Middle East Market: Steel, Metal Processing, Casting and Forging, Machine Tools and Automation

In recent years, as the Middle East has accelerated its pace of economic transformation, countries traditionally rely on oil as the pillars have promoted industrial upgrading through strategies such as "decarbonization, localization of manufacturing, and digital transformation". The fields of steel, metal processing, casting and forging, machine tools and industrial automation have thus ushered in new development opportunities. This article will focus on core markets such as Saudi Arabia, the UAE, and Egypt, and provide enterprises with reference for Middle East layout from multiple dimensions such as policy orientation, market demand, technology trends and industrial opportunities.

- Infrastructure-driven demand is released, manufacturing equipment ushers in a window period

The Middle East, especially the Gulf countries, are vigorously promoting urban infrastructure, energy engineering and industrial park construction:

A: Under Saudi Arabia's "Vision 2030", super-large projects such as NEOM and The Line have put forward huge demands for steel structures, automation systems and manufacturing equipment;

B: Egypt continues to promote the construction of the new administrative capital and six major industrial corridors, and the proportion of manufacturing industry has increased year by year, and the demand for machine tools, automation and core components is strong.

C: The UAE’s “Make it in the Emirates” plan proposes that the industrial output value will reach 300 billion Ah by 2031, focusing on the development of 16 core industries such as metal processing and machinery manufacturing;

according toData Bridge predicts that the Middle East steel market will grow from US$43.1 billion in 2024 to US$63.6 billion in 2033, with an annual compound growth rate of about 4.4%; while the industrial automation market will grow faster, with an annual compound growth rate of as high as 7.1%.

Analysis of industry stock and potential gaps:

(1) Steel field:

Saudi Arabia produces steel9 million tons, but the consumption exceeds 13 million tons, and the annual imported steel exceeds 3 million tons, which are mainly used in infrastructure, pipelines, automobiles, and machinery manufacturing.

(2) Casting forging and metal processing

Regional local castings are insufficient annual production1 million tons, especially high-precision parts rely on imports. Egypt and Saudi Arabia are actively introducing small and medium-sized casting lines and forging equipment in China and India.

(3) Machine tool market

The current UAE and Saudi CNC machine tool markets are still mainly imported.The total demand for machine tool equipment in 2024 exceeded US$1.2 billion, with China, Japan and Germany as the main suppliers.

(4) Automation equipment

The demand for PLC, robots, sensors and industrial software has increased by more than 8% annually, mainly driven by petrochemical, metallurgy, water treatment and intelligent manufacturing transformation projects.

Country

Annual steel production (10 kt)

Annual consumption of steel(10KT)

Market size of machine tools (Billion USD)

Annual growth rate of automation equipment(%)

Annual production of castings(10KT)

UAE

900

1300

6.5

8.2

45

Saudi Arabia

330

410

5.8

7.5

25

Egypt

780

1100

2.3

6.8

60

It can be seen that the Middle East market is not only active in material procurement, but also actively moving towards the transformation stage of efficient, green and intelligent manufacturing. Many industries are still in a state of unbalanced supply and demand, and foreign-funded enterprises are facing a good entry window.

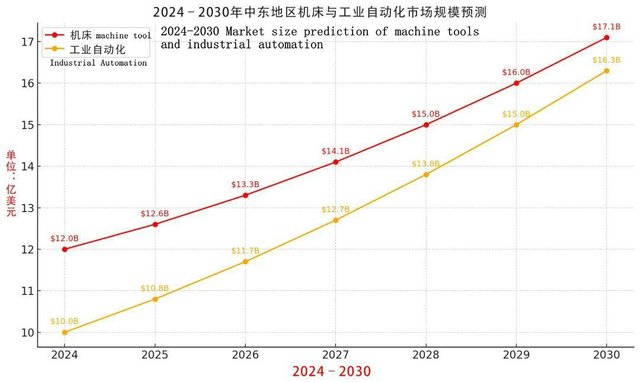

This figure shows the scale forecast of the industrial automation and machine tool market in the Middle East in the next few years:

The industrial automation market is expected toIn 2024, it will grow by about US$10 billion to over US$16 billion in 2030, with an average annual growth rate of about 8%;

The machine tool market is fromUSD 12 billion grew to more than USD 17 billion, with an average annual growth rate of more than 7%.

The trends in the graph reflect the strong momentum of intelligent upgrades and equipment upgrades in manufacturing, bringing continuous business growth potential to related suppliers.

(Chart description):

The picture showsThe forecast curve of the Middle East industrial automation and machine tool market size between 2024 and 2030.

The red line represents the machine tool market: it has grown steadily from US$12 billion in 2024 to US$17.1 billion in 2030, reflecting the trend of manufacturing companies continuing to update equipment and expand production.

Orange Line stands for the automation market: fromUS$10 billion grew to US$16.3 billion, indicating that the region's investment in intelligent and digital control systems continues to increase.

This figure intuitively reflects the Middle East manufacturing industryThe market momentum of the transformation of "technology-driven, efficiency-first" is suitable for market analysis reports or business negotiation display purposes.

- Policies guide comprehensive efforts to manufacturing"Localization + greening" progresses simultaneously

Middle Eastern countries are supporting the construction of local manufacturing systems and green and low-carbon transformation with strong policies:

A. Saudi Arabia: Industrial City and Science and Technology Park Administration (MODON provides comprehensive policy support for land, water, electricity, taxation, etc.; the Industrial Development Fund (SIDF) provides long-term low-interest loans for manufacturing, metal processing and other projects.

B. UAE: Ministry of Industry and Advanced Technology (MoIAT) implements the Industry 4.0 strategy, provides financing support through the China Development Bank; implements local procurement incentive mechanisms, and promotes the procurement of local machinery and metal products first.

C. Egypt: Signed with the United StatesThe QIZ Agreement allows products manufactured in Qualified Industrial Zones (QIZs) to enjoy zero tariff export US policy; promote the "Made in Egypt" strategy, focusing on attracting the landing of basic industrial clusters such as casting, welding, molds and machine tools.

- Industrial trends: Resource advantages and technology-driven, creating a manufacturing ecological chain

A. Green metallurgy upgrade: Saudi Arabia, the UAE and other countries invest heavily in green hydrogen iron production (DRI) and other projects, using local solar energy and natural gas resources to develop the low-carbon steel industry;

B. Speed up intelligent manufacturing: widely introduced by local industrial enterprisesAutomation solutions such as PLC control, remote operation and maintenance, and AI predictive maintenance promote the integration of "digitalization + automation" on industrial sites;

C. Upstream and downstream ecological integration: such as EgyptLeading companies such as Ezz Steel and Saudi SABIC have gradually built a complete industrial chain from raw material-component-system manufacturing, providing intervention opportunities for related equipment and service providers.

- Opportunities and challenges coexist

opportunity:

Super large infrastructure projects continue to release equipment and material procurement needs

Policy incentives and park supporting facilities are improved, and foreign investment access channels are smooth

The localization trend of manufacturing industry is clear, bringing a window of cooperation and investment

Green and low-carbon and digital manufacturing drive a new round of industrial upgrading

challenge:

The market competition is fierce, and differentiated advantages need to be formed through technology and services.

Access policies are complex and need to be implemented with the help of local partners

Shortage of technical and operational talents affects local operation capabilities

Geopolitical fluctuations affect investment security and project cycle

- Overseas strategy suggestions: Focus on key areas and create brand value

Priority will be given to high-potential markets such as Saudi Arabia and the UAE: These two countries have strong implementation capabilities and large market capacity, and are ideal export places for high-end equipment and automation solutions.

Actively participate in local professional exhibitions and park connection activities: such asRiyadh Metal & Steel, Egypt Metal & Steel, Saudi Smart Manufacturing, etc., use the exhibition to establish initial customer relationships and quickly integrate into the local procurement chain.

Build a localized service mechanism: set up a representative office or choose local channel dealers to cooperate to improve after-sales response efficiency and customer trust.

Strengthen brand international expression and green technology label: highlight core advantages such as energy conservation and efficiency, smart and environmental protection, and fit the Middle EastThe main theme of "Sustainable Industrial Development".

- Conclusion

The Middle East is coming from"Resource output economy" leap to "manufacturing + technology-driven economy". Under the resonance of policies, markets and transformation, enterprises in the fields of steel, metal processing, machine tools and automation are facing unprecedented development windows. Manufacturing companies should take advantage of the policy trend, accurately enter sub-sectors, deepen their local service and cooperation networks, and fully release the strategic potential of "going overseas to the Middle East".

More info : https://www.sinosteel-pipe.com/en/blog-5612363175728871.html