Rise and fall Ripple - analysis of mass hysteria

In late 2017 and early 2018, Ripple became a favorite crypto currency for many . In the media constantly wrote about this currency, traders from Asia could not get enough of this currency for purchase, and also it is impossible not to notice the newcomers whose XRP was at the top of the shopping list.

Nevertheless, the fall of Ripple was as fast as its rise. Now that the dust has settled down and the hype has cooled down, the retrospective shows mass hysteria over the rise and fall of Ripple .

Phase 1: Stagnan

Two months ago Ripple was a great sleeping crypto currency. Because of the huge number of XRP tokens, even its huge market capitalization was dissipated and the cost remained small. Purists had an ideological basis for hatred of XRP, arguing that it was not even a crypto currency.

After a short growth in May, Ripple passed a period of prolonged decline. In the period from August to December 2017, XRP traded at a price of 16 to 26 cents, while other altcoys received exponential profits. It seemed that the time Ripple would never come. But then, on December 9, XRP started climbing uphill.

Phase 2: Takeoff

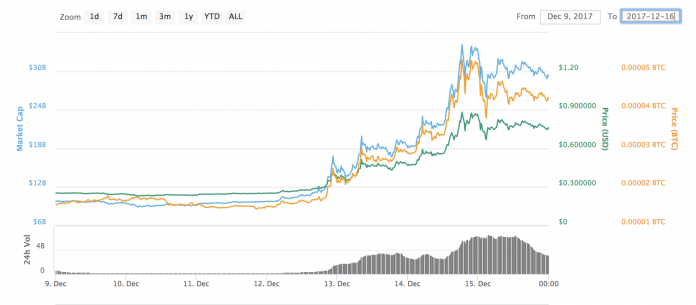

In the period from 9 to 16 December Ripple grew from 24 cents to 88 cents, showing growth of 366% in just a week.

December 13 Forbes released an article : "Is XRP the next cryptorocket ? "

Phase 3: Enthusiasm

From December 17 to 22, Ripple rises from 76 cents to $ 1.19, showing a gain of 160% over the week. The coin, at that time, grew by 500% in two weeks.

December 17, Oracle Times writes : "3 reasons why Amazon will choose Ripple (XRP) in 2018"

December 22, Bloomberg writes : "Bitcoin is 2017, Ripple rises at the end of the year"

Phase 4: Greed

Ripple ends the year with another huge leap - on December 23, XPR tokens cost $ 1.19, and on December 29 it's $ 2.24, showing an increase of 188%.

December 30 news.bitcoin.com asks : "Is Ripple a competitor to Bitcoin? "

Phase 5: Misconception

Ripple starts the year with a new growth, rising from the low of December 31 at a price of $ 1.93 to a record high of January 4 at 3.86 dollars.

January 2: CNBC television channel broadcasts "How to buy Ripple - one of the hottest rivals of bitcoin". On the same day, Laura Sheen of Forbes points out that two of the founders of Ripple are now billionaires, and Chris Larsen is the richest man in America.

January 4: Ripple reaches a historic high.

On the same day, Nathaniel Popper of NYT criticizes Ripple, saying: "I do not know how banks use or plan to use the XRP token for the tens of billions of dollars needed to maintain the market value of XRP."Popper concluded, "Even virtual currency analysts believe that there is a big difference between the success of Ripple and the XPR token, which needs a lot to justify current prices."

January 5: Ripple CEO Brad Garlinghouse criticized Popper, accusing him of intimidating market participants.

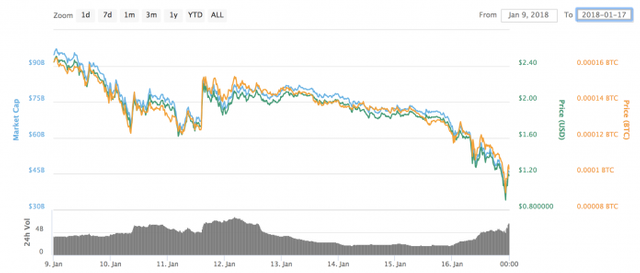

Step 6: The New Paradigm

Over the next four days, Ripple fell slightly in price, but by January 8 it still costs $ 3.36, indicating a 1400% increase in just a month or so.

On January 5, Coinbase rejects rumors that he plans to add new tokens to the site, which undermined the prospect of transferring XRP tokens.

January 7, British newspapers write about Ripple, calling it "a new exciting crypto currency, which has received interest from the crypto-investors."

Phase 7: Failure

Over the next week, Ripple starts to fall, reaching a low of 89 cents on January 16. At this point, the token fell to 430% from a maximum of 12 days, and XPR is no longer the second largest in terms of currency.

January 10: Three days after the British edition of Express advertised Ripple, it writes : "Why does XRP fall so fast?" What happens to Ripple? "

January 11: The news that Ripple has signed the MoneyGram agreement raises the XRP tokens by 20% before the currency has moved again, and has continued to fall.

On January 16, Forbes documents the decline in Ripple, citing one analyst: "As soon as Coinbase announced that they would not add any new tokens to their sites, Ripple began to fall ."

Phase 8: Return to normal

As the crypto-currency markets begin to recover, Ripple played some of its losses, reaching the price of $ 1.43 on Dec. 21. Compared to the beginning of December, its growth is still almost 600%, but the coin has fallen by about 60% from its peak.

The early investors who bought XRP a month ago, were the winners, but most who bought in the peak mania, lost a lot. The media stop writing about Ripple.

The reality may turn out to be more prosaic: Ripple is unlikely to disappear without a trace, but it also can not affect the market capitalization of bitcoin, which is now 3.5 times larger than the centralized contender for its role.