Stablecoins Reach All-Time High of $251 Billion

A 22.36% growth so far in 2025 confirms the crucial role of stablecoins as a bridge to banking and borderless liquidity for the entire crypto ecosystem.

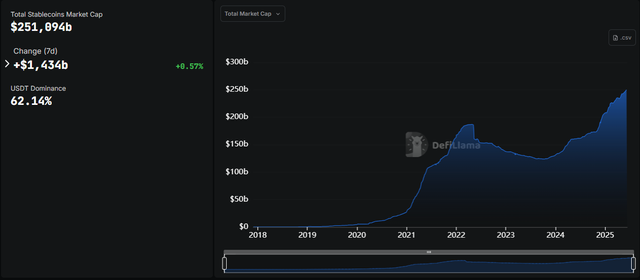

The cryptocurrency landscape has reached a momentous milestone. The total market cap of stablecoins has broken an all-time high, reaching $251.1 billion, according to the latest data from DefiLlama. This impressive 22.36% growth so far in 2025 not only reflects a maturation of the sector but also underscores the indispensable role that these stablecoin-pegged cryptocurrencies play in the expansion and functionality of the global crypto ecosystem.

The exponential growth of stablecoins is a bullish sign for the entire cryptocurrency sector / Defillama

The Stablecoin Momentum: Benefits for the Crypto Sector

The exponential growth of stablecoins is a bullish sign for the entire cryptocurrency sector. By offering a relatively stable value compared to the inherent volatility of assets like Bitcoin or Ethereum, stablecoins act as a secure gateway for capital, making it easier for investors to move in and out of positions without having to constantly rely on traditional fiat currencies. This increases market liquidity, allowing for faster and more efficient transactions and encouraging greater participation from both retail and institutional investors.

Furthermore, their stability makes them the preferred tool for trading, yield farming, decentralized lending, and other DeFi applications, by reducing the risk of capital devaluation while participating in these activities. In essence, stablecoins are the "glue" that allows the complex mechanism of decentralized finance to function more smoothly and predictably.

Stablecoins: Overcoming Barriers in the Digital World

Stablecoins are fundamental to the functionality of the entire crypto sector due to their key functions in addressing the limitations of traditional banking and their versatility in exchanges:

Addressing the Limitations of Banking: They offer an alternative to traditional banking systems, which can be slow, expensive, and restrictive for international transfers or during non-banking hours. Stablecoins enable fast, cheap, and 24/7 global movements of value, democratizing access to financial services for unbanked or underbanked populations.

Use on Centralized Exchanges (CEXs): They are the preferred base currency for trading most cryptocurrency pairs. Traders use stablecoins to buy and sell volatile assets without having to constantly withdraw and deposit fiat money into their bank accounts, which speeds up trading and reduces friction.

Use in Decentralized Exchanges (DEXs) and DeFi: These are the cornerstone of the DeFi ecosystem. They allow users to interact with lending, liquidity, staking, and other financial tools without constant exposure to the volatility of other cryptocurrencies. They facilitate the formation of stable liquidity pools and allow for more predictable yield calculations.

Leadership and Dominance: USDT Leads, Ethereum the Preferred Home

Within this thriving market, Tether (USDT) maintains its undisputed leadership position with a 62.14% dominance, representing an impressive $156.03 billion in circulation. USD Coin (USDC) follows closely behind, with a market capitalization of $60.80 billion, equivalent to 24.22% of the total market cap.

Regarding the blockchains hosting the largest number of issued stablecoins, Ethereum (ETH) remains the preferred platform, accumulating 49.88% of the total. Tron follows with a significant share of 31.63%. Other blockchains such as Solana (4.45%) and BNB Smart Chain (BSC) (4.08%) also play an important role.

The all-time high market cap for stablecoins isn't just an impressive figure; it's a testament to their consolidation as the backbone of the crypto market. Their ability to offer stability, facilitate trading, and overcome the barriers to traditional banking make them essential tools for the mass adoption of blockchain technology and decentralized finance. With continued growth and innovation in this sector, stablecoins are laying the foundation for a more robust, efficient, and inclusive digital economy.

Disclaimer: The information contained in this news item is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risks and may result in the loss of all or part of your invested capital. Always conduct your own research and consult a financial professional before making investment decisions.

Upvoted! Thank you for supporting witness @jswit.