Money isn't any object Understanding the evolving cryptocurrency market

The evolution of cryptocurrency

In recent years, cryptocurrency—and above all, Bitcoin—has incontestible its worth, currently boast fourteen million Bitcoins in circulation. Investors speculating within the future prospects of this new technology have driven most of the present capitalization, and this can be possible to stay the case till a particular live of value stability and market acceptance is achieved. except the declared value of cryptocurrency, those endowed in it seem to be looking forward to a perceived “inherent value” of cryptocurrency. This includes the technology and network itself, the integrity of the cryptological code, and also the suburbanized network.

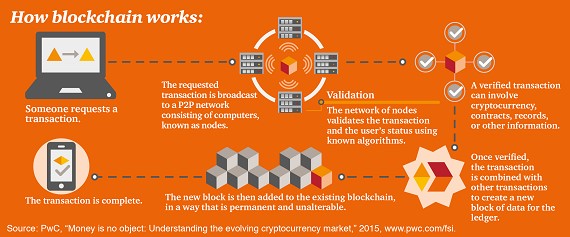

The blockchain public ledger technology (which underlies cryptocurrency) has the potential to disrupt a large type of transactions, additionally to the standard payments system. These embrace stocks, bonds, and different money assets that records square measure hold on digitally and that presently there's a desire for a trustworthy third party to produce verification of the group action.

In our read, the cryptocurrency market can develop at a pace set by the key participants, characterised by possible growth spurts of legitimacy from one or a lot of of those participants in what we tend to decision “credentialising moments.” For the market to achieve subsequent innovate its evolution toward thought acceptance and stable enlargement, every of the 5 key market participants—merchants and shoppers, school developers, investors, money establishments, and regulators—will play a task.

Keys to promote development

Consumers and merchants

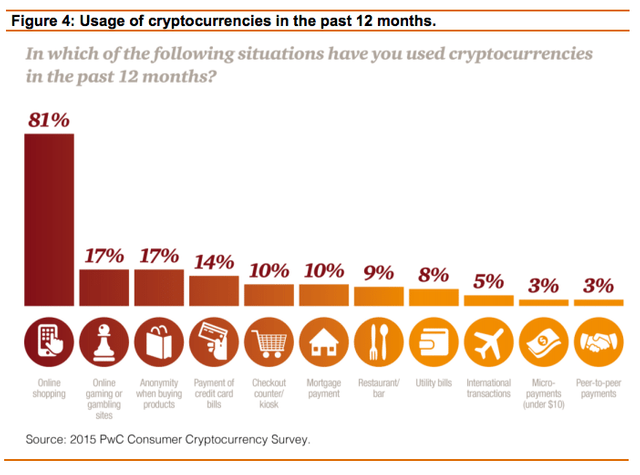

For shoppers, cryptocurrencies supply cheaper and quicker peer-to-peer payment choices than those offered by ancient cash services businesses, while not the requirement to produce personal details. whereas cryptocurrencies still gain some acceptance as a payment choice, value volatility and also the chance for speculative investments encourage shoppers to not use cryptocurrency to get product and services however rather to trade it.

As shown below, solely 6 June 1944 of respondents to PwC’s 2015 client Cryptocurrency Survey say they're either “very” or “extremely” conversant in cryptocurrencies. we tend to anticipate that familiarity can increase as shoppers begin to possess access to innovative offerings and services not otherwise accessible through ancient payment systems.

From the angle of companies and merchants, cryptocurrencies supply low group action fees and lower volatility risk ensuing from nearly instant settlement, and that they eliminate the chance of chargebacks (the demand by a mastercard supplier that a distributer keep on the loss of a deceitful or controversial transaction).

Tech developers

Many gifted school developers have devoted their efforts to cryptocurrency mining, whereas others have centered on a lot of entrepreneurial pursuits like developing exchanges, pocketbook services, and different cryptocurrencies. In our read, the cryptocurrency market has solely began to attract talent with the depth, breadth, and market focus required to require the business to subsequent level. For the market to achieve thought acceptance, however, shoppers and firms can have to be compelled to see cryptocurrency as a easy resolution to their common transactions. Further, the business can have to be compelled to develop cybersecurity technology and protocols.

Investors

Investors typically seem to be assured concerning the opportunities related to cryptocurrencies and cryptography. The “inherent value” of the underlying technology, mentioned higher than, provides these investors sensible reason to be optimistic. As a result, solely recently have a number of the tried and true cryptocurrency firms attracted institutional investors and Wall Street attention.

Financial establishments

Traditionally, banks have connected those with cash to people who would like it. however in recent years, this middleman position has been diluted, and disintermediation within the banking sector has evolved quickly. This has resulted from the increase of web banking; increased client usage of other payment strategies like Amazon gift cards, Apple Pay, and Google Wallet; and advances in mobile payments.

Regulators

Government attitudes round the world toward cryptocurrency square measure inconsistent once it involves the classification, treatment, and lawfulness of this technology. rules also are evolving at totally different paces in several regions.