Stablecoin Market Capitalization Reaches Record $234.06B

Tether's (USDT) Absolute Dominance Sparks Fears of Systemic Risk in the Crypto Market

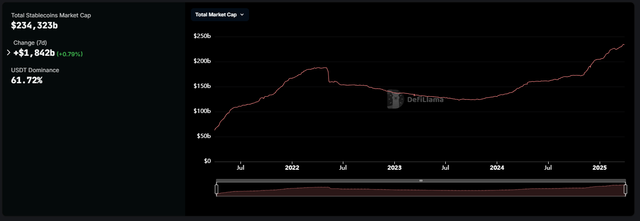

The stablecoin market has reached an unprecedented milestone, with a total market capitalization of $234.06B as of March 26, 2025, according to data from Defillama. This represents a 15.35% growth year-to-date. However, this exponential growth is accompanied by growing concerns about the overwhelming dominance of Tether (USDT). This cryptocurrency now represents 61.72% of the market, with a market capitalization of $144.61B.

The stablecoin market reached an unprecedented milestone, with a total market capitalization of $234.06B as of March 26, 2025, according to data from Defillama.

Bifurcated Market: Retail vs. Institutions

This analysis reveals a clear bifurcation in the stablecoin market. While the retail sector prefers USDT on the Tron and Solana blockchains due to their low fees and fast transaction speeds, institutions are leaning toward USDC and BUIDL on Ethereum, seeking greater security and regulatory compliance.

Tether (USDT): The undisputed giant, used primarily for trading and low-cost transactions.

USD Coin (USDC): Gaining ground in the institutional space, with a focus on transparency and compliance.

Solana (SOL): Experiencing explosive growth (+320% YTD), driven by its efficiency and low fees.

Blockchain Dominance and Distribution

The distribution of stablecoins across different blockchains also offers valuable insight into user preferences. Ethereum remains the primary hub for regulated stablecoins like USDC and DAI, with a dominance of 53.42%. Tron, on the other hand, dominates the use of USDT for low-cost transactions, with a 28.45% market share. Solana experienced explosive growth, reaching 5.42% dominance, driven by the adoption of USDC and new protocols.

Critical Risks on the Horizon

Despite growth and mass adoption, the stablecoin market faces significant risks:

- Regulation: The implementation of MiCA in the European Union and potential measures in the United States could generate volatility.

- Technology: Solana's dependence on smart contract risks in new protocols are a cause for concern.

- Economy: Exposure to Treasury bonds and interest rate pressure could affect the stability of stablecoins.

Additional Revealing Data

- According to recent data from Chainalysis, 40% of remittances in Latin America already use stablecoins, underscoring their growing importance in emerging economies.

- Additionally, the analytics platform Glassnode detected a worrying pattern: USDT issuances precede Bitcoin (BTC) and Ethereum (ETH) rallies in 92% of cases. The recent $10B USDT injection during the first quarter of 2025 coincided with BTC breaking through the $72,000 mark.

Future Scenarios: What Does 2025 Hold?

Three possible scenarios for the stablecoin market are proposed:

- Bullish Scenario (45% probability): Market capitalization between $260-280B, driven by the approval of stablecoin ETFs.

- Baseline Scenario (35% probability): Gradual growth, with a market capitalization of $240-260B.

- Bearish Scenario (20% probability): Adverse regulation, with a market capitalization below $230B.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The cryptocurrency market is highly volatile and carries significant risks.

Upvoted! Thank you for supporting witness @jswit.