Tokenized RWAs Surpass $23 Billion

The explosive growth of on-chain Real World Assets, with an 84% increase in new investors in one month, marks the unstoppable convergence between traditional finance and the innovative DeFi ecosystem.

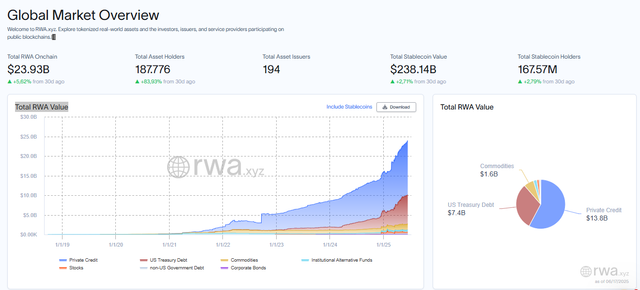

Real World Assets (RWAs), or tokenized Real World Assets on the blockchain, are experiencing unprecedented expansion, cementing themselves as a fundamental pillar in redefining the global financial landscape. According to the most recent data from RWA.xyz, as of June 16, 2025, the total value of on-chain RWAs has reached an impressive $23.93 billion. This milestone, driven by +113.85% annual growth and, more crucially, a staggering +83.93% increase in the number of holders in just 30 days, underscores massive adoption and growing confidence in the tokenization of tangible assets.

The market for tokenized Real World Assets is on an unstoppable upward trajectory. /RWA.xyz

Milestone Figures: RWA Momentum

The dynamism of the RWA market leaves no doubt about its significance. RWA.xyz metrics paint a picture of exponential growth and consolidation:

Total RWA Onchain Value: The market capitalization of tokenized real-world assets stands at $23.93 billion. What stands out is its robust increase of +5.62% in just the last 30 days, signaling sustained momentum that captures the interest of investors across the spectrum.

Explosion of Asset Holders: The most revealing and crucial data point of the moment is, without a doubt, the dizzying increase in the user base. The total number of RWA asset holders grew an astonishing +83.93% in just one month, reaching 187,776 holders. This figure not only demonstrates the democratization of access but also adoption at a pace never seen before, suggesting organic demand and expanding trust.

Issuer Diversity: With 194 asset issuers operating in the ecosystem, diversity and competition in the RWA market are booming, offering a wide range of tokenization opportunities.

The Launchpad: The Crucial Role of Stablecoins

The flourishing of the RWA sector would not be possible without the robust infrastructure provided by stablecoins. These anchors of stability in the volatile crypto world are the primary conduit for capital inflows and outflows into tokenized RWAs. The data reflects their vital role: the total value of stablecoins amounts to $238.14 billion, with a healthy increase of +2.71% over the past 30 days. Similarly, the number of stablecoin holders grew +2.79% over the same period, reaching 167.57 million. This vast liquidity and stablecoin user base are the fuel that ensures the fluidity and operability of RWA trading.

What are investors tokenizing? Market preferences

The composition of RWA's total value reveals investor preferences and prevailing trends:

Private Credit: Dominating the space with $13.8 billion, tokenized private credit highlights the quest for efficiency and liquidity in traditionally opaque and illiquid markets. It allows investors to access financing opportunities and lenders to diversify their capital sources with greater transparency.

U.S. Treasury Debt: At $7.4 billion, the tokenization of U.S. Treasury bonds has established itself as a key trend. It offers on-chain investors the opportunity to earn returns on assets considered low-risk and highly liquid in the real world, bypassing the barriers to entry of traditional finance.

Commodities: Tokenized commodities, at $1.6 billion, although a smaller segment, are growing, democratizing access to investment in physical assets such as precious metals or energy.

The macro trend that encompasses these preferences is the dizzying growth over the past year: the total value of RWA exploded from $11.19 billion on June 16, 2024, to $23.93 billion on June 16, 2025, an increase of +113.85%. This is not a fad; it is a structural evolution.

Key Trends: The Unstoppable Merger Between TradFi and DeFi

This growth pattern is underpinned by powerful underlying forces:

Institutionalization: The growing tokenization of assets such as Treasury debt and private credit suggests increasing institutional participation, attracted by the operational efficiency, transparency, and near-instant settlement offered by blockchain technology.

Democratization: RWAs are opening up investment opportunities that were previously reserved for a select few, allowing a broader range of investors to access stable returns and diversification in their portfolios.

DeFi-TradFi Convergence: Tokenized RWAs are the most tangible and effective bridge between Decentralized Finance (DeFi) and Traditional Finance (TradFi), attracting capital and building trust by linking digital value to tangible, regulated assets.

Sustained Growth

The tokenized Real World Assets market is on an unstoppable upward trajectory. With a total value of $23.93 billion and annual growth of 113.85%, RWAs are demonstrating their ability to inject liquidity and efficiency into traditional markets. However, the most powerful indicator of their success is the +83.93% explosion in the number of asset holders in just one month, confirming that this sector is not only attracting large capital but is also gaining massive traction in adoption by an ever-expanding user base. RWAs are quickly establishing themselves as an essential backbone for the next phase of digital finance, merging real-world robustness with the transformative innovation of blockchain.

Disclaimer: This article is for informational and journalistic purposes only and does not constitute financial advice or investment recommendations. Web3 assets and protocols, including RWAs, carry a high level of risk, and their value can fluctuate dramatically. Investors are advised to conduct their own thorough research and consult a financial professional before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.