Six Months of Steem Power Distribution

I have been a Steemian for just over 6 months now. When I first joined, the hot button topic was a perceived rampant inequality which was only getting worse. Investigating further for a couple of weeks, it was clear the opposite was true - in fact, there was a rapid redistribution occurring at the top, where whales' stakeholding was falling fast. Said rapid redistribution was short-lived - let's find out what happened next.

This post will look at six months of data from Steemd.com's Distribution page. While some of my earlier posts focussed on the Active metrics, this long term look will focus on "All Accounts". Note that this includes bots, investors, aliases, silent observers - the whole lot. However, since the numbers are stake-oriented, they all matter for the overall economy, if not necessarily direct impact on Steemit.

All data is collected manually. That may seem like quite a waste of time and effort - why not simply automate it? My intention was to tell a story - go through the months and find out exactly what was happening, make a note of the events that may have influenced changes in distribution trends. Needless to see, it'll be full of speculation. In hindsight, yes, it was too much work for proportionately little value - though I remained committed to see the six months out. I'd invite the talented Steem developers to make a distribution trends chart - it would be a nice fit for web apps like Steemdb.com or Steempunks.com.

So, let's get down to how it all happened.

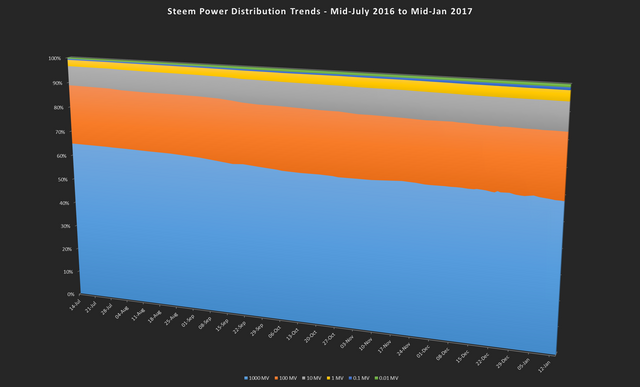

TL;DR - What was a rapid redistribution in Mid-2016 sped up further, before slowing down to a crawl towards the end of 2016. It has since picked up pace once again following Hardfork 16.

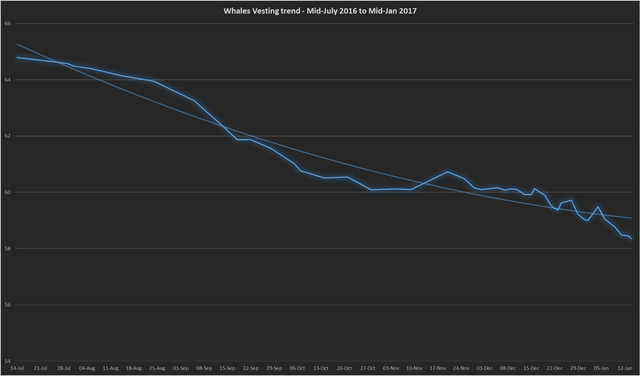

Whales

Needless to day, the whales' behaviour would have the greatest impact on overall Steem Power distribution. Each change here would rippled down to the other tiers. From July to August, whales were powering down and selling at a steady pace, dropping over 1% every month. As the price of Steem started to decline in September, more whales joined in and the whales' stakeholding plummetted. By October, the whales tier held 60% stake - down from 65% just 3 months prior.

It wasn't a straight decline however, there were two anomalies. A couple of users saw the declining price as an opportunity in and powered up to whale status in early September. Later in the month, @steemit vested two accounts with mega-whale stakeholding.

By October, the price of Steem had declined so much that powering down whales stopped dumping, in favour of holding. This led to a temporary plateau in whales' stakeholding.

In November, we saw a very rare increase in whales stakeholding. This was driven by three factors. A low price of Steem combined by Steemit, Inc stating their intent to make widespread economic changes encouraged investors to power up - indeed we gained 3 new whales during this period. Meanwhile, witnesses published aggressive price feed discounts which encouraged SBD holders to convert to Steem and power up. We gained one new mega whale in this time through a mega conversion and power up.

At the same time, greater investing and excitement about the economic changes led to a temporary price bump, so whales started dumping again. Approaching Hardfork 16, things stabilized at 60%.

With the power down rate now nearly 8x faster, that could bring a hypothetical 8x faster redistribution. The negligible interest for Steem Power post HF16 could also be an active deterrent against holding. However, post Hardfork 16 a surprisingly few number of whales chose to power down - most electing to baghold. As Steemit Inc. employees hold a significant chunk of this tier, there would seem to be an agreement to not power down, so all changes post HF16 would be due to independent whales.

There was indeed a slump the first week, but an interesting trend emerged - the stakeholding would somewhat recover by the end of the week. The price has been relatively stable during this period and we haven't seen much new investment or new whales. What is really happening then, is that some whales are consolidating their multiple Orca accounts into single Mega-whale accounts. Conversely, other whales are transferring stake from their mega-whale accounts to smaller Orca accounts. In the end, it's a bit of a zig-zag pattern between two competing ideas.

In January, however, the decline has picked up, reaching an all-time low at 58.36%. We have seen 2 whales drop away from whale status down into the Orca tier. Six months ago, whales held 65% of the network, so that's roughly 1% drop in whale stakeholding per month. Not as rapid as many had hoped for, but a steady and sustained decline.

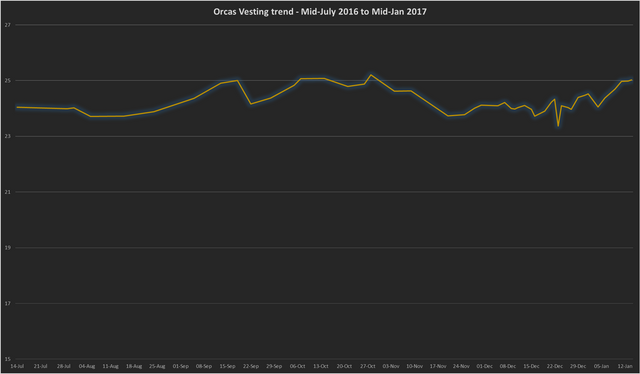

Orcas

Of all the stakeholding tiers, the Orcas are the most curious of the bunch. They barely saw a change throughout the last six months, yo-yoing around the 24%-25% range. Most users in these tiers are miners and early content creators. The latter are the most likely to be holding. The Orcas continued to increase their stake steadily till early September, when there seems to have been a change in focus in curation away from early (and now highly staked) content creators to newer authors. Since then, it's been relatively stable.

There's definitely some connection with the Whale tier - we often see Orcas being promoted to Whale status, and vice versa. Indeed, the last week saw the greatest increase in Orca stakeholding, mostly driven by the 2 ex-whales who are now large Orcas.

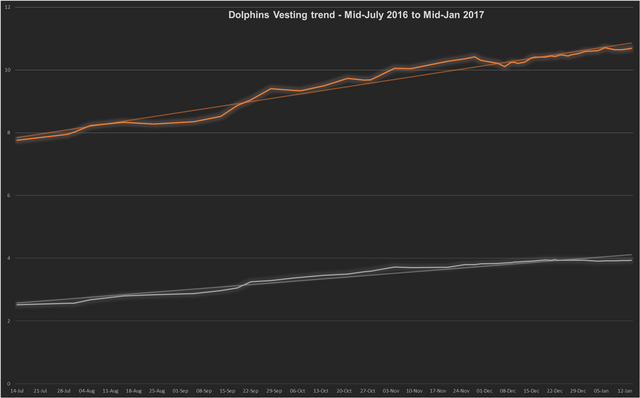

Dolphins

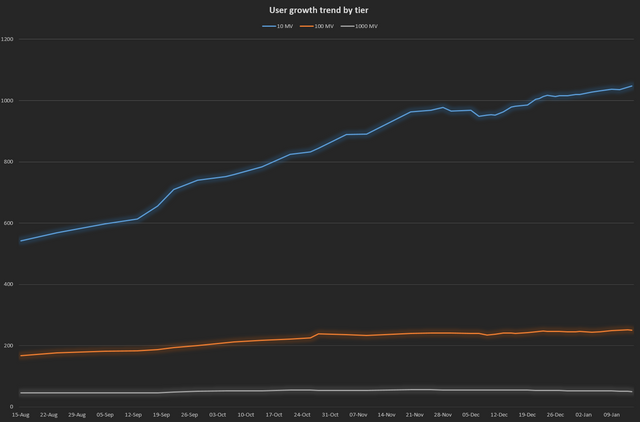

Note: Orange is the 10 MV tier; Grey is the 1 MV tier.

Dolphins have seen the most consistent and sustained trend - upwards. We do see some spikes in September, and slight declines in November. The September timing is strongly correlated (Note: Correlation does not mean causation) with the emergence of massive curation guilds. The latter is possibly due to the temporary increase in Whales' stakeholding - squeezing out all tiers by a little.

Over the last 6 months, both Dolphin tiers have gained 40% and 50% stake respectively. That is 7%-8% increase every month!

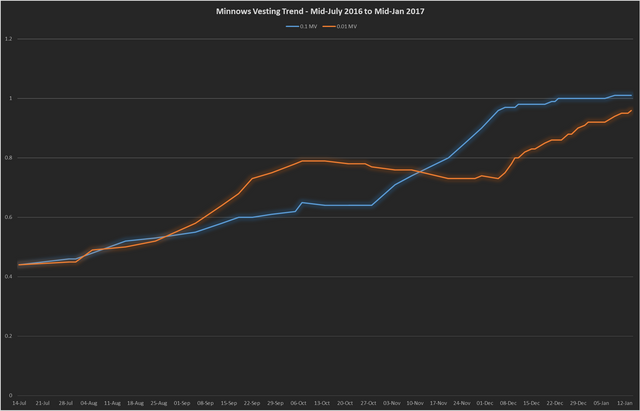

Minnows

Minnows' stake has effectively doubled in the last six months, though gains are always easier when you're coming from such a small pool.

There's once again a correlation in timing with the curation guilds. The 0.01MV contains nearly 10x the amount of users, but in November, the 0.1MV overtook the 0.01MV tier. The 0.1 MV tier consists of many authors rewarded by massive curation guilds, as new users in the 0.01 MV tier would graduate quickly to the 0.1 MV tier. However, since December, the 0.1 MV tier has plateaued out while the 0.01 MV tier is gaining rapidly. I'm not sure why this is - any ideas?

Some additional thoughts - Firstly, to be pedantic, the post is really polling VESTs distribution rather than Steem Power. So how are these changes happening?

- Powering Up/Down - The different tiers power down / up at different rates.

- Rewards - Differing author and curation rewards distribution among different tiers.

- Movement between tiers - Users moving up or down between the various tiers.

Hope this post has been helpful and that the series has bowed out on a high.

Hello @liberosist,

Congratulations! Your post has been chosen by the communities of SteemTrail as one of our top picks today.

Also, as a selection for being a top pick today, you have been awarded a TRAIL token for your participation on our innovative platform...STEEM.

Please visit SteemTrail to get instructions on how to claim your TRAIL token today.

If you wish to learn more about receiving additional TRAIL tokens and SteemTrail, stop by and chat with us.

Happy TRAIL!

Why are these content-free comments getting upvoted so much? As far as I can tell, this is just self-promotion spam that doesn't actually convey any useful information to a reader of the post.

Didn't notice this... nice catch.

Wow, this is amazing and I think not a waste of time at all. I think the growth in power of the dolphins is especially interesting and a good sign. I could see an argument be made that this is the most important group to be growing in power because they are the ones who are really committing to the platform and adding the most value. But that's just off the top of my head.

I'm sure most of us have noticed that. The most engaged Steemians are in the 10MV - 100MV tier. They have also grown their accounts organically post-July 4th. A lot of 100 MV+ Orcas made a lot of money creating content in the early days but are no longer active. Needless to say, the same applies for most early miners as well.

@liberosist when can we consider ourselves dolphins?

does the 10M vest still apply?

From a dolphin to another dolphin: I hear you :)

@andrarchy is an orca ;-)

My mistake, sorry :)

Thanks for doing this analysis @liberosist. Overall the redistribution seems little. And this despite an extensive decline of the seem price during the observed time-frame.

One question, have you included the steemit account in the analysis?

The decay in Steem price is what slowed it down, like I mentioned... Once Steem hit the 10 cent mark in November, whales switched to holding.

Good question - Nope, the @steemit account is not included; same as Steemd.com.

Thanks for clarifying!

What is the total number of orcas and whales and mega whales broken down by category?

Can be found here: https://steemd.com/distribution

Here's a bonus chart just for you.

High res

To answer your question - 1040 Dolphins in the 10MV-100MV tier; 250 Orcas in the 100MV-1GV tier; 50 Whales in the 1GB+ tier.

Wow, That is far more than I realized, thank you for the hard work on these charts.

Thanks for doing this. I have been wondering about the distribution for some time as I think that is a big part of many of the problems we currently face with the site.

What is your final conclusion of the data? Is this healthy activity or do we need more rapid distribution? Is this kind of activity conducive to the long term health of the platform?

You did a great job putting all this together! Thank you for your hard work :)

On one hand, you could argue that the re-distribution isn't rapid enough. The network is still controlled by a few dozen accounts. On the other hand, it also means that whales see potential and aren't rushing for the exits.

However, I do think a lot of whales were holding for the Roadmap. The next few weeks will determine where they really stand. We may see the re-distribution pick up significant pace in the coming weeks.

Ultimately there could be an equilibrium between whales bringing investment and a certain magnitude of equality required for mass appeal. No idea where that would lie...

Im glad the analysis has even cohorts now.

That said, numbers like this are not very useful in measuring distribution.

If youre talking about distribution, you want to know what percentage of the stake is in each standard deviation from the mean. (and also, just as a side note, what the SD and the mean are) (though it would make sense to exclude the smallest accounts). Thats really the only way you can make meaningful comparisons between distribution

Sadly, ive never been able to figure out how to pull the numbers out for all the accounts

Of course. You can do that by accessing the blockchain directly. Should be pretty simple for developers.

Thanks for doing this, very insightful. I would love to see something like this on a weekly basis, it's an important metric for the health of the ecosystem. Congrats!

It is - which is why I hope a Steem developer picks up this idea and has live charts for the same :)

I am not sure this is really a waste of time at all. This is a very nice analysis, and very useful actually. Thanks for putting all of this together! :)

It's a waste of time doing it manually. But yes, I (obviously) agree it's very useful and valuable to have it automated.

Very useful data and insightful analysis.

GREAT information! Thanks for your diligence. I look forward to more of your content. This is valued info. Following