Railway Cyber Security Market Size, Trends, Growth and Forecast 2024-2032

Global Railway Cyber Security Industry: Key Statistics and Insights in 2024-2032

Railway Cyber Security Industry

Summary:

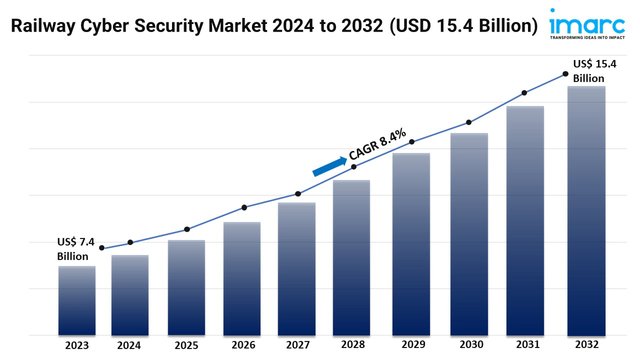

- The global railway cyber security market size reached USD 7.4 Billion in 2023.

- The market is expected to reach USD 15.4 Billion by 2032, exhibiting a growth rate (CAGR) of 8.4% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest railway cyber security market share.

- Solutions hold the majority of the market share in the offering segment because they provide comprehensive and customizable security tools.

- Infrastructure holds the biggest share in the railway cyber security industry.

- Network security remains a dominant segment in the market.

- Conventional passenger trains represent the leading rail type segment.

- The rise in digitalization and adoption of internet of things (IoT) in railways is a primary driver of the railway cyber security market.

- The increasing implementation of stringent regulatory standards is reshaping the railway cyber security market.

Railway Cyber Security Trends and Drivers:

- Increasing Digitalization and Adoption of Internet of Things (IoT) in Railways:

The railway industry is undergoing a significant transformation with the adoption of digital technologies, including the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. These innovations allow for real-time monitoring, automation of key processes, and predictive maintenance, which enhance operational efficiency and reduce costs. However, with increased connectivity comes heightened vulnerability to cyber threats. IoT devices, sensors, and other digital infrastructure create new entry points for cybercriminals to exploit. Rail operators are increasingly reliant on digital networks to manage everything from train scheduling to passenger information systems. As a result, the risk of cyberattacks aimed at disrupting services, stealing sensitive data, or causing safety failures is growing. To counter these risks, railway operators are investing heavily in advanced cybersecurity measures to ensure that their systems remain resilient in the face of potential cyberattacks.

- Stringent Regulatory Requirements and Standards:

Railway operators across the globe are under increasing pressure to comply with strict cybersecurity regulations and standards imposed by governments and international organizations. These regulations are designed to mitigate the risk of cyberattacks on essential services and ensure the continuity of operations. Non-compliance with these regulations can lead to substantial fines, operational disruptions, and reputational damage. As a result, railway operators are actively seeking to implement robust cybersecurity frameworks, including the deployment of firewalls, encryption, and intrusion detection systems. The growing need to meet these regulatory requirements is a major driver of cybersecurity investments in the railway industry as operators strive to safeguard their systems and maintain compliance.

- Growing Risk of Cyberattacks on Critical Infrastructure:

Cyberattacks targeting critical infrastructure, such as railways, are becoming more frequent and sophisticated. Hackers often target transportation systems to cause widespread disruption, steal sensitive information, or demand ransom payments. In some cases, cyberattacks can compromise safety-critical systems, potentially leading to accidents or service delays. Moreover, ransomware attacks on rail systems are reported, where hackers encrypt operational data and demand a ransom to restore access. These incidents are raising awareness among railway operators about the growing threat posed by cybercriminals. Moreover, as rail networks become more interconnected and reliant on digital systems, the potential consequences of a cyberattack can be severe, impacting not only the railway operators but also the broader economy and public safety. To combat these threats, railway companies are increasing their investment in cybersecurity technologies, such as threat detection, risk assessment, and incident response solutions. The rising awareness of these risks is driving the adoption of advanced cybersecurity measures, ensuring that rail operators remain protected against evolving cyber threats.

Request for a sample copy of this report: https://www.imarcgroup.com/railway-cyber-security-market/requestsample

Railway Cyber Security Market Report Segmentation:

- Solutions

- Risk and Compliance Management

- Encryption

- Firewall

- Antivirus/Antimalware

- Intrusion Detection System/Intrusion Prevention System

- Others

- Services

- Design and Implementation

- Risk and Threat Assessment

- Support and Maintenance

- Others

Solutions exhibit a clear dominance in the market because they provide comprehensive and customizable security tools essential for protecting critical rail infrastructure from evolving cyber threats.

Breakup By Type:

- Infrastructure

- On-Board

Infrastructure represents the largest segment due to the increasing need to secure complex and expansive rail systems, including signaling and operational networks, from potential cyberattacks.

Breakup By Security Type:

- Application Security

- Network Security

- Data Protection

- Endpoint Security

- System Administration

Network security holds the biggest market share as rail systems heavily rely on interconnected digital networks, making them highly vulnerable to cyber intrusions and requiring robust protection.

Breakup By Rail Type:

- Conventional Passenger Trains

- Urban Transit

- High-Speed Rail

Conventional passenger trains account for the majority of the market share, driven by their widespread usage and the need to safeguard both passengers and operational systems against cyber threats.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market owing to the increasing expansion of rail networks and increased investment in cybersecurity.

Top Railway Cyber Security Market Leaders:

The railway cyber security market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Alstom

- BAE Systems plc

- Cervello Ltd. (Kearney Company)

- Cisco Systems Inc.

- Cylus Ltd.

- Nokia Corporation

- Siemens Mobility GmbH (Siemens AG)

- Thales Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163