💭 WHAT DID WEALTH MANAGER TELL ME?

I asked the person across from me about how my idle cash could generate some returns while just sitting there. And honestly, the answer wasn't satisfying at all.

He just talked about buying gold, stocks, or Bitcoin. But see, the thing is, my asset portfolio already has those things pretty well covered and diversified. Naturally, I've got a bit of cash left over, just... doing nothing.

Then I got some advice from a wealth manager in the USA – a guy from a financial firm that handles wealth management for the big players over there. He said that with my already quite full and diverse portfolio, that idle cash could actually serve as a kind of collateral, meaning it should be able to revert to USD at any moment without losing value.

He gave me 3 options: a flexible-term bank deposit, just leaving it in a safe, or staking it in USDT pools (those platforms that don't require converting to any other tokens).

After weighing things, especially with the Trump administration's past impact and the financial market doing this cha-cha dance right now, I'm leaning towards staking my USD in the guise of USDT as a pretty stable approach. The thing is, I'm hoping for a higher interest rate than the bank offers, and the ability to get my money back whenever I need it.

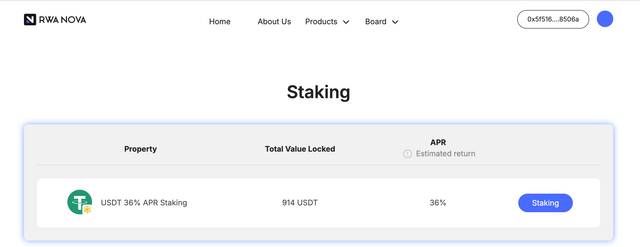

Someone pointed me towards RWA NOVA's USDT staking pool. It wasn't just the 36% APR that caught my eye, but the fact that it's a real-world asset (RWA) tokenization platform. Behind it are actual, operating investment projects in Laos and Thailand, so if there were any risks, their real assets could potentially back up any lost funds.

Though, of course, I'm not expecting that.

Back in the day, Trump showed positive support for RWA, and this industry has been growing for 8+ years, reaching trillions. You never really see extreme troughs on its chart because it’s anchored by fixed real-world assets and has never been dismissed as 'virtual assets.'

So, I'm going to give it a shot to protect my idle USD. At least that 36% APR should cover inflation, and it's multiple times the average return of my ETF and S&P 500 portfolio.

I'll let you know how it goes after a month. But if you happen to know anything more about rwanova.io and their USDT staking, please do share. Thanks!