Ripple Price Isn’t Actually Down 30%: CoinMarketCap Removes South Korean Price

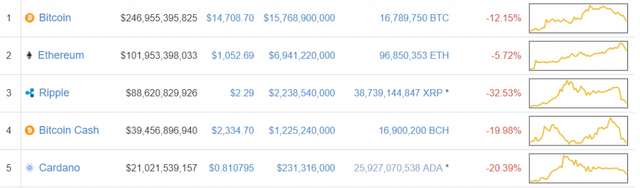

The price of Ripple, as shown on CoinMarketCap is believed to be down by 30 percent today. But, its actually only down by 10 percent.

CoinMarketCap Fiasco

Earlier today, without prior notice or any reasonable explanation, CoinMarketCap removed the trading price of Ripple on South Korean cryptocurrency exchanges from the global average calculation of Ripple.The removal of South Korean rates was controversial, primarily because the well-regulated South Korean cryptocurrency exchange market has been accountable for more than 50 percent of global Ripple trades over the past few weeks. Bithumb, the world’s second largest cryptocurrency exchange with a $2.6 billion daily trading volume, processes $750 million worth of Ripple trades alone on a daily basis.The decision of CoinMarketCap to suddenly remove South Korean rates was questionable because it has removed South Korean rates from all other cryptocurrencies including bitcoin, Ethereum, and other cryptocurrencies. As such, the price of all cryptocurrencies that are concentrated in the South Korean market has decreased substantially.For casual traders and especially newcomers, the abrupt removal of South Korean rates from Ripple’s global average price seemed like a major correction and a panic sell-off. Ripple’s chief cryptographer David Schwartz wrote:

“Coinmarketcap’s decision to exclude Korean prices from the displayed XRP price made the price appear to drop, likely triggering some panic selling. Look closely at the data and don’t be misled.”

Schwartz emphasized that the new price of Ripple, without the high premium rate of the South Korean market, is more meaningful. But, it has triggered a minor sell-off, as investors began to demonstrate concerns over the short-term performance of XRP.

“[South Korean market] They are outliers due to a shortage of cryptos in Korea and difficulty getting KRW out. The new price is more accurate and meaningful, in my opinion,” Schwartz added.

Good Decision?

Experts and analysts have contrasting viewpoints on the removal of South Korean rates from the global price of cryptocurrencies on CoinMarketCap. Some, including Schwartz, stated that the removal of South Korean rates is beneficial for the market and for every cryptocurrency listed on CoinMarketCap since only a small portion of investors are affected by the premium rates in South Korea.It is extremely difficult for foreigners to trade cryptocurrencies in the South Korean market and challenging for South Korean investors to take advantage of the arbitrage opportunity. As such, the price of cryptocurrencies in the South Korean market is exclusive to local traders and investors.The question about the rates from the South Korean market and whether they should be reflected on the global price of cryptocurrencies remains unanswered. While some experts believe it could make the ecosystem healthier, others believe that considering the sheer trading volume coming from the South Korean market, and strict regulations imposed by the government to regulate the sector, South Korean rates should be considered in calculating the global average price.But, ultimately, due to strict capital controls, it is not possible for foreign traders to move South Korean won out of the local cryptocurrency sector. Thus, experts believe that the removal of South Korean rates can be justified.

Source from www.ccn.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://futureblock.io/2018/01/08/ripple-price-isnt-down-30-coinmarketcap-removes-korea-price/

Very informative! Thank you very much!

I didn't even know..... But I do know now that, it would be the time to buy some Ripple for a month long swing trade