What is Ripple ? XRP Huge Guide!

What Ripple is?

Ripple is not a pure crypto currency. We need to distinguish between the Ripple and the digital Asset XRP.

The company Ripple offers solutions for the processing of global transactions. You rely on an Open Source Protocol.

The crypto-currency, XRP is only held for part of the Ripple. The focus is on the digital currency, but the offered technologies.

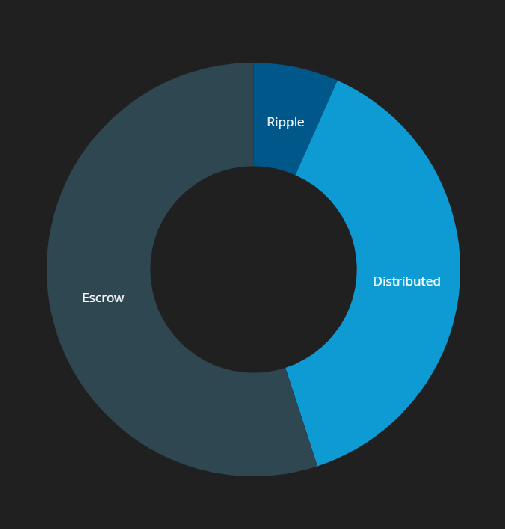

The exact distribution of the XRP you can find on the website of Ripple.

https://ripple.com/xrp/market-performance/

Ripple Team

Ripples CEO , Brad garlinghouse was in leading positions at AOL and Yahoo!. At his side is the Vice-President of Ripple Asheesh Birla. He is also VP of Global Technology.

Cryptography is a core point of the entire technique. The chief of this team is David Schwartz. He has developed Cloud-storage systems and EMS for e.g. CNN.

CTO Stefan Thomas has the well-known Video "What is Bitcoin" and is the founder of WeUseCoins.com. With the Team a wealth of financial and banking knowledge in the Form of Marcus Treacher, the "Global Head of Strategic Accounts" and Cameron Kinloch.

PR - and globalization-Department are also well-positioned with QuickBooks PR Manager, Monica Long.

Technology of Ripple

Ripple is basically a large public database. In a Ledger of Bank accounts and associated balance sheets.

Thus, the data in this Ledger up-to-date, you will be continuously by the Ripple Transaction Protocol (RTXP) is renewed. The balance of the data is done on several thousand servers worldwide.

So everyone can keep track of the activities of the Ripple Protocol. If Changes to the main book, the Computer, which are connected to Ripple. A consensus algorithm behind the process.

Make payments with xCurrent

A short and simple explanation of how Ripple at all works with an example.

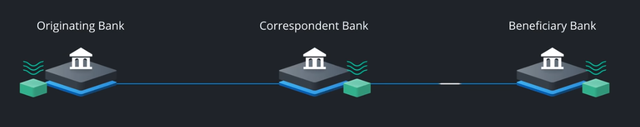

You want to send an amount from the USA to Germany, clever, often not directly, but with a bench as an intermediate station.

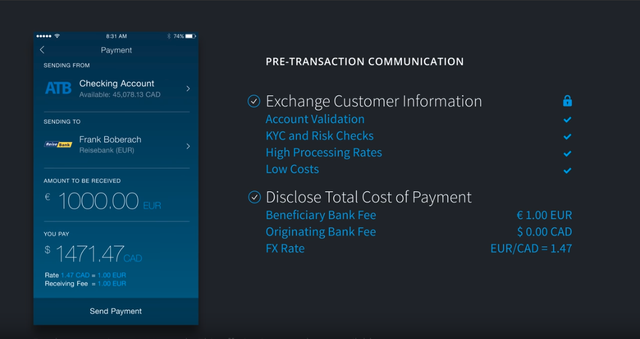

xCurrent of Ripple provides a bi-directional Messenger available for all the banks to communicate with each other. Another Protocol takes care of the payment processing.

The different account formats , such as SWIFT or ISO by xCurrent translated.

By the xCurrent technology, the data of the transactions are cross-checked and validated. In addition, the cost for the transaction will be charged.

The fact that all the data is available, the transaction is already validated before the money is moved.

Ripple coordinates the transaction flow between all banks participate. To be confirmed through cryptographic signatures.

More details at: https://ripple.com/solutions/process-payments/

Payments send xVia

To send amounts over the Ripple network is also offered. With a simple API interface, the transmitter and receiver transactions will be able to coordinate.

It can be, for example, invoices are directly attached.

What are the potential business applications of Ripple?

Ripple wants to modernize the ways of payment around the world.

Tons of Euro and Dollar are daily transferred with an outdated infrastructure. Ripple wants to be with RippleNet build a network, which banks and payment service providers.

Application for banks

Ripple himself calls many of the advantages that banks have, if you use the technology and the network:

- New revenue through global availability

- Lower Transaction Costs

- Regulated Standards

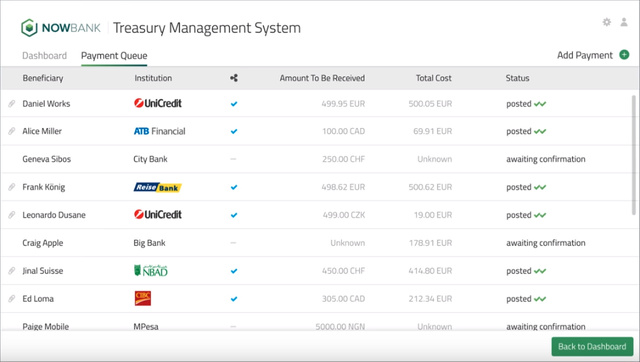

With Ripple can use different banks, and Details of the transactions are stored centrally and synchronized . Including cost and delivery time, as well as invoices as an attachment.

The other side relates to the End-User. So far, it is not always possible to simply money in a different country and in other currencies to transfer. For the benefit of both banks, ripple the.

Ripple connects both banks and allows for a quick, low-risk and cost-effective Transfer. The exchange rates of the currencies are charged directly with.

Application for payment service providers

According to Ripple, there are numerous benefits of such service providers with the cooperation. He has a System to all partners to connect in the Ripple network.

Here, too, is emphasized, how quickly the payments and that the Details are very transparent to see.

It is the technologies xRapid and xCurrent come in question, if the service providers want to use XRP directly or Fiat currencies to manage.

Digital Asset XRP

This Coin is also called "Ripples". There is only a fixed amount of. The Coin can not be mined / mined.

If a transaction is made with XRP, then a small amount of it destroyed. By this measure, Spam is prevented.

XRP is aimed at companies, such as the aforementioned banks and payment service providers.

XRP is faster than other transaction systems:

- XRP: 4 seconds

- ETH: 2 minutes

- BTC: 1 hour

- Traditional Systems: 3-5 Days

More: https://ripple.com/xrp/

There is always the possibility to purchase Bitcoins or similar Coins, and then change accordingly on the favorite platform.

If you have XRP to buy directly want to have it in your Wallet to send, then remains only Bitfinex & Kraken. The Alternatives you can find directly on the website of Ripple.

Other markets XRP to buy: https://ripple.com/xrp/buy-xrp/

Value of XRP

Since Ripple of banks is supported, it can increase the value of this Digital asset, XRP. After all, the value is heavily influenced by the cooperation. The success of the company Ripple, however, is not 1:1 to the value of XRP subject.

The technology will remain for banks continue to be very interesting. At Ripple, we can assume that in the future more collaborations to follow.

Currently, the banks buy but no XRP in order to complete transactions on the Ripple network. Ripple is in favour of the introduction of XRP in banks, which act with less strong Fiat currencies.

Weblinks: