Stablecoin market cap hits all-time high

The stablecoin ecosystem is coming back to life, surpassing levels prior to the collapse of LUNA and UST. Bitcoin and monetary policy are driving growth.

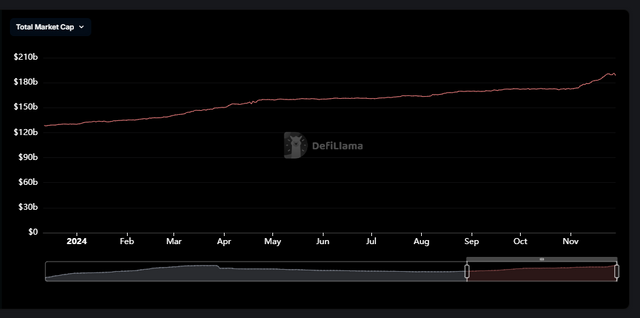

The stablecoin market reached a new all-time high, with a market cap of USD 190.66 billion on November 23, 2024. This growth represents an increase of 46.35% so far this year, marking a renaissance for this sector after the collapse of LUNA and UST in May 2022, which had caused a prolonged decline in the issuance of these tokens.

In the last month, stablecoin capitalization grew from USD 172 billion to USD 190.66 billion to hit an all-time high / DefiLlama

The rally began to consolidate in August 2023, when the market capitalization bottomed out at USD 122 billion. Since then, the ecosystem has shown a sustained recovery. This is driven by factors such as the rise in the price of bitcoin, speculation about the approval of ETFs in the United States, and a more favorable political environment for cryptocurrencies.

Bitcoin and monetary policy: the drivers of growth

The resurgence of the stablecoin market is closely linked to the performance of bitcoin, whose price has seen a strong rally since late 2023. This growth accelerated in November 2024, following the victory of US President-elect Donald Trump, who promised to relax regulations on cryptocurrencies. In addition, the US Federal Reserve began a series of interest rate cuts in September, weakening the dollar and benefiting the crypto market.

In the last month, the capitalization of stablecoins grew from USD 172 billion to USD 190.66 billion to hit an all-time high. This coincides with the frenzy over the price of bitcoin, which is approaching the psychological mark of USD 100,000.

USDT dominates the market, but new competitors emerge

The stablecoin market continues to be dominated by Tether (USDT), which accounts for 71.04% of the total, with a market cap of USD 134.10 billion. In second place is USDC, with USD 36.21 billion, backed by MiCA regulations in Europe. In third place is DAI, with USD 4.72 billion, closely followed by Ethena's USDe token, which quickly climbed to fourth place with USD 4.12 billion.

What are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to a fiat currency such as the US dollar. These coins offer a safe alternative within the volatile cryptocurrency market, being widely used for transactions, savings and as a refuge from volatility.

A booming market with promising prospects

The growth of the stablecoin market reflects renewed confidence in the crypto ecosystem. With a more favorable political environment, expansionary monetary policies, and the rise of bitcoin, stablecoins are consolidating themselves as a fundamental pillar in the world of decentralized finance.

Disclaimer: This article is for informational purposes and does not constitute financial advice. Cryptocurrency investments carry significant risks.