Bull Market is Back

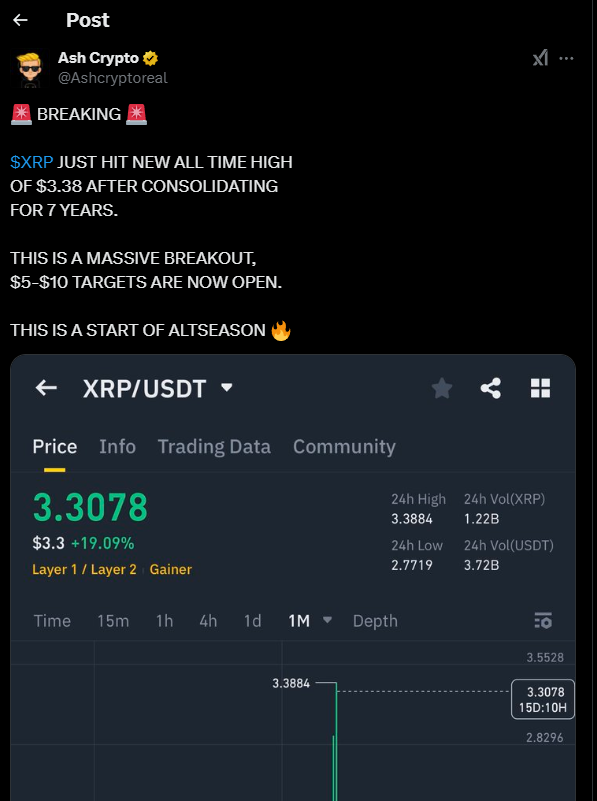

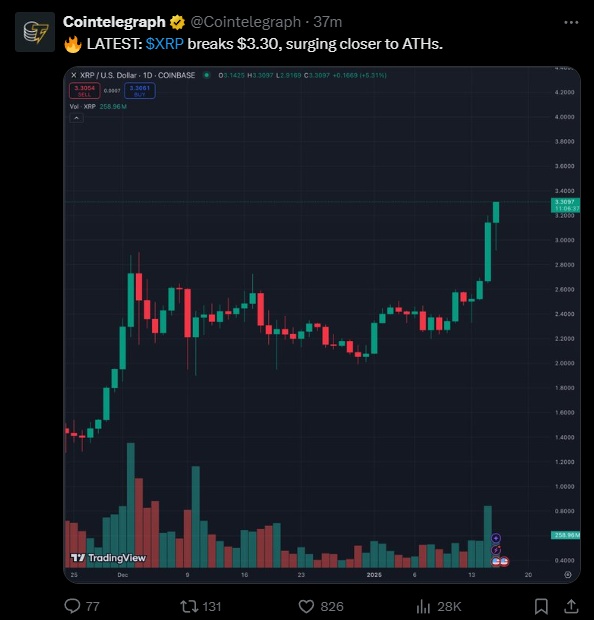

With trump Stating that US strategic Reserve will include crypto made in USA , This gave a boost to coins like #xrp #sol

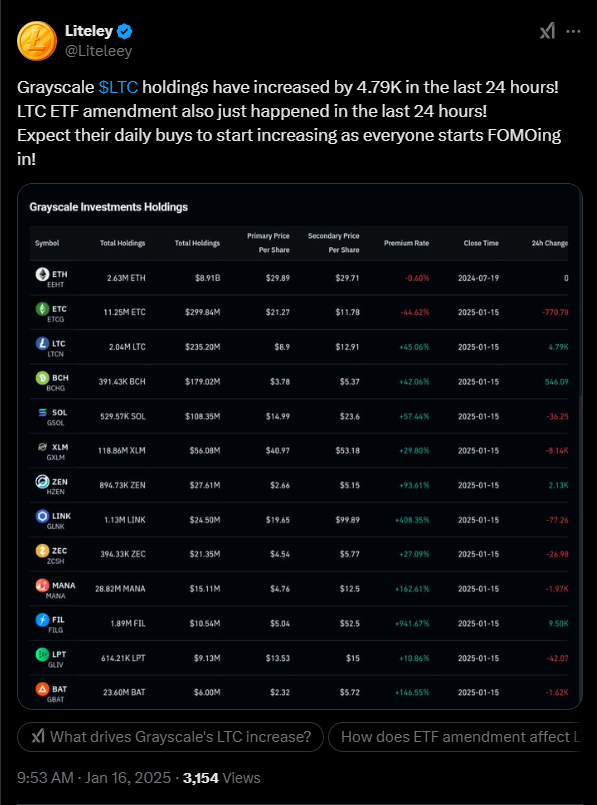

BILLION FROM STOCK MARKET WILL FLOW INTO THESE BITCOIN & OTHER ETFS. 2025 IS GONNA BE MASSIVE

The performance of U.S. alternative investments has indeed seen a boost following Donald Trump's election victory, reflecting market expectations around his proposed economic policies. Following Trump's win in the 2024 election, there was a significant rally in certain sectors:

Cryptocurrencies: Bitcoin, in particular, surged to new highs, with the price hitting above $75,000 due to Trump's supportive stance on cryptocurrencies and plans to make the U.S. the "crypto capital of the planet." This was accompanied by a rise in crypto-related stocks, such as MicroStrategy, which saw its stock price increase dramatically.

Stocks in Specific Sectors: Sectors expected to benefit from Trump's policies like lower taxes, deregulation, and tariffs saw significant gains. For instance, bank stocks and small-cap stocks performed well, driven by expectations of lighter regulation and a stronger domestic economy. Energy and financial companies also rallied, anticipating benefits from deregulation and a pro-business environment.

Investment in Data Centers: A notable example of foreign investment spurred by Trump's policies includes a $20 billion commitment from DAMAC Properties to build new data centers in the U.S., showcasing confidence in the U.S. market under his administration.

These movements illustrate how markets react to the anticipation of policy changes under a Trump presidency, with investors adjusting their portfolios to capitalize on expected shifts in economic policy.

Can Solana Reach $1000

comments below