Proof of Work v Proof of Stake - EXPLAINED

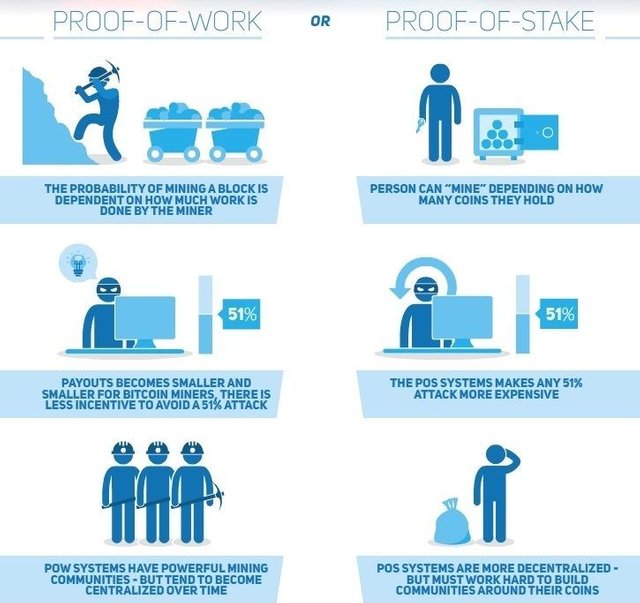

Since Ethereum is famously nearing its transition, there are a lot of people who asking what is the difference between Proof-of-Work (PoW) and Proof-of-Stake (PoS). These are both different ways of “mining” cryptocoins and each have their advantages and disadvantages. Hopefully this article will clear up some of the confusion you’re having.

Proof of Work

In cryptocurrencies, proof-of-work is a system that uses hard-to-compute but easy-to-verify functions to limit exploitation of cryptocurrency mining. It allows for miners to independently try to find the next block, and once they do that miner transmits the solution they found throughout the network. Now, the rest of the network is now being told that the solution for the next block is X, but they don’t have to do all of the work that the miner did – they just need to perform a single check that proves the miner did in fact do the work, and the block it found is in fact legitimate.

Say Andy wants to prove that he can do a really difficult maths question. Helen doesn’t know what the answer is, but she know’s that the answer, when put through a SHA-256 hash, is 7345c10137e159f890acb6b17a8049.

Andy completes the question and hashes his answer. Helen can then look at Andy's hash and compares it to the hash she has, and if they are identical, then she knows Andy found the right answer. Helen still does not know the answer or how Andy got that result – but she knows that Andy arrived at the right answer.

Proof of Stake

With PoS, wealth creates wealth. The more coins you have, the higher stake you have, meaning bigger rewards. Someone’s chance of getting a block depends on how much stake they have so in order for someone to get more than 50% of the forging power (“forging” is the process by which new blocks are made just like “mining” but the exact method in PoS is different so it was given a different name), they would need to control more than 50% of the coins in existence.

When you become a “forger”, you “lock away” a portion of your coins and begin staking.

Since PoW uses up a lot of electricity, it fixed this issue by attributing “mining power” to the proportion of coins held by a miner. This way, instead of utilizing energy to answer PoW puzzles, a PoS miner is limited to mining a percentage of transactions that is reflective of his or her ownership stake. For instance, a miner who owns 3% of the Bitcoin available can theoretically mine only 3% of the blocks.

So why are more coins moving over to PoS?

Ultimately, I think it’s due to two reasons. Safety and cost.

In order for someone to perform a 51% attack, they would need to buy 51% of the total coins available. With bigger market cap coins, this is no issue unless some dirty billionaire comes along and ruins it for us all! Cost is the other advantage. No more paying for electricity, no more upgrading your miner with the latest tech every other year. Simply by holding a certain amount of coins, you will be able to generate more… without doing anything! That’s the true definition of passive income.

Do you guys Stake? Which coins have been profitable for you?

How about DPos?

Hey proxhotdog, I am currently doing my research into delegated proof of stake. I did not feel knowledgeable enough at this time to go into this!

Am i right in saying with DPoS - every stakeholder has influence that is directly proportional to their stake, and no stakeholders are excluded from exercising this influence? I will be reading up today for sure!