The silver case: A once-in-a-lifetime opportunity?

You may have heard of investments that have changed the lifes of some people in a short span of time. Ideas that no one considered and that proved to be brilliant. Ignored financial assets that suddenly skyrocketed and created new millionaires. Well, how is this possible? How do some foresee what most only know when it becomes news and it’s too late to act?

Although some cases can be explained by the sheer ingenuity of an inventor, or by an entrepreneur's unusual business tact, there are equally fortunate situations where you don’t have to be exceptional to thrive; situations where good information and thoughtful attention would be enough to transform common facts into exceptional opportunities.

This post is dedicated to the very special case of silver. I hope you will carefully consider the information gathered here. If they are correct, and if you walk the path between theory and action, they can have a surprising impact on your financial life for years to come.

Investing in silver

Scenarios such as this, where it’s possible to see with such a level of clarity how severely undervalued a particular asset is, are rare in the investment world. There are many factors that come together to make the investment in silver a unique opportunity at this time. To understand the first of these factors, however, a historical perspective is fundamental. More specifically, monetary history.

Monetary history

No fiduciary currency has survived more than 50 years in the more than 5000 years in which humans have used coins.In his investment book in precious metals, "Guide to Investing in Gold and Silver," Michel Maloney explains that there’s a pattern that has been repeated throughout history for at least 2,400 years. In which governments expand the money supply and consequently dilute the purchasing power of their currencies to the point where the population's psyche and the country's collective sense begin to feel that something is not going well. As the devaluation progresses, the population feels the currency’s loss of purchasing power. At that moment, a great shift happens. The free will of the public sets a new threshold for the price of gold and silver. In doing so, metals are valued in a way that compensates accounts for all the currency creation that has occurred since the last revaluation.

"It's automatic, and it's natural; gold and silver have always done this, and will always do. People have an innate sense of the rarity of gold and silver. When paper money becomes too abundant, and thus loses value, people always turn to precious metals. As the masses rush back, the value (buying power) of gold and silver grows exponentially.” (Michel Maloney, 2008)

He completes:

“During these events there is always a huge transfer of wealth, and it is within your power of choice whether it will be transferred to you, or away from you. If you choose to have it transferred to you then you must first educate yourself, and secondly, act. It is a failure rate of 100%. No fiduciary currency ever survived, and now they are all fiduciary. So this change will be the most dramatic in world monetary history. It will be the greatest transfer of wealth in world history. So it is the greatest opportunity in history.”

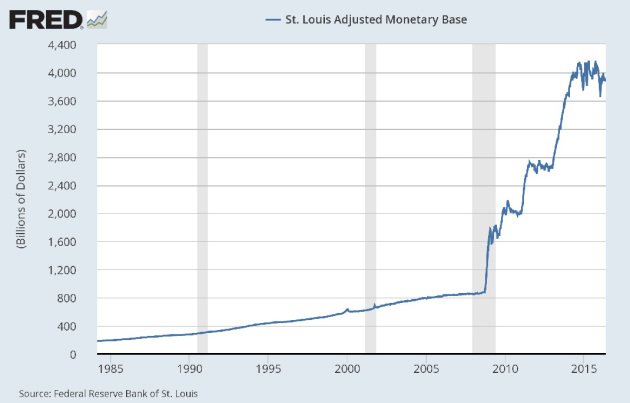

To illustrate what is being said, note the figure below that shows the expansion of the monetary base by the Federal Reserve (Fed), the American central bank. Keep in mind that since the end of the Bretton Woods Agreement (1971), when the US dollar lost convertibility to gold, the world uses US currency as a value reserve, a kind of ballast for other currencies. Note the "discreet" inflationary response of the Federal Reserve to the 2008 crisis:

This Keynesian policy was followed by other major central banks, such as the European Central Bank (ECB) and the Bank of Japan (BOJ). It did not work. There is no recovery in the American economy, nor in the others that have adopted similar policies. To make matters worse, US government debt has more than doubled since the 2008 crisis - from $ 9 trillion to $ 19 trillion in 2016.

This is the largest cycle of monetary expansion and indebtedness the world has ever seen. It is being promoted by central banks in collusion with their respective governments and aims to suppress interest rates in order to save governments and financial institutions that would otherwise have failed. On a global scale, it is a unique experiment in world history.

Not by accident, some countries are already thinking of a post-dollar world, and their central banks are getting rid of the US currency at a record pace. China and Russia lead this movement, and the chosen alternative to the dollar is ... you guess: gold.

“Silver is the most important investment you will make in this decade; the most undervalued asset available to investors today.” (Gregory Mannarino, 2016)

The increase in interest depends on the perception of improvement in the indicators of the American economy. Each time the economic data comes in below expectations - and this is how they have behaved lately - the market is betting that the Fed will delay the promised increase in interest rates. Given that to increase interest rates contracts the money supply, the price of metals falls on the promise, but rises with the fact; That is, the non-increase. Imagine how much higher the climb will be when the market expectation is the opposite - lower or negative interest rates!

It is necessary to understand that the underlying factor, which potentiates the investment in gold and silver, is the conviction that the American economy is doomed and dependent of continuous money creation by the Fed. There was no solution to the problems of the 2008 crisis, only a radical monetary expansion. Thanks to this, many financial institutions and the American government itself have remained artificially solvent until now.

Unfortunately for the ordinary citizen, when this low-interest spree and monetary inflation ends, it will be in the form of a severe economic crisis, much larger than the previous one. That is because, although the US government currently pays a negligible percentage of interest to finance itself, it would be insolvent in a scenario with historically normal interest rates. At some point, the US will have to choose between a formal default or an inflationary one that would destroy the purchasing power of the dollar and generate uncontrolled price inflation.

Fortunately for the investor to protect himself in time, it is at that moment that economic agents desperately seek a safe haven: it is when gold and silver shine, just like 1980.

“We are entering a period of financial crisis that is the biggest that the world has ever known. The transfer of wealth that will take place during this decade is the greatest transfer of wealth in history. Wealth is never destroyed. It is merely transferred. And that means that on the opposite side of every crisis, there is an opportunity.” (Michael Maloney, 2008)

But why having more silver than gold?

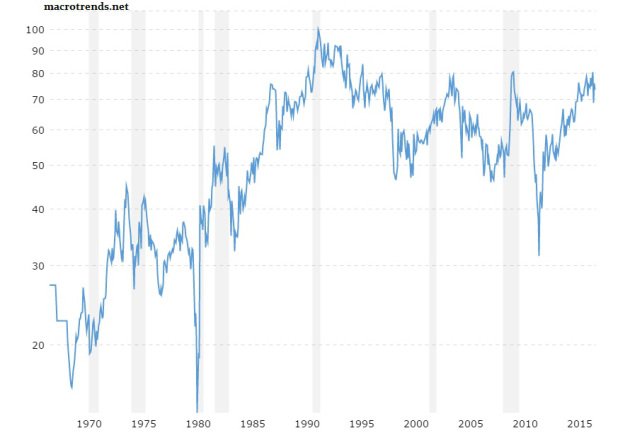

The explanation lies in the current ratio between gold and silver prices when compared with historical ratio. Historically, the ratio was about 16: 1, reflecting the average supply of each metal. Since the financial crisis, however, this relationship has been much higher. Today, it is above 76: 1. This indicates that silver is extremely devalued relative to gold. Look:

According to the historical relationship between the two precious metals, the silver price has more way to go than the gold price.

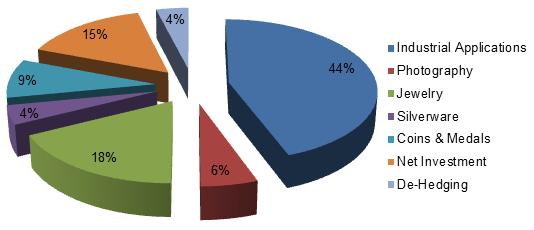

It is a growing demand for a good that is increasingly used in our day to day life. As you can see in the chart below, we are dependent on silver:

Conclusion

“The secret of investing in gold and silver is knowing when to own them and when to use them to buy stocks or other assets. To do this you need to understand where in the cycle you are and how future fundamentals can change it.” (Peter Schiff, "The Real Crash", 2012)

Although you advocate for the return of the gold standard (as is my case), in fact, you don't need a special appreciation for the metals themselves to see this investment opportunity. As in any investment, the opportunity is made through cycles: success depends on knowing how to identify the time to buy and the time to sell, only. In the case of silver, the information summarized in this article indicates that we are at the beginning of a new bull market.

If you stop to keep up with the economic news, your intuition will tell you that, structurally, there is something wrong with the world's economy. The current situation is a shadow valley: economic stagnation, record indebtedness, capital controls, inflationary policies, and - the last anomaly created by central banks - negative interest rates. An escape scenario for fiduciary coins is clearly on the horizon. In this context, in addition to financial protection, silver at the current price becomes an excellent investment opportunity.

If you found this information useful, share this article with your friends; give them new elements for analysis, - elements that will hardly be offered on the formal market, until it's too late.