Should SBD Be a Pegged Asset? If So, When Should We Peg It?

This is a complicated topic which I'll say up front most people are not willing to really, truly do appropriate work to care about and understand effectively. If that's you, and you're okay with trusting witnesses you elect to make a good decision on your behalf, don't bother reading further. We've got your back.

If you do want to have an informed, educated understanding of Steem Dollars (SBD) and what value they bring to the STEEM ecosystem, please strap yourself in and read on. This will not be a short conversation. It will not be summarized to make it easy. We'll do our best to work from first principles and read relevant source materials to best inform our understanding. If we take shortcuts here, we may not be fully respecting the impacts of our decisions on a $50M market (SBD) or a $1.6B market (STEEM). I'll also include a video so you can see my body language as we talk about this. It's all good. :)

In any complicated discussion, it's important to start with definitions and first principles as much as possible. So what's a Steem Dollar? Let's go to the white paper starting with page 9:

Steem Dollars (SBD)

Stability is an important feature of successful global economies. Without stability, individuals across the world could not have low cognitive costs while engaging in commerce and savings. Because stability is an important feature of successful economies, Steem Dollars were designed as an attempt to bring stability to the world of cryptocurrency and to the individuals who use the Steem network.

Steem Dollars are created by a mechanism similar to convertible notes, which are often used to fund startups. In the startup world, convertible notes are short-term debt instruments that can be converted to ownership at a rate determined in the future, typically during a future funding round. A blockchain based token can be viewed as ownership in the community whereas a convertible note can be viewed as a debt denominated in any other commodity or currency. The terms of the convertible note allow the holder to convert to the backing token with a minimum notice at the fair market price of the token. Creating token-convertible-dollars enables blockchains to grow their network effect while maximizing the return for token holders.

(see the white paper for more, but let's skip ahead a little)

One example of an issue that may take some time to correct is short-term market manipulation. Market manipulation is difficult and expensive to maintain for long periods of time.

In my reading, the white paper seems to imply speculators buying up SBD above $1 could be considered market manipulation. In the past, when this has happened, it's been relatively short lived and the peg eventually finds itself again.

The current spike in SBD price has lasted much longer.

Steem levels the playing field by requiring all conversion requests to be delayed for three and a half days. This means that neither the traders nor the blockchain has any information advantage regarding the price at the time the conversion is executed.

This is a good thing, because it makes it difficult to manipulate. To those that don't know, SBD is a debt against $1 USD worth of STEEM and there's a conversion function on the blockchain so you can get STEEM for your SBD. The steemit.com interface removed the interface for this conversion feature because with a high market value of SBD, those who convert would lose a lot of value.

A lot of the discussion about SBD right now is if we should implement a conversion in the other direction so we could create SBD using STEEM. The white paper actually covers this:

Minimizing Abuse of Conversions

If people could freely convert in both directions then traders could take advantage of the blockchains conversion rates by trading large volumes without changing the price. Traders who see a massive run up in price would convert to SBD at the high price (when it is most risky) and then convert back after the correction. The Steem protocol protects the community from this kind of abuse by only allowing people to convert from SBD to STEEM and not the other way around.

This concern, to me, is one of the main reasons why SBD is not worth $1 today and that extra value put into STEEM instead. If we had this two-way conversion, fluctuations by speculators in either direction would favor those who opt for stability instead. It's worth noting, the white paper is not sacrosanct. Changes have been made in the past to improve the system (such as removing liquidity rewards).

The main question we should be asking, IMO, is do we think a two-way conversion is a risk? If it's not a risk, and the white paper is wrong, then we can move forward with the idea of making a possible change. If it is a risk, we can stop here, and we're done.

Back to the white paper:

In effect, feed producers are entrusted with the responsibility of setting monetary policy for the purpose of maintaining a stable peg to the USD

This is an important point to reiterate. This is the job of witnesses. Many have argued in the past we, as witnesses, were not doing our jobs when SBD got manipulated up. Some witnesses implemented a feed bias, but personally I didn't like that solution as it tweaked with other economics of the system and had unintended consequences I won't get into here. This issue has been discussed on Github as well in issue 1839. To get fully informed, give that a read and the comments there as well.

Back to the white paper again:

The primary concern of Steem feed producers is to maintain a stable one-to-one conversion between SBD and the U.S. Dollar (USD). Any time SBD is consistently trading above $1.00 USD interest payments must be stopped. In a market where 0% interest on debt still demands a premium, it is safe to say the market is willing to extend more credit than the debt the community is willing to take on. If this happens a SBD will be valued at more than $1.00 and there is little the community can do without charging negative

interest rates.

I haven't heard anyone discuss negative interest rates, and it's certainly not something I'm a fan of, so I'd suggest we can leave that off the table. We can go with this explanation and be done with it. Let the debt continue to increase until the market finds an equilibrium on it's own many weeks, months, or years from now.

That's certainly an option and one holders of (and speculators on) SBD would like to see. It may also mean we miss out on a potential opportunity as a community if we instead build and support a stable token.

To better understand the value potential here, please read this great post which @smooth brought to my attention: An Overview of Stablecoins by Myles Snider

Stablecoins are one of the highest convexity opportunities in crypto. They aim to become global, fiat-free, digital cash, so the total addressable market (TAM) is simply that of all the money in the world: ~$90T. The opportunity for stablecoins is, intrinsically, the largest possible TAM. This vision is larger than that of Bitcoin itself. A fiat-free currency that’s price stable will challenge the legitimacy of weak governments around the world.

Here's another overview I enjoyed:

Dangerous volatility and why we need a stable cryptocurrency by Christopher Georgen

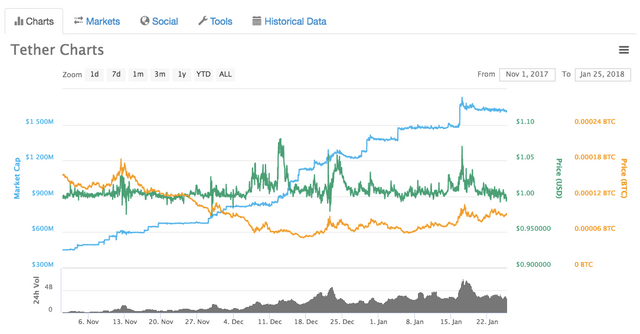

One of the reasons this is being discussed right now, I think, is related to concerns over Tether (USDT) and how it requires trust in a third party to actual hold and secure real USD and not just print new Tether out of nothing. Based on the incredible market cap, the market clearly wants a pegged asset:

Tether:

That's over $1.6 billion! If there was a chance the STEEM ecosystem could capture some of that value via STEEM -> SBD conversions and a stable SBD, should we consider it? How much could that increase the value of STEEM as people buy it up to convert? How much could the entire rewards pool increase if the value of STEEM goes up?

For comparison:

BitUSD:

Steem Dollars:

One may argue that bitUSD has been pretty stable and if USDT runs into trouble, it will enjoy all those new users. That may be true, but if the opportunity is large enough, do we want to give up on trying for some of that for our community as well?

So here's how I'm thinking about this:

Are pegged assets valuable?

For me, based on all we've explored so far, I'd say yes, the market greatly values a stable, pegged asset. If more exchanges were to need better, more trusted stability than USDT and SBD was an option, that could increase the number of exchanges trading both SBD and STEEM because they get one for free when adopting the other. Not only that, when SMTs are launched, if they already support STEEM/SBD, they will be all set for whatever SMT tokens are worth trading (we've seen this already with Ethereum's ERC20 tokens).

Should SBD be a pegged asset?

Well, that's what it was designed to be, so for me that's a clear yes. I may go so far as to say it was designed poorly or that the original design with a low market cap of both SBD and STEEM prevented a risk with two-way conversions that we may not have today because of a higher total market cap.

Should we enforce the SBD peg in both the up and down directions?

To me, if we don't, there's no way to enforce the peg in the upwards direction. It will remain a speculative asset just like STEEM in which case, what value does it bring?

Should we enforce the SBD peg, right now?

This, I think, is the key question. This is the one that has so many people concerned and frustrated. Many really, really enjoy the value of their post rewards right now and directly relate that to a high SBD price. What they may not realize is that high payout might more accurately be related to a rise in STEEM price, not just SBD price.

@smooth pointed out in a conversation recently that STEEM has gone up 46x compared to SBD only going up 7x (with a couple brief spikes to 10-12x) in the same time period. That increased the total rewards by 46x, not just the portion of the rewards paid out in SBD.

One of the things I've seen often in this discussion is claims about SBD growth being the sole driver of user adoption recently. This may be true, but I've yet to see a convincing, fact-based argument for it that isn't just pointing out a correlation (not a causation). It's possible the price of STEEM (and SBD) going up (potentially caused by it being added to a new Korean exchange) is what is really driving new user adoption.

Something that should not be ignored is that the STEEM blockchain doesn't function correctly when SBD are not worth close to $1 worth of STEEM. That's why the internal market is all messed up price-wise. That's why posts don't show accurate potential payout values. It might also be why we've seen a rise in scammers and self-voting as people post more and self-vote more while the SBD is above $1.

Bloggers love the high rewards and don't seem to care about price swings or boom and bust cycles. At least, they don't care as long as the value of STEEM underlying the value of everything else stays high.

Application developers who rely on stable payments for paying for things in the real world with USD do care.

Users in countries with truly broken national currencies who are desperate for any rewards they can get should, IMO, value a stable peg because they can't afford to speculate. If they get paid out with a $7 SBD and it goes down to half that at $3.50, that could be devastating for them. Conversely, if STEEM increased in value and instead they get 7 SBD, each worth $1 each, they can know for certain that value will remain stable. This is a point I'd like for more people to be discussing. A stable currency is critically important for a successful economy and some of our friends in the STEEM ecosystem may really need a stable currency.

The last article I want to reference on this topic comes from one of the first posts I ever read here on Steemit. This post, more than most others, got me so excited about the potential of this platform. Please, give it a read:

The real money isn’t in blogging, content generation, or voting. The real money is found in bootstrapping a digital currency. A currency owned and operated in a decentralized way by ordinary people.

This is the magic of a stable SBD. This is the long-term goal chosen over short-term gains. This is a world-changing idea.

This is what I'd like the STEEM blockchain to support.

Does it need to happen right away while SBDs are still high? Maybe not. Maybe we should let inflation run its course as more and more SBDs are printed. Maybe we apologize to app developers, those who need a stable daily currency, and those who think we're missing a huge potential need for stable coins if USDT falters.

Maybe we can wait.

There's a risk there in both lost opportunity cost (bitUSD and others like it might explode upward in marketshare while we watch) and in creating more debt for future boom and bust cycles which end up wrecking not just speculators, but everyday users who believe their SBD is worth more than it is. Also, if the SBD increases in value even more, implementing a peg later will be that much more difficult.

Conclusion

My current position as a witness:

A working SBD peg is very valuable to the STEEM ecosystem, especially long-term. The peg is currently broken, and we should explore and develop plans to fix it, such as a two-way conversion, as long as we are sufficiently convinced it does not introduce systemic risk. Unless there is a consensus, we should not implement a change right now while the price of SBD is abnormally high. That said, exploring options for keeping it from going higher might be worthwhile (such as a conversion feature which works if SBD reaches > $10, as an example). I'm in favor or developing and testing the code for a two-way conversion, but not implementing it until the price comes down further (maybe < $2?) or the community as a whole demands a change and begins to un vote witnesses who don't move to support the peg.

Those are my thoughts as they are right now. I've participated in many hours of discussions which continually impress me with how much the witnesses and the community care about this place and want to see it thrive.

Here are some of the posts I've read on this topic. Please link me to any other valuable contributions in the comments below.

- Witness Discussion – SBD price and reverse peg - @reggaemuffin

- Still in Defense of a High SBD: Why Witnesses Should not Implement Steem to SBD Conversions Now- - @aggroed

- Can I have a list of top 20 witnesses that want to bring SBD price down right now? - @steemitadventure

- Vlog 198: Enforce the SBD peg or not? - @exyle

- Unpegged SBD: A Pointless Speculative Asset - @greer184

- High SBD or $1 SBD? — Putting Greed Aside, High SBD Is Still Best - @ginquitti

- SBD - how do you explain what is going on? - @famunger

- Is SBD propped up by design? - @knircky

- STEEM DOLLAR Peg Debate : Stakeholder Analysis - @buggedout

- How do we fix the peg without popping the SBD bubble? I may have an idea. - @bmj

- STEEM DOLLAR Will Fall To $1 USD : Here’s Why - @buggedout

If you've actually read all that, you've done more work than I have. What do you think?

Luke Stokes is a father, husband, business owner, programmer, STEEM witness, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

SHOULD Bitcoin be a pegged asset? If so, what should we peg it to? Hmm... Discuss!

i would like to bring witness t0 me ye i.d. 0 w/(h) e (a)d https://steemit.com/g0fig/@xubrnt/ned-steemit

Great post Luke. This is a very interesting topic and from my personal experience the Steem Dollar getting way out of wack caused me to cancel my power down in the fall and then ultimately led me to powering up 0.5 BTC worth because I anticipated the price of STEEM getting pulled up because of the SBD being so high.

I personally do like the idea of the dollar peg and I'm blown away that the reward pool has increased 46X with these increases. To be honest it is kind of weird because a lot of us bloggers aren't really feeling it. I feel like I was making more money when STEEM was worth $2 and I had less followers than I am now.

It might be because there is tons of self voting and that is draining a lot of the pool. I'm not really sure. I would say some of my videos that I have uploaded on DTube have been some of the best work I have ever done on this platform especially my video on EOS which made maybe $15 or so.

Payouts are wacky and we have just accepted it but I'm also surprised no one mentioned NuBits anymore in the dollar peg conversation. It is unfortunately only on Bittrex but I have used it before and it seems to have a mechanism to keep it fairly stable.

It Tether blows up then I'm assuming my BitShares investment could payoff big if people feel they can't go to SBD because of the increased prices.

Thanks Brian. Yes, payouts our funky and whenever we set expectations about them, we're bound to be disappointed. On the plus side, you do currently have a potential payout of $123 on a Picard meme on Dmania. :)

Interesting that you're confident a rise in SBD will directly lead to a STEEM rise. I see them usually happening together (especially when the combo gets added to a new exchange), but I'm not fully confident STEEM will always rise and fall with the price of SBD directly. Time will tell, I guess, but even then, it's still a correlation, not necessarily a causation. Most likely, they both go up and down based on the larger cryptocurrency market movements.

I'm not as familiar with NuBits. I'll have to look into it. I remember hearing about it as one of the pegs that broke, but it seems like it's doing well recently. I'll have to give it a second look. And yes, I think BitShares has a lot of room for growth for many reasons.

You know... I can disappear for a long time (say weeks) on your posts. Not intentionally.. just "life happens".

...so then a few weeks pass... I come back to your blog, and I always ready myself "what if @lukestokes has sold out in the time I've been gone?"

Nope. Your morals are always intact. Money flows. It doesn't change who you are... You continually post, share your important thoughts... and never go silent.

I love steem. I like the price of steem.

Without being able to go to sleep at night knowing that @timcliff and @lukestokes are a key part of every block solved, I don't think I'd ever develop the confidence I do.

This is the long way of me saying @lukestokes -- you lead by example and thank you so very much... :)

Wow. Thank you so much. That's one of the nicest compliments I've ever received. I love steem also and how it rewards individuals like me very well for helping as best I can.

hello sir @lukestokes, I am @princessjoyesto and I also chose you and vote you as my witness in the steemit community I hope it is okay with you. Have a good day ahead sir.

lol @lukestokes is that your secret second account?

No, but it does kind of seem like they have a crush on me, huh? :)

@intelliguy is as his nickname implies, great! ( :

Great topic and video Luke! I think we need something that's pegged to the dollar. Steem currency is already living it's own life and to not create confusion it's essential that we have a separate currency that's stable.

I think many see this as well. The real question we have to answer is, what to do about the broken peg and when should we do it?

True!

thanks for the detailed article, @lukestokes. A stable currency definitely has utility and value for a community and I would like to continue down the path of incentives and trying to find potential losers when SBD is much greater than $1.

The Minnow (as an author)

Steem(it) has a retention problem and much of it is b/c new users never make their first $5. With a high SBD price, this helps minnows the most and hopefully they will see rewards to incentivize them to stay around. Also, the majority of their rewards are paid out in a liquid asset. This can literally change lives. Check out my dude @bendollars and how excited he and his family are with his first payout. Think about what an extra $5/day could do for some people. SBDs offer this opportunity. https://steemit.com/introducemyself/@bendollars/my-first-steem-payout-experience-on-steemit-and-more-expectations-bendollars-24-10-2018 This is a winner b/c of the high SBD price.

The Minnow (as a curator)

Simliar to the argument above. Community growth centers around minnow engagement and retention. A $0.25 comment could now be worth $1 b/c of the high SBD price. This is a winner b/c of the high SBD price.

Whales/Dolphins (and their tribe)

That $0.05 upvote you give someone actually means a lot more. You can support more of your tribe/community without taxing your VP. This is a winner b/c of the high SBD price.

Investor/Speculator

Look, some people will buy anything in this crypto market. These are the losers of gambling on an asset that should be at $1. You want your community to have a strong currency. Don't fall in to the Keynesian fallacy. While I agree that having a pegged asset is great, it's mostly great because of protection to the downside. If someone is willing to buy something from you for more than it is worth, then I believe it's a gift. Let them buy overvalued assets and let those who have more knowledge benefit from the additional time and experience that they have. These are the losers b/c of the high SBD price (assuming it eventually normalizes).

Conclusion:

By artificially restricting the up-side of SBD, you are hurting the community and it's ability to self fund at the expenses of speculators. This most notably hurts Minnows opportunities to make their first few dollars or rewards (especially in a liquid asset).

Thanks again for the great post :)

I agree Steemit has a retention problem, but I'm not sure STEEM does. It's an amazing cryptocurrency. I'm all about changed lives, but I also want to ensure people actually understand where the value comes from. It comes from investors increasing the value of STEEM which increases the rewards pool and the $ number people see on their posts which gets them excited about Steemit. You mention currators, but they are actually losing out with a high SBD price. People use bots for self-voting instead of curate because there's a better ROI there.

The Keynesian fallacy warnings are important. I'm certainly not wanting to artificially control anything. What I am trying to do is avoid boom and bust cycles which I think a broken peg allows for. If the SBD peg worked in both directions, that manipulation wouldn't be possible and the market cap of STEEM is large enough to not be easily manipulated compared to SBD (though it still needs to grow much larger).

Speculators would still be giving us a gift, we'd just be able to collect on it quickly as we convert STEEM to SBD to get more if it. Since the SBD could go right back to STEEM again, it wouldn't be creating new money out of nothing. That's the theory, anyway.

As to your conclusion, I do think it has validity. What I also see is people start to expect SBD to be worth something high. They hold it as it goes back to $1 instead of obtaining STEEM which (IMO) has a much, much higher upside. I want to get more people thinking long-term, not short-term. That's where the real value is. If they can't speculate on that future value, they they shouldn't speculate on a broken pegged coin either. It would serve them best to hold a stable coin.

Great comments, @ashe-oro. Thanks!

I've voted you as witness for your insightful thoughts on this... your witness account is lukestokes.mhth yes? I'm sure it is, but still want to check...

I disagree with you in the timing, I'd personally prefer to bite the bullet and do the hard work now.... it might be harsh, it might be messy, but no time is ever going to feel like the right time, there's always going to be reasons to not... but the way I see it is if ecommerce and app developers are cautious to use this platform because they don't know what price they can set their products or services at... then that's a problem that slows the build of Planet Steem.

Regardless, you really seem to have thought it all through, and I couldn't ask for any more from a witness.

Yes that is his witness account.

Thanks heaps Smooth!

Thank you so much for your support. I really appreciate it.

As for the timing, I tried to make it clear that on this issue, I will go forward with what the community seems to want most. If people started voting based on those who are willing to support the peg or not, I may change my position on the timing and, as you said, bite the bullet. Ideally, we'd do it in such a way as to ensure as few people as possible get burned by the change.

In the meantime, my advice remains the same: as long as SBD is above $1, I sell for STEEM. I hope others will follow that example. If everyone did that as soon as they received post rewards, the only people who would get burned by an SBD correction would be the speculators who caused the peg to break in the first place.

I wouldn't be so quick to act. I don't think we fully understand the implications of a two way conversion, which is why these discussions are happening in the first place.

I'm more focused on economic stability first and foremost. Right now, I would consider things stable and well understood even if the peg is not working. Yes there do appear to be reasons to accelerate the peg, but the reverse conversion idea I'm very hesitant about.

Ultimately I am pro peg and it's like the post mentions, it's about timing and how we proceed.

Really enjoyed reading your thoughts on the topic and I hope to hear from more witnesses in this actual thread and hopefully it is upvoted for visability.

I think my concern mimics yours about the timing. Overall I think long term a pegged SBD may be the best course but I am not so certain on that because the use case and it vastly helping steem is speculative. That being said it was the original intent so I lean towards that solution. The thing is, I would like to give things plenty of time to see if the market corrects itself before action is taken. In an ideal world this sort of solution would be done before any of this happened or while the price is back to "normal".

A couple things I do notice is IMO from watching twitter and being active in chat is that it is driving traffic to the website, although that isnt some be all end all factor to me, just a consideration.

Another factor is the SBD price being high gives "normal" posters a chance to power up and get some of that steem easier than if SBD is one dollar. I see that as a chance to spread the Steem around more and I think that is actually beneficial for the system as a whole instead of Steem itself just increasing in price right away.

My thought is to watch it over the course of 4 or 5 months to see what happens to the price before seeing if anything needs to be done. I dont think that will cause Steem to miss out on some super special opportunity and gives SBD time to self correct as more is introduced to the exchanges etc.

I also like the idea of a better STEEM distribution and if people take high valued SBD rewards to buy STEEM and power it up, that could certainly help.

At the same time, a high SBD value may only further encourage those who are taking a massive amount of the rewards for themselves already. Example:

grumpycat transfer 3,014.813 SBD to bittrexSo it goes both ways. The new users could benefit and the entrenched holders could benefit more.

Thanks for chiming in and taking a broad view of the topic. There are costs, benefits, risks, and rewards on all sides of this discussion and it's important for us to understand things as best we can to make decisions which benefit the most number of people.

"a high SBD value may only further encourage those who are taking a massive amount of the rewards"

Oh yeah? ONLY the whales, aye? Have you ever had to worry about money in your life? Let alone do work to survive? I'm sorry to sound harsh, but the incentives are ENORMOUS because of SBD. You really don't need much to survive in this world, which is why I'm asking you if you understand how much the rewards make people happy. Again, sorry. But I had to ask.

$0.36 under this comment, which today is $2.16. Write a few other good comments and you've got a day's worth of salary for many people. Is that not encouragement enough in your view?

Hello Bobby. In answer to your question, yes, I have. When I was in high school, my parents lost the house we lived in and we moved on to a boat. Food was donated to us and money was very tight. You can read the whole story here:

Living on a Boat for Two Years Shaped My Life.

That said, I won't get into a victim scoresheet process where my victimhood grants me a voice in any given discussion. Short-term, "poor" thinking leads to poverty. Long-term, "rich" thinking in terms of investment, time-value of money, compounding interest, understanding probabilities, etc, etc leads to abundance and prosperity.

Have you considered you may be thinking short-term which may actually harm the very people you want to support? If STEEM has gone up 46x and SBD only 7x, why are you pushing for the loser in that race? Why not further incentivize more exponential growth in STEEM which increases the entire rewards pool (both for authors and curators)?

I'm not ignorant about how some people's lives are radically changed here because of simple upvotes. I've tried to delegate my witness earnings to help support important communities here.

I'm all about making people happy and fully recognize how the rewards do that. I'm not willing to automatically assume a high, non-pegged SBD is the best way to increase those rewards and I've spent many hours making my case in the original post.

will vote for witness after this game, XD

I'm with you there about timing. I also don't think we have seen the effects of the current rate of printing due to steem prices rising.

About the influx of traffic, I don't think it's the high SBD. I think it's the visibility of STEEM in general due to both steem and sbd prices pumping. Most people coming here don't even understand how the two work.

Great post. You've pulled together all the resources and angles into one post which is a great repository.

I personally would tackle this problem with a stakeholder analysis first up and then try to find some sort of compromise between them. If you can't get people on board and agreeing to some commonality there will never be a solution.

I agree, looking at this in terms of stake holders is important, but I want to make sure we're using the correct definitions first so our premises can be accurately justified. The challenge with story telling in terms of stake holders is we can get caught into thinking correlation is causation. We might, for example, say "More users are joining now that the SBD value is high, so clearly we should keep it high to gain more users!" when the truth might more accurately be, "The rising value of the entire cryptocurrency market combined with STEEM / SBD being added to a Korean cryptocurrency exchange caused both to rise which increased the rewards pool and attracted more users because of their interest in cryptocurrency in general which increased due to the overall rise in the space."

Getting the definitions right is a good place to start as it makes sure the conversation is all happening on the same page and it's important to get the WHAT right.

I did a bit of a Stakeholder Analysis on this issue because I think it's important WHO is taking part in the conversation. I'd appreciate your feedback on it if you have the time.

Great post! I'll add a link to it in my root post. I like how you outlined the various stakeholders involved.

Thanks for taking the time to check it out, and for the link. Much appreciated!

SBD going back near $1 is one of my criteria to reevaluate my stance that we shouldn't convert now. I'm pro conversion eventually. Just not now.

Triggers:

SBD naturally falls back near $1

Coinbase wants to use us as a fiat exit

Ebay wants to price shit in SBD

Bittrex wants to replace tether with us

We hit a 10B marketcap

Doesn't have to be those, but those or something like it would make me reevaluate immediately. Those opportunities mark major events that would push the rise in steem over the current benefit of high SBD to posters.

Otherwise crashing the SBD market with this conversion now I think would cause harm to the network as a whole and I don't see how the millions, billions, or trillions suddenly materialize because we had a $1 SBD before and no one gave a shit.

@aggroed For those triggers to happen you need to fix the SBD peg first! Doh!

I'm not gonna use SBD as a Teher alternative if it is not dependable with its peg.

Same goes for Commerce. It cannot seriously get off the ground without a proven stable SBD.

If you're an ebay seller and want to sell a product for 300$ on SteemBay, with the current SBD it is a nightmare: you need to rely on a real time conversion system (ala BitPay/Coinbase), which still means converting to BTC (fees) then converting to FIAT (more fees) and all in a fluctuating market. Good luck with that.

Instead with a stable SBD I can set the price at 300 SBD (and not 50 SBD as it is now), and when I sell the product I can keep the 300 SBD in my account knowing my earnings will be unaffected by crypto market swings. And then the 300 SBD can be used at any time to buy products on SteemBay, without needing to return to the FIAT market! (no need to sell the SBD for FIAT= Steem Moon). This will be a game changer especially in heavily taxed countries.

The SBD has never been stable since it's conception, it has some stable periods...but that's not sufficient for a online shop to move it's operation to Steem unless the SBD peg is proven dependable . It needs to be within the narrow range as envisioned in the whitepaper.

Imagine a shop selling 300$ products for 50 SBD today, and then seeing the SBD tank shortly after. That would be immediate bankrupcy.

Btw posts are already receiving high payouts, the problem is that payouts are not distributed widely and always end up in the pockets of the few circle-jerkers. Overly greedy and shortsighted people are making us miss these big opportunities.

If the pegging had been done 7 months ago by now Steem would be among the top 5 cryptos and SBD would have been used as Tether alternative and we'd have a thriving market-place.

If SBD was stable right now I'd be using it rather than Tether which is untrustworthy, who wouldn't? This opportunity is probably lost though as new ETH based stable coins are soon to be introduced on exchanges.

I hope you enjoyed the SBD earnings, but you've done tremendous damage to Steem with your front page posts defending the broken SBD and you held us back. It's time to realize it.

Upvoted as a well-written and powerful expression of the "Pro Peg" case. I'm personally quite open minded about this and willing to consider both sides of the issue, but your comment has indeed swayed my views a bit in making clear in stark terms how ignoring the peg and savoring the increased rewards has come at a real cost, perhaps a catastrophic one in terms of lost opportunities now that we've squandered our early lead and competitors are arriving.

thanks. it was more of a disjointed frustrated rant, I'm glad I managed to somehow put some points across.

But I apologize to @aggroed for the tone of my post, I'm sure his posts defending the high SBD are NOT done with malice or nefarious intentions.

It doesn't have to involve malice to still do tremendous damage (and I don't think you suggested any). Often that happens with the best of intentions.

I kind of implied blind greed and author short term self interest as the reasons why he supported the high SBD, and I might be wrong on that.

That's a good point. But I still think there is a strong case that defending the broken peg with whatever motive has done a lot of damage, and your comment was unusually clear and effective in making that case.

To be clear though, I don't view it as primarily a personalized issue, if at all. @aggroed is not at all the only one making that argument and certainly is not personally solely responsible for where things stand today.

Let's try not to make unsupported claims about what would have happened in a could of, should of, would of way. We can't possibly know what would make STEEM a top 5 given decisions made 7 months ago. We also don't get very far as a community making direct, personal accusations unless we have direct evidence of malice involved.

Instead, let's try socratic questioning and let people make up their own minds. Is it possible @aggroed's passionate love for this ecosystem and community caused him to miss some important parts of this discussion? Maybe. Is he solely to blame for the price of STEEM (either up or down)? Clearly not.

Let's be nice. We can disagree, even passionately so, but when we throw out unsubstantiated claims as accusations, it just makes people defensive and angry.

I'd say it should go without saying the @aggroed has the ecosystem's best interest at heart and so do you, that should be obvious to everybody!

But in this particular case, I think he is the one making the more sober and realistic analysis.

You should always rely on a real-time price feed. Depending on the peg is suicide. Even running a shop that hypothetically accepts Tether without actually checking a live price feed would be idiotic. It would be just as idiotic to do that with SBD, even if it had a hard peg.

Shop owners who accept any crypto should have live prices to guard against people who take advantage of shocks in the market.

quote out of context.

I was not referring to live price feed conversion (this can easily be implemented into Steem or any wallet), but to services like Bitpay which convert (exchange) the paid crypto instantly into FIAT and which merchants rely on in the bitcoin world. This is clear in the part you omitted from my quote. ;) ("ala BitPay", "fees", etc)

Of course it is wise to always keep an eye on the real live SBD price, that's common sense. In any case merchants wouldn't start adopting SBD until it's peg was fully proven and battle tested. So even if the proposed changes were to be implemented tomorrow and worked in controlling the SBD price, it would be months before online shops would even consider using it.

Market swings of around 1% are probably unavoidable but they would not be that much of an issue, especially considering all the savings in fees and possibly taxes compared to the FIAT system.

If the SBD had taken tether's place then it would also take its place when authorities choose to take action against Tether for the creation of money and various other schemes they've been up to. You do not want to be in that position. None of us should want to be in that position.

And as far as pegs go, you must not be a very good student of economic history to not know that pegs go terribly, terribly wrong all the time, and are very exploitable and ripe targets for manipulation. If you know there is an infinite buyer or seller on the other side, and you outweigh them or even just whittle away at them over time, you can destroy them. It leaves us at great risk to attempt any sort of peg, and the consequences would be far worse than letting the speculators get burned.

For instance do you think China's peg worked at all? What good has that brought the world. Deflated wages for Chinese workers, their country's soil, water and air is in ruins, and they've burned up all their capital reserves. Add to that the amount of new debt creation they had to endure just to stay afloat and it's just a total mess right now, even if they can claim to have the largest economy.

Pegs always fail. Do not think otherwise.

You make some valid points. But the current SBD already has a peg mechanism when it falls below 1$ (Steem needs to be printed to keep it afloat). So the current SBD has all the disadvantages of a pegged asset without any of the benefits. If we are to keep SBD lets peg it properly, if not lets get rid of it altogether.

Regarding the risk of authorities getting involved ....Steem is a decentralized blockchain what can they do about it? The Steemit website may face a shut down, but decentralized apps like Vessel would still operate and Steem based websites will still operate outside US jurisdiction. Frankly I wouldn't be surprised to see Steemit relocate HQ to some cryptohaven like Zug, Malta or Isle of Mann. The regulatory framework in the US has become way too oppressive for innovation

Do you think the bitUSD peg is being manipulated or has failed or will fail terribly?

I am very, very uncertain about bitUSD's future, I mean I asked Stan right here on steemit about what Arise Bank's association with it is and he just vaguely said "on and off-ramps". That combined with what I've read about Arise Bank does not give me great confidence. And sadly for new users like me it's one of the few trading pairs we have access to off of the steemit website, so it's very troubling to me.

Literally every one of those items on your list except the first and last is guaranteed not to happen unless SBD becomes stable at $1 first. Since you saw fit to list them, you clearly recognize the importance of those opportunities and others like them to the Steem ecosystem. In order to have any chance to pursue them, we need to fix the peg first.

Read the post. The market conditions have changed dramatically. There was a time when Tether was a tiny little thing stuck at under $1 million market cap for years and no one gave a shit! Yes that's right, Tether went from $500000 to $1.6 billion. Likewise for BitUSD, NuBits and the others (though they are of course smaller; Tether is the current leader).

The answer to your (implied) question as to why this matters now when it didn't matter before is simply that it is 2018 now and not 2016 (however, I will say that even in 2016-2017, the Steem community was spawning its own SBD-based initiatives that could accomplish some of the same goals as items on your list, initiatives that were smothered in the cradle because we failed to act to fix SBD when it started to de-peg back then). The environment and market is completely different and the scale of the opportunity is vastly larger now. Given the other powerful attributes of Steem (large user base, ease of use, ability to on board users, speed and scalability of the blockchain, no/low fees, etc.) we are well positioned to pursue that opportunity but we have to fix SBD first, or we are just not even in the game.

I think you're right, because of the social media aspect we're still well positioned. Once the changes are brought in we can:

Normally it would take 6 to 12 months before anyone would trust a pegged asset with big money, especially after a somehow failed experiment like the SBD was. But if we are able to put across through the influencers the message that the SBD was only meant to be a coin with a 1$ floor (therefore pretending that it worked perfectly), and that SBPD is instead a new pegged stable dollar coin....then we can see adoption much sooner.

I don't know when the ERC 20 pegged coins will be production ready, but I believe because of the Ethereum brand they will be adopted immediately by the community. Ethereum has had more fuckups than any blockchain out there but somehow they can't seem to do wrong in the eyes of the investors for some reason which frankly I can't comprehend. Also their peg may be backed by real dollars in the bank (I don't know yet).

So it is possible that they might beat us in capturing the Fiat market on exchanges. Currently we only have Poloniex as potential market anyway. But for the retail and online shopping we're still in with a shot. Also lets not forget we have an internal market here on Steem which could skyrocket in volume.

To capture the retail market it would be wise to start already working on a SteemBay portal in preparation for the SBD changes. So it can launch as soon as the fork occurs.

Though it is very possible to imagine a future where retailers start accepting all battle tested pegged assets: OpenUSD, SBPD, ETHUSD, TETHER etc

Because of the integration with Steem social media and the 0 fees the SBPD could end up being the most convenient. Ultimately though no pegged asset can compete with a proven Dollar backed coin (meaning with dollars in the bank) like Tether was supposed to be.

So I might overstated the importance of having a properly pegged Steem backed Dollar, but we should at least give it a proper go. Even a small fraction of the finance and retail markets would bring enormous value to Steem.

Btw before announcing the replacement of the SBD with the new pegged Dollar coin it would be best to wait till it goes back towards 1$ so not to cause a major backclash in the market.

This is such an important point. We have to have a long, trusted history as a pegged asset before we'll be taken seriously as a pegged asset. It may take many months or even years and the longer we wait, the longer it will take to build that trust.

Daaaaamn. Either BitFinex is just friggen amazing at on-boarding new fiat into cryptocurrency or that sure seems like a nice money-printer they have there. Heheh... I won't get into that discussion here though. :)

USDT doesn't necessarily work the way people think it does in terms of so-called "on boarding" (i.e. people from outside crypto deposting new USD and getting USDT in return). It can also attract capital directly from crypto wealth and do so completely legitimately (i.e. without the rumors of fiat printing being accurate). Here's how.

Let's say people are selling their ETH, BTC, XRP, etc. (even STEEM) wealth into USDT, and this drives up the price of USDT (say to 1.01 or 1.02). Assume Tether/Bitfinex has $100 million of its own corporate working capital from VC, private backers, etc. They can use that $100 million to legitimately print 100 million USDT for their own account. At this point the printing is not fraudulent, fractional reserve, etc. because $100 million gets transferred from corporate working capital into the USDT escrow account. They then dump that USDT onto the market in exchange for BTC, ETH, etc., driving the price of USDT back down to 1.00.

Now the final step is interesting. Tether can take the BTC, ETH etc. they just bought and send it to a high-limit corporate account on a major fiat exchange, and sell it back for USD, replenishing the original $100 million corporate funds, to repeat the process again when needed.

I have a feeling this is actually where most of the USDT market cap growth has come from (assuming it isn't mostly fraud), but I have no proof it of, just inference.

Interesting. I question how they can keep printing new Tether and aren't burning it, but maybe that's just a sign of more people coming onboard. To my understanding, they can't print Tether unless it's backed by money in the escrow. If they keep printing, that implies real new money going towards the escrow, right? Maybe it's not "new" money, but money Tether/Bitfinex already has on hand, but it still seems to me when things fluctuate the other way, we should be seeing Tether burned and funds returned back from the escrow to BitFinex to cover real USD withdrawals. Maybe if the bull run turns bearish we'll see that.

Again it isn't a question of onboarding necessarily, just capital flows, and quite possibly it is because with $400 billion or so in newly-added crypto wealth the overwhelming majority of capital flows are from other highly-appreciated cryptos (BTC, ETH, XRP, many others) toward USDT not away from it. Also keep in mind USDT's role in trading pairs, which itself creates added demand for it (especially as USD price of the other coin increases; more USDT needed for buy orders). Also, to me it sure looks like many of the paths by which new outside, so-called "onboarding" capital is entering crypto have little to nothing to do with USDT (Coinbase, Korea, Japan, etc.). Or perhaps it is all or part fraudulent as many suspect. I don't know (and in some sense it doesn't matter; part of the problem with the non-trustless peg model is that it simply can't be trusted).

It isn't so much a matter of bull run vs. bear run as it is demand for stable crypto. It is quite plausible to me that demand for stable crypto has mostly just increased over the past year or so (and indeed this is mirrored by the other, smaller stable cryptos). But at some point when the demand for stable cryptos tops out and heads downward, there should indeed be burning of USDT.

By all accounts BitFinex's ability to handle real USD withdrawals has, at best, been greatly hampered by banking issues. So this path by which capital could conceivably exit USDT may be quite small. But in any case given the natural friction of exchanging between crypto and fiat (and relative lack thereof in exchanging crypto-to-crypto) it may always (or at least for a long time) be that the dominant flows into and out of USDT are between USDT and other cryptos, not between USDT and USD directly.

Or! ... The witnesses wanting this shit could come together and create a THIRD, off-chain, dollar-pegged currency and hop the fuck off SBD. :) Just a thought ;)

It just makes me so mad that a FREE, DE-centralized (not centralized) community is SO quick to hop on a controlled, socialist-like mentality to try and regulate shit - exactly which was supposed to be PREVENTED on this DE-centralized platform. It makes me sick.

@boobysteem if you want "free market" for SBD then lets remove the bail-out rule for SBD. let's see how long it lasts next time it drops below 1 $..

In case you haven't noticed Steem has to be printed every time the SBD drops below 1$.to keep it afloat. The SBD is already a regulated coin, just a poorly regulated one.

Dan, which I have immense respect for, got 2 things wrong with SBD : 1- the SBD peg isn't working as the WhitePaper envisioned . 2- the reverse converse is not exploitable anymore in the way the Whitepaper describes

Have you read the white paper? Do you know it was written mostly by an anarcho-capitalist (Dan Larimer) who is not, at all, a fan of the "socialist-like mentality" you're describing? What's the point of creating another currency that is pegged with two unpegged, speculative currencies? Do you realize how confusing that would be and how much coding effort would be involved?

If you understood the conversion mechanisms built into this system, you'd have to come to the conclusions they aren't "controlled" by anyone. They are all done voluntarily by individual market actors without any centralized control at all.

I want to believe you're working to bring constructive discussion here, but this comment looks like trolling. Please, read all the sources I referenced in my post and then we can have a more informed discussion about what's really going on here.

I'll answer your questions using points below here:

"It's confusing"

"If you understood the conversion mechanisms built into this system, you'd have to come to the conclusions they aren't "controlled" by anyone. They are all done voluntarily by individual market actors without any centralized control at all."

"they aren't "controlled" by anyone"

"written mostly by an anarcho-capitalist (Dan Larimer)"

Thanks!

I said two separate currencies would be confusing. People are already confused with STEEM and Steem Dollars. How would STEEM, Steem Dollars, and Steem Dollars For Real This Time not be more confusing?

Of course they aren't using it now. Who would? They'd lose out big time because it currently only goes one direction. That's why it was removed from the steemit interface. The point being, anyone can use it. It's not some lever that only some people can pull. As long as enough people use it, the peg will be maintained (at least when it drops below $1).

Can you explain to me how that would happen? Do you really think witnesses would risk their position by doing something 500k people who voted them into that position wouldn't want? The whole point of this discussion is to figure out all perspectives for what's best for the network. There's a sound argument that we've lost quite a bit a money for everyone involved because we didn't fix this sooner and instead Tether went from $500k to $1.6B.

So Dan's opinion, considering he's no longer involved in STEEM, is more valid that the existing 20 witnesses and all the supporters and users we have here today? How is that decentralized? If the network sees the value in a pegged asset and wants one, then the Steem Dollar should be it, as designed. If we can do that after it naturally corrects back down to $1, why shouldn't we? That's what this discussion is all about.

I gave a shit. I gave many shits, aggroed. Heheh.

I hear what you're saying though. We can't assume a conversion would automatically increase the value of STEEM (even though it's a compelling story, in my mind). At the same time, we can't assume the high SBD value is what is getting people excited about Steemit right now when it could just as well be (and as smooth argues and I mentioned in my post) more of a result of STEEM itself growing in value which increases the reward pool for everyone.

Those triggers sound mighty nice to me.

Do you have concerns about SBD going higher and making it even harder to bring the peg back in play? If not, why should we even bother with SBD at all? Why have two speculative tokens on the STEEM blockchain if we're going to abandon the peg? I'm also curious what you think about the argument that some in developing nations really do need and highly value a stable currency. For them to hold their money in a speculative cryptocurrency doesn't make sense if they have bills to pay.

"concerns about SBD going higher and making it even harder to bring the peg back"

Literally what is written here is this: "Do you have concerns about making too much money which makes it harder to become POOR again?"

These whales and witnesses literally don't live in real life and can therefore afford to DESTROY millions of dollars. Why? Because "muh fiat currencey!"

Nice.

The more comments of yours I read, the more it looks like trolling. Did you even read my post? Did you even consider the possibility that the single greatest way to help the poor would be by giving them a stable asset to trust in while also increasing the value of STEEM which increases the entire rewards pool they enjoy?

What bothers me most about your comments is they seem to imply malicious intent where there is none.

@aggroed you may want to read what I mentioned to @lukestokes about yourself helding a panel with the top 20 or 25 witnesses specifically only to debate about the SBD.

This is something important I thin, very important to be discussed and people hearing the witnesses opinions will see the side of each, and then people can take their voting opportunities to see whats best to do.

Looking forward to your thoughts!

Regards, @gold84

Not all the witnesses are native english speakers so I'm not sure a panel discussion is the best way to flesh out this issue. Reading just my post on video took me over 21 minutes. This isn't a simple topic to be figured out on a short-from panel discussion. This should be done carefully and methodically with data-driven, well thought out proposals.

You are totally right @lukestokes ! Perhaps a panel can be done at the end, once everything has been analyzed properly as you mention. Or perhaps no panel is needed. Just thinking in a loud voice, and trying to find ways to help.

Regards, @gold84

I don't thing it should be pegged right now we should wait and watch little more

Never peg!

Why? Please explain yourself. Explain how those who are literally dying in Venezuela would not benefit from a pegged, free-to-use cryptocurrency they could put their life savings in? Explain to them why a speculative investment makes more sense? When SBD goes from $12 to $6, explain to them why they just lost half their life savings.