Stock Trading Psychology Level, Where are you

When writing this article outside it was already dark, the night came over, and it seemed that criminals were already hanging around waiting for the victim. Well, this is what we call assumptions and may be wrong, but will affect human behavior. Though not necessarily criminals, could be even more girls waiting in the spa. It could be. . .

I really understand your turmoil when you enter the capital market. Really!

Especially for beginners, like a sailor who can not read constellations, do not know where he is.

Even when we have studied technical analysis in great depth, applying the Darvas Box theory, or whatever it is, ultimately humans will become. . . human. What I want to say here is, humans have the advantage of "taste", past the touches when trading stocks.

The movement of the stock market is a true sense of every trader, so there is a term trading psychology. But if we are not able to understand the psychology of ourselves, let alone cuan, no loss is good.

There is a term

“Master your emotions and you will master the market” Are you ready to master your emotions? Ready to master the emotions of the market?Psychological level of stock trading

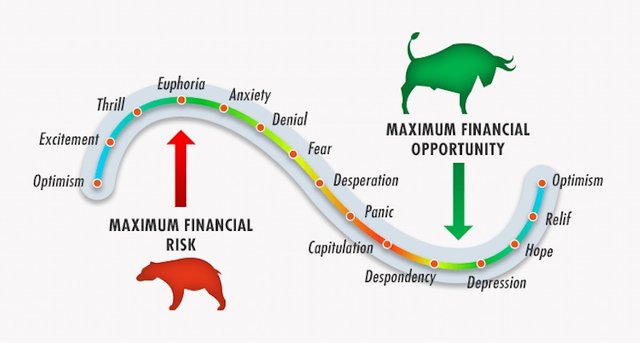

This time I will not be an economist or an investor, but a storyteller of the psychology of the capital market. One of the approaches I use this, dividing the trading phase into 14 sections and you can see it below.

image source [2]

image source [2]The most dangerous peak point is when people are at the euphoria level, while the best chance when the market is at the point of depression.

It's ideally, but as a rational human being, we will never know when that time comes right. Well, let's talk one by one.

1. Optimistic

Beginning with conducive market conditions, the market is optimistic that it will continue to rise over time. At this level, you will think that looking for money in the stock market is very possible.

2. Excitement

Capital market charts are dominated by green, as are your portfolio. Hope grows, the mind that initially thinks "maybe" gets a profit, turns into "easy" looking for money in the stock market.

3. Thrill

The spirit of portfolio value increased, so do not believe because the results exceed expectations. The stock market is so passionate about the hormones of the traders! If to praise your own intelligence, then there is at this level. Be careful, confidently necessary, but overconfidence can kill you!

4. Euphoria

The stock market is too excited, even tends to be irrational. When almost everyone shouts "Buy! Buy! ", That means it's an alarm for us! This point is the highest risk and do you know what will happen?

5. Anxiety

For the first time the market moves out of your way! Profits are undermined because your portfolio is down.

Surprised? Certainly!

Instantly you think as a long-term investor. Let's see the rest.

6. Denial

You are sure that the market will rebound and rise again, unfortunately the reality says otherwise. The stock market did not bounce as expected, and negative thoughts began to emerge. The intention of being a long-term investor turned into an "important rebound".

7. Fear

Real capital market realism slapped trader! From high confidence, move into confusion. The stock players do not know what to do, when it should if the intention of becoming a trader should calm himself first. Unplug from the market with profit slightly better, than continuous stress and price down.

8. Desperation

The mind is stuck, dead end all, while the hard-earned profits get yawned!

I have experienced it, believe me! Stock investment loss is a necessity, make the experience.

9. Panic

Confused at the lowest level, already ga understand what to do again. It seems all the effort is in vain, because the portfolio continues to decline.

Ever been?

It's not us who can make a profit from the capital market, but rather the market that controls the trader.

10. Capitulation

Finally resigned and out of the market. The problem is you've lost too basic, and unfortunately it could be this is the turning point of the market to climb again.

11. Despondency

Usually after leaving the capital market, is the right time to take a break. Not thinking about anything related to the stock world.

12. Depression

Do not kill yourself first!

Unfortunately life is only temporary, should not be accelerated.

Drink tequilla first, eh milk is okay too. Start deh analyzes again, evaluate the failure of trading. Enter the capital market with a nominal bit.

13. Hope

After dark the light came out, said RA Kartini.

We begin to evaluate new opportunities emerging in the stock market, scrutinizing news about companies in Indonesia.

14. Relief

Market POSITIIIIF!

From the hope, the traders become excited again and sure will get the cuan from the capital market. Cycle repeated again deh to the beginning of it.