The Steemit Platform did DeFi Before DeFi was cool!

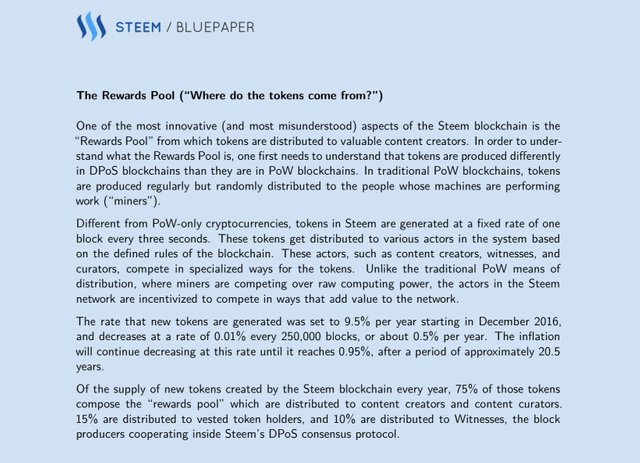

Steemit has always allowed investors to earn interest on deposited Steem, which is NOW common in DeFi

Decentralized is all about yields and return on investment. Steemit always provided investors interest on deposits

Steemit has a baseline yield of about 5.0 % interest payable to holders of the Steem blockchain Token Steem powered up to Steempower via the Steemit smart contract. This is easily performed in your wallet in the native Token Steem on all deposits to the Steemit wallet.*

Start earning approximately 5% interest on your STEEM by converting it to Steempower in your wallet with a 4 week lock up period.

DeFi platforms change Liquid Tokens to illiquid tokens. Steemit changes liquid Steem to illiquid Steem Power

Most DeFi investments lock your token up in non-tradeable tokens. And Steemit does the same thing.

Steemit locks up your Steem as SteemPower

Many DeFi programs give you the opportunity to invest earn yield beyond Depositors interest. Steemit does also.

DeFi programs sometimes allow you to earn interest from depositing your coins in liquidity pools where someone uses your money to make money and you get a share of the profits. So you collect interest and a share of profits.

Steemit allows you to deposit Steem in your account, power it up to SteemPower, By which you earn baseline interest 8.5% and earn addition funds on your SteemPower by an investment tool called Delegation

Delegation allows others to use your funds to generate earnings through curation. You then get a share.

New DeFi Programs are new, some are vulnerable to theft, Steemit wallet security is time tested.

Steemit Wallets have a masterpassword and three other less powerful alphanumeric keys for specific functions. This provides an unequally level os security.*

Steemit was doing decentralized finance before decentralized finance was cool.

Questions?

Contact me here or on discord shortsegments #8903

Steemit has fast free accounts, I can help you set up your account without knowing any of your passwords!

Fast Free Accounts

Create a new account via Steem Instant Sign-up LINK

Buy Steem on one of these exchanges: Binance, Upbit, Bithumb, Huobi Global, HitBTC, Binance, Bittrex, Bitvavo, VCC Exchange, MXC, CoinDCX, Gate.io, WazirX, Poloniex, Upbit, RuDex and Altilly.

Transfer the Steem to your new account wallet on Steemit

Power up your Steem to Steem Power.

Start earning interest on your Steem 8.5%

Do you want to earn more? Yield Earn addition returns while your Steem stays safely in your wallet!

Delegate your Steem Power to Steem-Staking

Delegate the amounts below you want to delegate by clicking the number

25 50 100 250 500 1000 <- these are links

After clicking the link, you will be asked to confirm your username and the amount of SP you like to delegate.

Please sign with your active private key.

Remember to leave at least 50SP in your account.

After clicking the link, you will be asked to confirm your username and the amount of SP you like to delegate.

Please sign with your active private key.

Remember to leave at least 50SP in your account.

Your done!

Your account will start receivIng weekly payments starting in about seven days.

Steem-Staking will list your delegation in the Steem-Staking Report, and the expected date of the first interest payment.

The Steemit Platform did DeFi Before DeFi was cool!

Mentions;

@steemitblog

@steemitcurator01

@steemitcurator02

@steemitcurator03

@steemitcurator04

@steemitcurator05

@steemitcurator06

@steemitcurator07

@steemitcurator08

@johndoe

@stephenkendal

@cryptokannon

@steemingcurators

@crypto.pior

@ciska

@stef1

@oppongk

@beautychicks

@focusnow

@yohan2on

@mariita52

@tarpan, @toufiq777

@rishabh99946

@anroja, @ernaerningsih

@cryptokannon

@randulakoralage

@theitalygame

@alexmove

@kiwiscanfly

@olesia

@rashid001

Your post is manually rewarded by the

World of Xpilar Community Curation Trail

join the World of Xpilar Curation Trail, info can be found here

he is so lucky

We are lucky to be here and yo be able to invest and earn

We are lucky to

Be here and yo be able

To invest and earn

- shortsegments

I'm a bot. I detect haiku.

Thank you for your support!!

#reply2win

Thank you for your support!

Yes it did and no one really knows/knew about it, which is the problem. Steemit/STEM has failed because it marketed itself too much as a content site instead of a defi site. Do you really think if did away with abusive downvotes and marketed ourselves as a way to earn significant interest on your holdings that we would currently be trading at $.17? I sure don't.

How do we change that going forward. It still looks like you can easily earn 30%+ by powering up steem and simply curating each day. That is more than most defi platforms yet STEEM still languishes and fails to attract new investment or new users.

The narrative surrounding STEEM needs to change.

Hi @jondoe

I agree.

I will work with @stephenkendal , @steemingcurators , @stef1 , @ciska , @cryptokannon , @reply2win and any others who are interested in promoting this aspect of Steem.

@shortsegments

Awesome. Does anyone have the ear of Justin Sun or the Steemit,inc team (or even some of the large Asian Investors? We will likely need their help to really get things moving.

@glory7 once organized an AMA type session with Justin Sun, perhaps he still has contacts to get their ear on this ?

Yes go for it, see what he says.

Let me know what you are able to find out. It looks like @steemitblog has now gone quiet as well. Seems like something is happening, hopefully it's good. :/

Heh yeah, I locked my steem for steem power a long time ago; locking up coins takes them off the market, lowers supply, increases value, it's a good thing.

But I think Steem needs more defi type apps that specifically cater to trading & finance rather than blogging. I mean even the main purpose of getting a steam power loan (dlease) is to vote in blogs.

I understand what your saying. Steemit is mainly know for author rewards for posting and curation rewards for upvoting. Few people have read the white and blue papers to understand that like POS tokens DPOS tokens provide in wallet staking and through a feature called Delegation your investment can yield up to 30% return passively with no posting and no upvoting. You just delegate and your done.

While I would love to see additional DeFi applications I continue to promote what we have here already via my Steem-Staking project. Link

你好鸭,shortsegments!

@eii给您叫了一份外卖!

新鲜出炉的炸芋头片

吃饱了吗?跟我猜拳吧! 石头,剪刀,布~

如果您对我的服务满意,请不要吝啬您的点赞~

Thank you for the comment.

Scissors

You win!!!! 你赢了!我这新手村猜拳小能手的名号让给你了! 给你1枚SHOP币!

Scissors

It’s a tie! 平局!想不到你也出鸡爪!

I learned a lot from reading this post and this post is a very useful post for new users. New users will learn a lot by reading this post. So I would like to thank you very much for writing such a post

Thank you for the compliment and for comment

!shop

Thank you for the gift

you are so knowledgeable

Thank you for the compliment.

#reply2win

LOLzzzzzz How come a 76 reputation guy is soooo delusional.

There is no interest on the steem blockchain, there is only dillution of your stake, so increasing your steempower is in reality decreasing your stake holdings. Ohhh did I told you, the moment you put an amount value of USD into steem, the game starts, you need to keep up, just to keep the same amount value of USD.... and all the rest is speculation.

So how big is the probability that you can keep up playing the steem game?

We don't talk gains here...right ?

Hello

The absolute number of Steem increases, the value per Steem Token is constant or increases, the total value of my account increases and that is a net gain.

Example;

I start the year off with 100 tokens, worth 0.25 USD each

Total account value $25.00 USD

Annual inflation of 8.5%

Tokens awarded my account 8.5

NEW TOTAL TOKENS 108.5

NEW ACCOUNT VALUE $27.125

ROI = net profit / total investment

ROI 2.125/25

ROI= 8.5%

Add curation of 8.5%

Now token gain doubled 17 tokens

Net profit = $ 4.25

ROI = 4.25/25

ROI= 16%

This doesn’t include any author rewards I earn only fixed token inflation and conservative curation earnings, so my ROI will be greater if I post.

This makes sense, it’s simple math. How do we check curation earnings?

This sounds like such a cool marketing phrase. Maybe @stephenkendal will make some cool Gifs and we could have another contest with people tweeting the cool Gifs promoting Steem.

!giphy Steemit did DeFi before DeFi was cool!