What will cause the next market crash?

Economists are notoriously bad at making predictions. But here are five reasons on why the next market crash may be just around the corner.

US Public debt to GDP ratio is at an all time high (see figure below). This is furnished by China buying US bonds in exchange for exporting Chinese goods to US. The US debt will only accelerate due to the new tax bill that lowers expected tax revenue. High public debt usually crowds out private investment, raises price inflation and drives interest rates up. This can cause a market crash leading to a major recession.

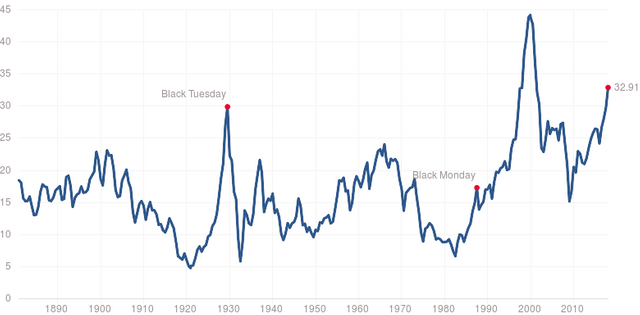

Unusually high market valuations - Let's look at the Shiller PE ratio for the S&P 500 on Jan 3, 2018. Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio). The mean value for Shiller PE ratio historically has been 16.81 and the median value has been 16.15. We are in the zone where prices to earnings are in the top-5% of the sample (more than 2 standard deviations away from the mean). This suggests too rosy an outlook without any reasonable justification and we will likely see a reversion to the mean.

Political climate - Trump Impeachment leading to heightened political uncertainty? Nuclear war based on a tweet? Riots/Terrorism? Euro disintegration following UK exit and Italy default?

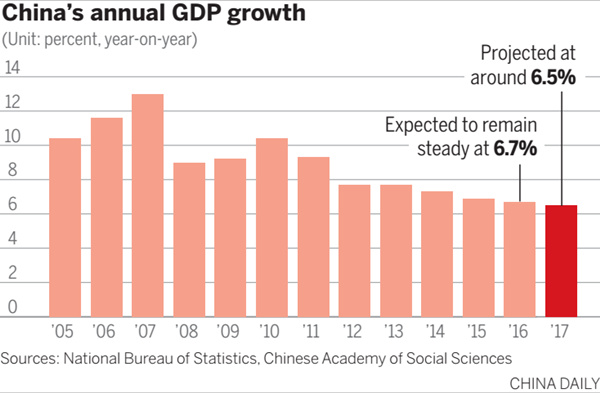

China growth collapse - diminishing returns set, productivity plateaus, high wage inflation, lower growth than previous years. The slowdown can already be witnessed starting from 2013 onwards.

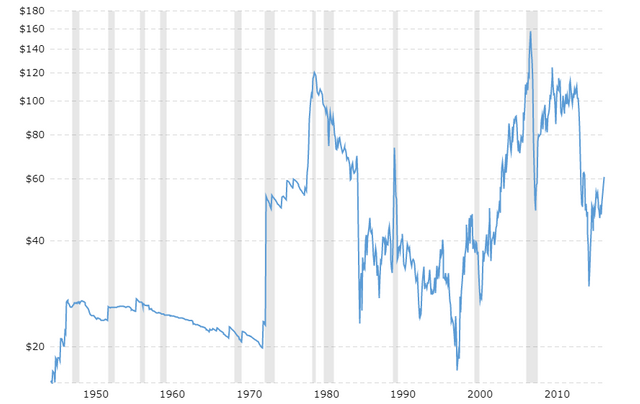

This will have negative spillovers on the US economy that is highly dependent on Chinese production.Oil Price Shock - The supply and demand shocks driving the crude oil market account for about 22% of the variation in US stock market returns (Kilian and Park, 2009). There has been an uptick in oil prices in the last month. If the price of oil doubles, we could see stagflation [recession+high inflation] that happened in early 1980s. Prices can fluctuate because of both international demand and supply. A political crisis in the Middle East (for example between Qatar and Saudi Arabia) could lead to a shortage of supply.

Crude Oil Prices - 70 Year Historical Chart

Of course, any of the reasons above could trigger fragility in the financial markets. My advice would be to start preparing for the stormy days ahead. Historical crashes and dead men tell no tales: "Where you are now, there once was I. Where I am now, once you shall be. Prepare yourself to follow me."

A crash means an open buying period for so more people can get into crypto.

i agree. crypto can go up if there is a market crash and people lose faith in the dollar. i actually think that bitcoin is not more of a bubble than the current stock market. see my other article here: https://steemit.com/bitcoin/@ilovechess/is-bitcoin-a-ponzi-scheme

I gave that article a read and it was a pretty good explanation. Well written.

Thanks. Glad you liked it. :)