Pumps and Dumps. Those that aren’t are often accused of being Ponzi’s, Pyramids, Speculative Bubbles or Pumps and Dumps. Ponzi’s and Pyramids are very similar and can be assessed together. Speculative Bubbles and Pumps and Dumps can also be considered together which in the interests of space I will do in Part 2 along with considerations for the future.

So in Part 1 let’s look at Ponzi’s and Pyramids and evaluate steemit.com in relation to them.

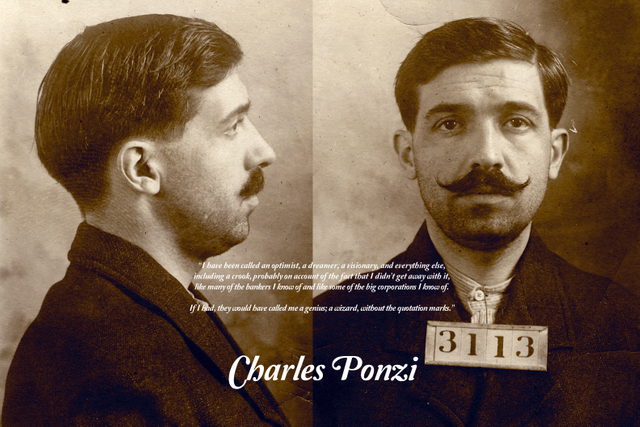

The Ponzi scheme is named after Charles Ponzi who scammed so much money in 1919 and 1920 that he was the first to become widely known throughout the United States.

A Ponzi scheme is a fraudulent investing scam promising high rates of

return with little risk to investors. The Ponzi scheme generates

returns for older investors by acquiring new investors. This scam

actually yields the promised returns to earlier investors, as long as

there are more new investors.These schemes usually collapse on themselves when the new investments

stop.A pyramid scheme is an illegal investment scam based on a hierarchical

setup. New recruits make up the base of the pyramid and provide the

funding, or so-called returns, given to the earlier investors/recruits

above them.A Ponzi scheme is similar to a pyramid scheme in that both are based

on using new investors' funds to pay the earlier backers. One

difference between the two schemes is that the Ponzi mastermind

gathers all relevant funds from new investors and then distributes

them. Pyramid schemes, on the other hand, allow each investor to

directly benefit depending on how many new investors are recruited. In

this case, the person on the top of the pyramid does not at any point

have access to all the money in the system.For both schemes, however, eventually there isn't enough money to go

around and the schemes unravel.

http://www.investopedia.com/terms/p/ponzischeme.asp#ixzz4A8na4su9

**

Initial investment

**

First up regarding Ponzi’s and Pyramid’s. Steemit.com is disqualified in that it does not require an initial investment from its users, in fact it gives them a small quantity of Steem Power to get started. The platform can continue to function in its growth stages without major upfront investment from many new entrants. The few that are investing are creating sufficient buying pressure for Steem to maintain a reasonable price and market capitalization.

Steem Power operates in such a way that prevents Steem being cashed out immediately, allowing those exiting to dump the price and market capitalization of Steem. This is an excellently devised protective measure to limit short term manipulations. Steem Dollars are devised to also further protect and safeguard those who remain invested in the platform.

The rewards/returns remain at 10% of market capitalization. If the market cap drops, there are less rewards that can be cashed out. Buying pressure will increase because, in order to receive a better share of the now more limited rewards, individuals will need to cash out less and reinvest more into Steem Power. This will cause the price of Steem and its market capitalization to rise due to greater buying pressure.

This rewards-to-market-capitalization ratio has a stabilizing effect by balancing supply and demand and evening things out over time.

**

Returns

**

Unlike Ponzi’s and Pyramids 50% of steemit.com returns are based on popularity (and hopefully quality) of content submitted. Only 50% of returns are based on investment to increase voting power and this is not a given. Voting rewards are dependent on how effective the “investor” is in voting up good content early. New entrants to the platform can experiment with their voting prowess before investing in Steam Power or, decide never to invest and just let it accumulate slowly.

Other returns are not monetized and are in the form of socializing, reading, writing and possibly broadening ones knowledge, understanding and perceptions.

**

Risk

**

Risk is set at the level you want it to be:

it can be as little as the time you spend on the site, reading and

voting for content,

you can risk more time by writing and posting content an commenting

on posts

you can invest in Steem Power to increase you potential curation

rewards

you could go full out and speculate on the price of Steem on

exchanges

In short risk is variable and determined by your own risk appetite.

**

Acquiring new investors

**

Steemit.com like any social media platform does need new entrants to grow and it’s up to each person to decide if the platform offers enough in monetized and non-monetized returns to grow.

Steemit.com’s value proposition is unique in the market today and it has first mover advantage.

Once steemit.com has grown beyond a certain tipping point the importance of a steady flow of new recruits will significantly diminish. More on this later in Part 2 under future considerations.

The new entrants are not required to pay the old entrants but just to ensure there is enough of a buyers’ market for Steem to prevent the market capitalization dwindling down to zero.

**

Conclusion

**

On the basis of the four points above it is safe to say that steemit.com is not a classic Ponzi or a Pyramid Scheme. I offers reasonable returns that match initial investments and efforts. Risk level is up to the investor and requirements for new recruits for growth are normal for any venture in the social media space.

stolen from https://steemit.com/steem/@gavvet/is-steemit-a-ponzi-scheme

Congratulations @magedmohamed! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!