MaaS - Money as a Service -Cryptocurrency

Will crypto ever go mainstream or will it the dark financial market for the brilliant and technical experts?

MaaS, I first heard the phrase from Amanda B. Johnson while she was acting as a spokesperson for Dash. MaaS - Money as a Service. Basically a payment service. The way I viewed her pitch was instead of being limited to a government controlled currency, provide a selection of payment options to be utilized based on their ability to add value to the users' purchasing choices. It was very clear that Dash knew they had to educate and reach out to mainstream people, in language they understand and paint a vision for their potential end-users. Also during that time Dash was performing very well.

In the Start-up companies, I've worked for that was one of the first things we did. We figured out who our target market was (someone who had a problem we could solve) and we painted a picture for them on what problem we were going to solve and why our product brought a solution. In the beginning phase of a product launch, we talked about the technology or the features of the product, but end-users don't really care about those things, they want to understand "What will this do for me?" and "Why do I want this?" Once we were able to answer those questions internally and externally, the products began to take off.

I had nearly forgotten the phrase MaaS until I was taking some notes last night on my view of where I think the Cryptocurrency Markets are at.

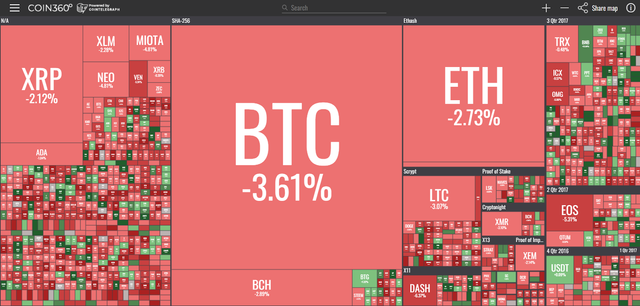

Here is my perception of the past year's events in Cryptocurrency Markets.

It is only my perception as no one knows exactly what or who drives the cryptocurrency markets. (When you hear someone speak with Authority on exactly what created pumps or dumps, proceed with caution, as I am completely unclear on how someone could have a firm grasp of what drives the market)

Bitcoin received a lot of interest and attention in 2017 and due to increased dollar value and this greatly improved Bitcoin's name recognition, it also gave critics a curious audience to feed FUD, Fear, Uncertainty and Doubt. Governments reacted with threats of Regulation and Bitcoin and the entire infrastructure of the Crypto Market Space was overwhelmed with the additional traffic and fees went up, speed of transactions went down and usability was greatly impacted. The technology is still difficult to understand and hard to use. It was a perfect storm for those who were interested to take a look and see exactly how immature the market space is and to walk away.

Don't Despair:

Right now in my opinion the value of nearly all cryptos is still purely speculation. The usability of the current cryptocurrency coins is still way above the average end-users ability to use. I am of the opinion that crypto cannot achieve mainstream adoption in its current state. Most aren't cheap, fast, easy or more effective than most government controlled currencies at this time. The most experienced tech and cryptocurrency experts will disagree here, because some high-end users know how to do these things. They over simplify the expertise and experience they have and how it isn't the same game for the less-skilled end-user.

What about blockchain some of the value is in blockchain? I've heard a lot of people talk about the blockchain aspect adding value to cryptocurrencies, but I am unclear on how that plays out. The blockchain engineering is still evolving and most of it is open source, so if you take away the speculation of the value of the tokens, blockchains will be easy for large businesses to replicate and utilize which adds very little value to the tokens themselves.

I'm not sad nor am I disappointed by where we currently are, I am just trying to figure out where we are at and how to support the emerging market.

There are so many new tokens trying so many different things right now which follows the development of both computer and Internet technology when they were immature markets with a lot of highly technical people. Many feel this is bad for the Market and I think it is just part of the process. I see nearly every crypto project as an experiment right now and those that fail will teach the next products some lessons until we reach a point where more tokens are easy, cheap, and solve a problem.

For me I am in love with the idea and hopeful about the future of MaaS, I don't like to trash talk coins and I realize the ultimate winners in the game might not even be around yet. I support the entire Market Space during this phase and think many of the projects have something to teach and potential. I want to encourage people to learn about Cryptocurrency and also encourage the market to consider who are the potential customers and what will they gain from using the tokens. I don't understand the hostile attitudes between the various end-users and their favorite coins, other than maybe being protective over their investments.

My conclusion is we still have work to do to reach "Mainstream" and Steem is a great chain that has made progress in the current market.

We have: Easy to remember Usernames, some ability to restore accounts, a platform that can be used for support and education, as well as other real use cases. We already have a strong community and we have proven that non-technical people can pick up and learn our product.

I've said it before, but Steem is a great platform to use as a Gateway Cryptocurrency to help onboard and educate average people on the value and use of cryptocurrency. while supporting the over all crypto markets.

This is just my view of the current market, I am not an expert, I've only been studying this space for the last 2 years, so please do not think I am presenting myself as a Crypto Expert.

What are your thoughts on the current market conditions and do you like to imagine who this whole industry may develop?

Your questions and comments help me to define my own views.

I imagine one of the main opportunities crypto in general will present is the opportunity to directly monetize things that you previously couldn't. Like here with Steem, we're directly monetizing content.

With Golem, you'll be able to monetize your cpu computing power, with Substratum you can monetize extra hard drive space you have on your computer.

One token people around here probably don't know about but that's of particular interest to me is RNDR, which will allow you to do gpu rendering on your computer and sell that computation for their token, then trade that directly for render time on their service(gpu rendering).

I think buying and selling things with crypto is only the beginning. You can make an "original" piece of digital artwork and store it on the blockchain so that only one version can exist, or a limited supply, etc.

Needless to say, I'm bullish.

This was probably a typo but I think it's a great one. The internet developed from a few meganerds older than I am, to my generation which learned it as teenagers and adults and adopted it and built it out, to the Millennials who exist within it like water.

Blockchain will probably go very much the same way. We're the old nerds, and we have the opportunity to be the specific old nerds who learn everything about how this new thing works and direct it and teach it to the next generations and reap the rewards of that.

You are right, it was a typo and I agree, maybe a Freudian one. :) lol, I agree with what you said as well. In my life I've been able to watch first computers and then the internet change the world, I think I will get to see a big part of how crypto may change the world economy and put power back in the hands of those who would like to make peer to peer transactions, with confidence and privacy.. (maybe, depending on the token)

There is no question the early adopters will have an advantage.

We can do this via cash still, but for obvious reasons, carrying a bunch of cash around makes little sense. Most people have little need to replace their credit card or cash. That's why I have a hard time grasping why crypto currencies would ever take off as a true currency. Even fewer people need to hide their money spending as well. So why would it ever be mass adopted for spending purposes?

I've always imagined that cryptocurrencies would be come the next version of stocks instead.

Stocks represent stake in a company, but the ledger was always with the stock exchanges and you'd have to sell your stake at the exchange and move your money through a clearing house to get it. No one would use stocks as money, but what if you could? Then you would have something like a cryptocurrency, which is exchanging stake in a company for something.

The obvious issue here is how crypto compares to home currencies. I live and work in the US, so my main goal is to get more usd or be rich in the currency that gives me the most value in a life where that currency is accepted. So early adoption isn't about the tech , it's about understanding the people who want to use the tech to I crease productivity.

Right now, most of those currencies are high level attempts at solving problems that do not really exist.

Let me rephrase that. They aren't problems that exists with the general public members of society, but they are problems that exists within broader financial systems that we are a part of.

Interesting point of view regarding the "New Stock Market" I can see that as well.

I do think there is a case for peer to peer transfer of assets without requirements of banking or carrying around cash. But heck we can have both.

Peer to peer is free already through services like venmo which is highly popular. You can pay a small fee and have it deposited in your bank instantly. Why would anyone use a crypto to do the same thing? Especially if the value will never stabilize?

So I don't think there is any value in a large scale peer to peer setup. Instead the coins would act as stock value in a company. That's why I think steem will be successful once the proper nodes are setup to allow app development (just like how Facebook become a giant with their api)

I like to pull one for @aantonop, where he painted a picture of how post Gen-Z kids would be frustrated at the clunky mechanism of global remittance and the archaic banking laws.

"why the heck i can't send 69 cents to Juarez from Cebu at 3:26am on a Saturday instantly", "what do you mean I can't have a Paypal business account at the age of 13, why the hell should my parents own the account to my media startup when they did nothing?", things like that.

Millennials gets angry when a webpage loads 0.3 seconds slower than usual, you think a "2 business day" banking policy is something they'd put up with?

I think we are only in the initial phase of cryptography, it is like with computers and the internet, there is always a group of users who use it when it is in its initial phase, but then, some great innovators make it accessible to the masses , as with Google, Microsoft and Apple. We are like those who used the internet before google existed, and like those who used computers before the Apple II.

Although crypto gained alot of mainstream attention in late 2017 I dont think many people actually took the time to try and understand it. I read spome books on blockchain and even the basics are hard to read. People just see it as 'internet money' or a bubble - its much more than thay and is solid tech!

I think we will see mass adoption of a handful of projects in the next decade and the rest will fall to the wayside much like the 'dotcom' era. There are loads of good ideas in crypto but also loads of scams and downright ridiculous ideas, so I think it will take a while to iron out.

Couldn't agree more with this! Trying to figure out the basics a few months back was a bit of a headache to be honest - I cant imagine some people who arent that up with technology trying to understand it all.Who knows though - it call all topple over tommorow :P

Companies are quick to say "blockchain not bitcoin", one most glaring example is the shit that Jack Ma pulled. Ultimately all they are about economic rent and control.

Though end-users don't really care these things like liberty from currency control. it wont be long before some financial disaster happen that saw the rise of cryptocurrency use (use, not price) that the smart ones would finally see the appeal of it. It's not about jumping in and hoping for "when moon", but to know that the money you own would be accepted anywhere in the world and whose fate is not decided by 12 unelected old men in a cushy room.

As for steem, I really believe that the 3 second blocktime, massive network capacity and DPOS consensus algorithm isnt that properly communicated to the wider public, even among the cryptocurrency space. Ask any folk in bitcointalk and most likely their understanding of Steem is something along the line of "Reddit with money". Totally doesn't do steem justice.

A quick search on Quora about the "fastest transaction crypto" and steem isn't in any of the answers. (Hmm, maybe i'll drop a

angrilypassionately written answer to shill for steem).IMO Marketing purely through user word of mouth may not be the best thing Steemit.inc can do. Perhaps they decided that now may not be the best time for full scale marketing yet, and i may agree to it. But if this is the extent of how Steem will reach the public, we're gonna have a problems.

There are a lot of tecnical issues to face, but for mass adoption crypto needs simplicity. Take Steemit for example, Steem, SBD, SP, delegates, witnesses, reputation, various keys. A average person would think what is all this crap.

Not to talk about other gazillion coins, POW, POS, Dpos, minting, forging, algo, cloud mining, mining pools etc...

Hi whattsup. People may laugh but that is why I bought Verge. Verge and Token pay are launching a debit card through the bank they purchased recently. They seem to be ahead of the game of mass adoption from all the other coins. verge got involved with Mindgeek as well plus a host of other companies. it is already being used daily by these companies. The price was at 0.02 c recently and I know it is a shot in the dark but I do believe it is the one that is going to catch everyone out.

steem is gamechanger platform

I am simply trying to amass as much as possible in the dip. Whether it is swing trading on exchanges, doing small silly stuff like earning PRE using presearch.org or slowly building up SP and STEEM here.

In order for something to be a great idea, people think something else must be a horrible idea and then the arguments can start. I don't love any of them coins, I just know that some will perform better than others and trying to predict which will resound better with the normies and make me the most money.

It is easy to by before the bottom and catch a knife. It will initially look like a bad or losing decision. When it eventually goes up, and it will, I will no be kicking myself for buying in at $6100 because I could have absolutely nailed it at $5500.

Would be nice finally have a good bull run but I am happy with the sales going on now.

Interesting points of view @whatsup . It is disappointing as you say. As you pointed out it is ao experimental the ultimate winner has not even been invented yet. Just like motorola came out with phone 1, apple took over, maybe the same will happen in the crypto space.