The Unusual Math That Makes STEEM a Powerhouse Cryptocurrency!

One of the investing mantras that developed during the most recent silver bullion rally was "buy at any price." While well-intentioned, such tactics rarely work in most asset classes, and so far, has not panned out for the precious metals.

But one sector where this investing tactic, if you will, has done wonders is in the cryptocurrencies. Early adopters of bitcoin and ethereum bought at whatever price they acquired it, and today, they are sitting on a hefty fortune.

Of the many cryptos that are available for trading, I believe that Steemit and the STEEM currency has a great chance of moving substantially higher, and therefore, yes...you can buy STEEM at any price!

But it turns out that we don't have to rely on one person's word for it -- we can trust a little thing called mathematics.

Most Investments are Average Performers

Most financial assets' profit/loss distribution channels follow a bell curve. That is, if you graphed the distribution via a histogram chart, its multi-degree polynomial trend line should roughly duplicate the shape of a bell.

Like the distribution of human intelligence, profit/loss channels are most dense within the smaller magnitudes. That is, we would expect a blue-chip stock to have several more trading sessions +/- 1% than we would +/- 20%.

This is an obvious and intuitive observation. Most stocks do not fly up or down 20%, just like most people are neither geniuses nor retards. The bulk of humanity resides in the average intelligence quota, or roughly, an IQ score of 100 points.

I am confident that if we charted histograms of S&P 500 companies, most would have the equivalent "financial IQ" of 100.

The Incredibly Favorable STEEM Math

When we look at a cryptocurrency like STEEM, we would expect a similar bell curve shape to its histogram. The curve could be shallower, meaning that there are nearly just as many "mid-tier" performance figures as there are "low-tier" results. But at the end of the day, big price jumps -- or big price drops -- are rare relative to the bulk of the histogram...this is just financial science.

Or is it? Perhaps "financial science" works in the traditional markets, which are bound to agencies that control our government, social structures, and most importantly, education. Maybe, just maybe, the cryptocurrency markets require a new form of science to truly understand them.

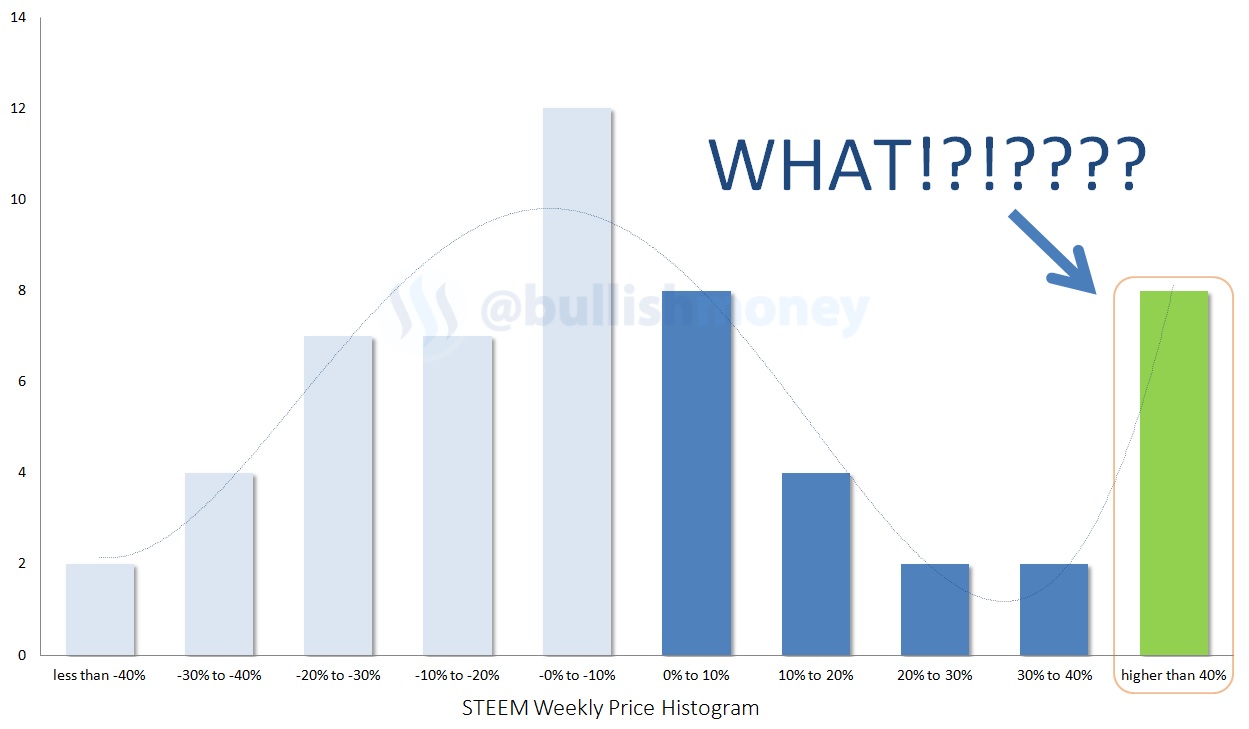

Indeed, when we look at STEEM's price histogram, we come across an inescapable reality -- it's not shaped like a bell curve!

On the tail end of the profit spectrum, the number of price movements equaling 40% or greater is level with the price movements between 0% to 10%. That's absolutely mind-boggling. The frequency of STEEM's biggest moves equal the frequency of what should be STEEM's bread-and-butter -- weekly price moves that average roughly 5%.

In other words, on any given up-week, you are just as likely to have a 40% profit as you are a 10% profit! What!?

Yes, It Gets Crazier!

Out of the last 56 weeks, only 24 of them were positive (one was actually 0%, or no net gain). That means that if STEEM was a coin toss, the coin would be staggered so that only 43 throws out of 100 would come up heads, as an example.

If you were to wager on this game, you would of course pick tails. This gives you a 57% chance of winning, which is far better than the house odds for most casinos.

Based on this logic, you would assume that STEEM is a losing proposition. But keep in mind that investing is not a binary action -- it involves magnitudes of wins or losses. And because the histogram is not shaped like a bell curve, and because it is extremely staggered to the upper threshold of profitability, buying blind in the Steemit markets will net you average gains of nearly 14%.

Again, what!?

Forever Young?

Everything about STEEM is based on the extremes. Were it not for the +40% profitability swings, STEEM would average a devastating -7%. I'm just speaking objectively -- as a viable, long-term investment opportunity, that histogram needs to shape up eventually, or it simply cannot, will not work!

For right now, this unusual dynamic can work because STEEM is in its infancy. According to Wikipedia, only 170,000 Steemit accounts were created. I bet some of you have more than 170,000 friends on Facebook!

Compared to social media giants, this is a laughable figure. And that's why "STEEM Math" is illogically logical! To borrow another commonly spoken phrase, it is what it is.

This dynamic is currently what catalyzes Steemit's remarkable rallies. However, as the years go by, expect its price histogram to follow the traditional bell curve.

STEEM is crazy. I love it!

Great observations and analysis in there. Perspective was fantastic. It's almost like thinking about the size of the govt debt. At a fraction of the big social networks, apples to apples, is hard to fathom how big Steem could get. It's insane to not accumulate.

I agree with your analysis, buying at any price works only on some selected stocks/crypto's.

Steem has the same potential if you ask me, 1,-, 1,50 or 2,- are all cheap prices if Steem goes up to 5,- or 10,- USD!

But then again, how low can the Dollar go? Do we even measure wealth in Dollars in the next 5/10jrs?

Great acumen into the intricate workings of Steemcoin and its possibilities. It's the currency that steemers just love to love!

And probably will be the most profitable for some time to come!

Interesting perspective! I look at network stats and it brings me great enthusiasm, despite whatever the traders might be doing to the price.

If I had no money to invest in steem, I'd still stick around just to be a part of the experiment.

Many thanks.

More analytical studies such as this will be welcomed.

!-=o0o=-!

To follow curated math content follow @math-trail.

If you wish @math-trail to follow you then read this article.

Check Out my views On Cloud Mining i think there is a big future in it to honest

https://steemit.com/cryptocurrency/@newmarket65/is-cryptocurrency-your-get-rich-quick-scheme

Follow Me and I will Follow You