Did bitcoin beat the dollar? Russia accepts BTC for its Gas and Oil!

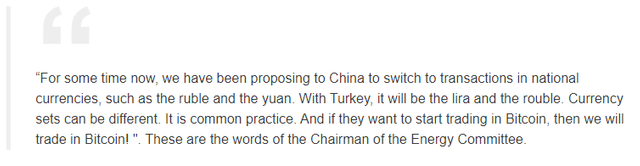

Russia is wielding Bitcoin as an economic counterattack weapon. Thursday March 24, 2022. All eyes are on Brussels, where three summits are being held simultaneously: NATO, G7 and the European Union. But the scoop is in Moscow where Pavel Zavalny, chairman of the Energy Committee is holding a press conference. He announces that “friendly” countries will now be able to pay in Bitcoin for Russian gas and oil. The Euro and the Dollar, he adds, are no more than "candy wrappers" for Russia.

- Positive fallout for Russia

- Bitcoin An Ideal Currency For International Trade?

- Bitcoin Exchanges With "Friendly" Countries

Bitcoin Exchanges With "Friendly" Countries

Russia is ready to accept Bitcoin for all of its natural resource exports. This response could have the effect of a bombshell in the economic war that is being played out on the sidelines of the fighting in Ukraine .

The new rules enacted by Moscow are more precisely the following. The “hostile” countries have the choice between the ruble or the gold. While “friendly” countries like China and Turkey can choose between the ruble, their own national currencies or Bitcoin. In short, everything except the dollar and the euro!

Positive Fallout For Russia

According to Pavel Zavalny, Russia no longer has any interest in receiving payments in dollars or euros. Indeed, Western sanctions have frozen Russia's foreign currency reserves. It can no longer store dollars or euros. In addition, his right to make purchases with these currencies is also reduced.

Bitcoin An Ideal Currency For International Trade?

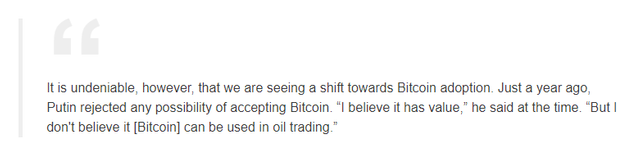

Bitcoin was designed in response to the 2008 financial crisis on the principles of independence, neutrality and transparency. The objective for these creators was to design a sound currency that escapes any manipulation. By these qualities, it could be the ideal currency.

In the crypto-sphere, there are many supporters of the dedollarization of international exchanges in favor of Bitcoin. To what extent is this feasible beyond institutional blockages? The answers lie in Bitcoin's current market size and liquidity. They seem to constitute a barrier to wide use for international trade.

And if we reintroduce the institutional blockages, we can only wonder about the feasibility of putting it into practice by Russia. Does it really have the capacity to free itself from the rules of international trade? To manage exchanges in Bitcoin to circumvent the sanctions? Putin has ordered the Russian Central Bank to put in place within a week, a mechanism supporting its decisions…to be followed, therefore, as well as international reactions.

To demand rubles from “hostile” countries is to force them to buy them massively. This is intended to support the currency rate. The purchases will thus stabilize the price of the ruble on the international market. What about bitcoin? Like gold, Bitcoin is considered a store of value. We call it digital gold. Thus Russia could store bitcoins instead of the dollar and the euro, without running any risk of confiscation.

Another advantage is that bitcoin exchanges are carried out independently of banks and outside the SWIFT network. Remember that Russia was partially excluded from this system. Accepting Bitcoin allows the sanctioned country to circumvent the exclusion.

If “friendly” countries respond to its incitement to use Bitcoin, Russia would ease the sanctions that deprive it of hard currency and its full ability to trade internationally.

In one week, we have witnessed two turnarounds. The first concerns the authorization obtained by the largest state bank, Sberbank, in order to issue and exchange digital assets. The second is the Bitcoin acceptance announcement.

In this troubled context of war, Russia seems to act as a catalyst on the ecosystem of blockchains and crypto-assets. And it is actively participating in the ongoing transformation of the global monetary system.