ScaredyCatGuide says Focus On The Financial Cost of Something As Opposed to The Payment

When the majority of people try to figure out how much than can afford they often think about a monthly payment as opposed to the actual cost of the item.

Whether it's a car, house or any other larger purchase it's the monthly payment that the dealer gets you to focus on. How much can you afford to shell out each month? As opposed to how much can you afford to pay for the item.

The is entrapment into the financial rate race. How is one supposed to get ahead financially if they are exhausting their monthly budget and spending more in the long run that something could cost otherwise.

Car Purchase

People do this all the time when purchasing cars. The finance guy in the dealer will work the numbers to find a monthly payment you can afford that he can close on right there and then, regardless of how much the car will cost you in the end.

Example

Recently my brother bought a brand new Corvette. I mean, the purchase alone wasn't the greatest decision considering he does not own a home and rents an apartment in addition to already owning a car, but him and I have always been opposites so that's besides the point.

However, within this transaction he did make me proud because a situation with the financing popped up and he actually made the financial smart and prudent choice.

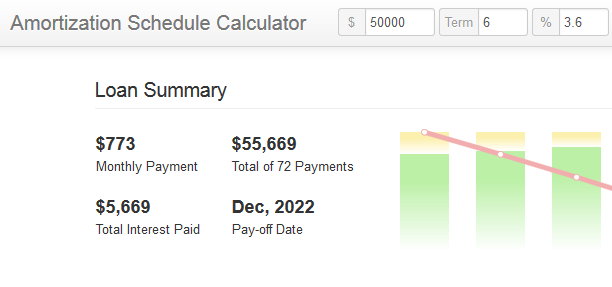

He was financing $50,000 over six years as part of the car purchase. Luckily his credit score is good so he was offered low rates.

The dealer offered him 3.6 percent financing over that time period

- Monthly Payment = $773

- Total Interest Paid = $5,669

- Total Cost after 72 Payments = $55,669

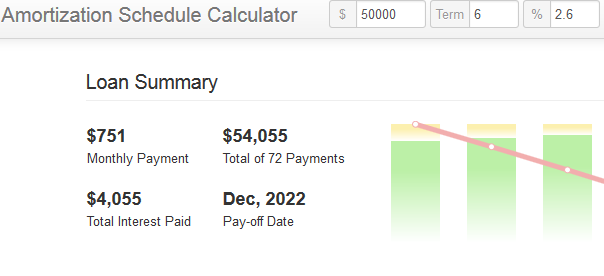

His credit union could do the car loan at 2.6 percent for the same time frame

- Monthly Payment = $751

- Total Interest Paid = $4055

- Total Cost after 72 Payments = $54,055

Why it was even a consideration

The dealer could close the financing that day and he could go down and get the car the next morning (dealer was 3 hours away as he find a better sale price there)

The credit union needed 5 days, which went over a weekend so he would have to wait until the following Friday when he was off from work to go get the car.

The Question

Do I get the car now and pay $22 more a month or wait a week and a half for the cheaper financing?

He mentioned it to three of his different buddies. All three of them said - "Dude, it's 20 bucks. Just go get it, you know you want it now."

And that my friends is the problem......that is how a large majority thinks when it comes to money.

It's only 20 bucks!

Let's see how that really works out. The actually number is 22 bucks times 72 times = $1,584!

However, that's not all of it. Remember the total amounts paid in interest for both loans?

Well, the difference is not just $1,584. It totals $1,614 Another $28 tossed away in the last payment that pays off the loan. The last payment is less than the regular payment as it's just the remaining balance, but the higher interest loan has a higher payoff amount,

Conclusion

By waiting a week to close on the lower 2.6 percent financing my brother is saving $1,614 over the next six years. There are so many things that can be done with that money, whether it investing (providing further value) or just using it to cover the cost of a vacation instead of it coming out of pocket.

Gotta say, I was proud of him for making the right decision as he generally has the financial rat race mindset.

Regards,

Thanks for the pic pixabay

Disclaimer: Info herein is my opinion and for educational purpose only.