R programming for quantitative investment: part 1 - fetch market data from web [originally posted in #crptocurrency]

[Originally posted in #cryptocurrency; I'm now posting in #programming after being recommended]

Fetch crypto price chart data from web and analyze data with Excel, R and other programs

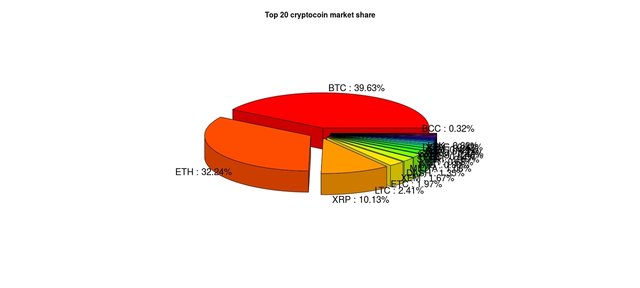

In this post we'll learn to use R to "read" web data and, as an illustrative application, use the data to plot a simple pie chart. I have been writing about a secure trading platform first before writing about trading strategies themselves. Instead of writing an intro-to-R type of post, I actually wanted to start with an application so the usefulness for the language is better realized. R users might find the post trivial; we'll soon write about advanced forecasting strategies with R's Finance and Time Series Analysis packages and other advanced techniques. Most important, we need data to conduct any kind of analysis. Here we'll learn to collect web data. For beginners, well, I guess to be able to plot - just with a few key strokes - with, say, R pietop20.R command, in couple of seconds - the below pie chart of percent of market share of top 20 (or any number) currencies should be enough motivation to learn R (or web scraping with other languages). I'm new to R - I will write as I learn. Suggestions and recommendations are much appreciated.

It looks cool, right? We can plot not only cool but also useful plots. If you don't understand the code now, just get along and get the concept. We'll talk about specific commands in other posts. I will leave links to resources I found helpful. If you don't want to install R, use SageMath online R console. So let's do it...

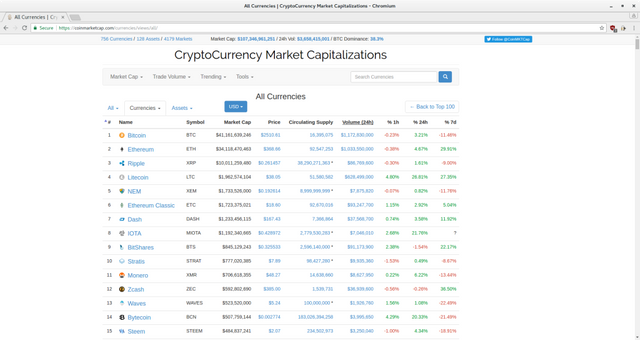

We'll "read" CryptoCurrency Market Capitalizations (CMC) price chart from their website and then analyze the data:

First load R packages, rvest, plotrix and dplyr. url_cmc is CMC price chart URL. In the code, texts entered after # are comments and ignored by R.

R> url_cmc <- "https://coinmarketcap.com/currencies/views/all/"

R> library(rvest) # for data fetching

R> library(plotrix) # for 3Dplot

R> library(dplyr)

Now do the actual reading:

R> url_cmc %>%

read_html() %>%

html_nodes(css = "table") %>%

html_table() %>%

as.data.frame() -> "tbl_cmc" # save table to variable <tbl_cmc>

The above code snippet "reads" crypto price chart and stores it to the variable named tbl_cmc.

Let's see what our program fetched by issuing head(tbl_cmc) command:

R> head(tbl_cmc)

X. Name Symbol Market.Cap Price Circulating.Supply Volume..24h. X..1h X..24h X..7d

1 1 Bitcoin BTC $42,533,685,929 $2593.64 16,399,225 $1,122,030,000 -0.10% 0.76% -10.30%

2 2 Ethereum ETH $34,637,433,018 $374.00 92,613,953 $688,324,000 -0.24% -1.57% -1.84%

3 3 Ripple XRP $10,845,834,234 $0.283253 38,290,271,363\n \n \n * $253,494,000 0.12% 4.85% 6.05%

4 4 Litecoin LTC $2,584,999,454 $50.08 51,617,607 $991,078,000 -0.30% 14.08% 59.22%

5 5 Ethereum Classic ETC $2,112,575,943 $22.78 92,744,703 $249,724,000 -0.95% 1.48% 3.51%

6 6 NEM XEM $1,806,894,000 $0.200766 8,999,999,999\n \n \n * $8,277,050 0.27% 2.42% -9.58%

It did fetch the table, but the table contains a few unwanted characters such as new line, \n, spaces, %. In order to conduct analysis, we need to get rid off these characters. Computers don't seem to go well with texts; they understand numbers better. I would like to remove the first column(coins' ranking from CMC - we'll create rankings based on our custom criteria), make the column names small, lowercase and meaningful. Having a look at the website should make this post's naming. Let's do...

R> tbl_cmc[] <- lapply(tbl_cmc, gsub, pattern = "\\\n|\\s|[%*$,?]", replacement = "")

R> tbl_cmc$X. <- NULL

R> names(tbl_cmc) <- c("name", "symb", "mcap", "price", "supply", "vol", "ch1h", "ch24h", "ch7d")

See how our table looks with head(tbl_cmc):

R> head(tbl_cmc)

name symb mcap price supply vol ch1h ch24h ch7d

1 Bitcoin BTC 42533685929 2593.64 16399225 1122030000 -0.10 0.76 -10.30

2 Ethereum ETH 34637433018 374.00 92613953 688324000 -0.24 -1.57 -1.84

3 Ripple XRP 10845834234 0.283253 38290271363 253494000 0.12 4.85 6.05

4 Litecoin LTC 2584999454 50.08 51617607 991078000 -0.30 14.08 59.22

5 EthereumClassic ETC 2112575943 22.78 92744703 249724000 -0.95 1.48 3.51

6 NEM XEM 1806894000 0.200766 8999999999 8277050 0.27 2.42 -9.58

Nice! We now have pretty nice looking table. Suppose, we're interested in top 100 crytocoins of total market capitalization. In order to select top 100, we can sort (descending) market capitalization, tbl_cmc$mcap. Oh, wait, can we run mathematical operations on market capitalization variable, mcap? Let's see:

R> typeof(tbl_cmc$mcap)

[1] "character"

We can't do maths on texts. Let's convert the character type to numeric:

R> num_tbl_cmc <- lapply(tbl_cmc[-c(1:2)], as.numeric) %>%

as.data.frame()

R> tbl_clean <- cbind(tbl_cmc$name, tbl_cmc$symb, num_tbl_cmc)

R> names(tbl_clean) <- c("name", "symb", "mcap", "price", "supply", "vol", "ch1h", "ch24h", "ch7d")

Check again with typeof(tbl_clean$mcap) command:

R> typeof(tbl_clean$mcap)

[1] "double"

double is a floating point data type in R (and all other languages) on which mathematical operations are valid. So let's select top 100 crypto by market capitalization and store the table in variable named top_100_mcap:

R> top_100_mcap <- arrange(.data = tbl_clean, desc(mcap))[1:100, ]

Now we might be interested to know how much the total of top 100 crypto market caps add up to. Well, do:

R> sum(top_100_mcap$mcap)

[1] 107433383060

So top 100 crypto add up to $107.433bn. Well, what percentage does BTC or ETH have of that total market cap? Fine, why not calculate market share percentage for all 100 currencies? We create mcap_prcnt variable where mcap_prcnt [i] = mcap[i] / sum(mcap). Based on the percentage data, we then plot a pie chart for top 20 coins by market cap:

R> top_100_mcap$mcap_prcnt <- top_100_mcap$mcap/sum(top_100_mcap$mcap)

R> top_20_mcap <- arrange(.data = top_100_mcap, desc(mcap))[1:20, ]

R> head(top_20_mcap, 10) # Display first top 10 currencies

name symb mcap price supply vol ch1h ch24h ch7d mcap_prcnt

1 Bitcoin BTC 42533685929 2593.640000 16399225 1122030000 -0.10 0.76 -10.30 0.395907536

2 Ethereum ETH 34637433018 374.000000 92613953 688324000 -0.24 -1.57 -1.84 0.322408473

3 Ripple XRP 10845834234 0.283253 38290271363 253494000 0.12 4.85 6.05 0.100954042

4 Litecoin LTC 2584999454 50.080000 51617607 991078000 -0.30 14.08 59.22 0.024061417

5 EthereumClassic ETC 2112575943 22.780000 92744703 249724000 -0.95 1.48 3.51 0.019664055

6 NEM XEM 1806894000 0.200766 8999999999 8277050 0.27 2.42 -9.58 0.016818739

7 Dash DASH 1461649683 198.280000 7371496 112050000 -0.96 12.24 4.92 0.013605172

8 IOTA MIOTA 1142659340 0.411098 2779530283 2694160 -1.49 1.00 NA 0.010635980

9 BitShares BTS 872772343 0.336173 2596200000 59671400 1.49 2.14 -7.89 0.008123847

10 Stratis STRAT 729533748 7.410000 98430281 7947920 0.37 -2.83 -8.76 0.006790569

BTC's market cap is $42.5bn, followed by ETH's $34.6bn. Now we plot the intended pie chart and create labels for it:

R> lbls <- paste0(top_20_mcap$symb, " : ", sprintf("%.2f", top_20_mcap$mcap_prcnt*100), "%")

R> pie3D(top_20_mcap$mcap_prcnt, labels = lbls,

explode=0.1, main="Top 20 cryptocoin market share")

This final code snippet generates the plot we saw at the beginning. Now let's say, we'd like to see which currency appreciated the most in last hour, then we order again by 24h growth and yet again by 7d.

R> top_perf <- arrange(.data = top_100_mcap, desc(ch1h), desc(ch24h), desc(ch7d))

R> head(top_perf, 10) # Display first 10 rows

name symb mcap price supply vol ch1h ch24h ch7d mcap_prcnt

1 VeriCoin VRC 18300343 0.604918 30252602 1977260 10.56 -0.15 66.81 1.703413e-04

2 Asch XAS 47499525 0.633327 75000000 15971000 10.33 133.39 180.12 4.421300e-04

3 Blocknet BLOCK 23716930 6.060000 3910516 44296 9.23 18.37 -3.52 2.207594e-04

4 Mooncoin MOON 23303904 0.000105 222009604607 180970 8.79 -6.74 -34.73 2.169149e-04

5 XtraBYtes XBY 16459430 0.025322 650000000 115598 7.61 -25.02 8.62 1.532059e-04

6 Cryptonite XCN 10643830 0.031960 333032866 4084900 5.26 32.47 241.90 9.907377e-05

7 BitBay BAY 34102242 0.033847 1007555925 268915 4.23 20.89 14.56 3.174269e-04

8 RaiBlocks XRB 13358903 0.163423 81744327 380100 3.45 11.06 362.08 1.243459e-04

9 Steem STEEM 486078959 2.070000 234664310 3165330 3.36 2.95 -8.51 4.524469e-03

10 FedoraCoin TIPS 14751163 0.000033 443168182458 255852 3.06 26.78 15.14 1.373052e-04

We see, Vericoin (VRC), grew the most, by 10.56% -0.15% 66.81% in the last hour, last 24 hours and last week. It'd have been nice to know how a currency, BTC or ETH, for example, is performing compared to the market, right? Or suppose we've a portfolio of BTC, ETH, ETC, XMR, DASH, SC, IOTA and ZEC. Wouldn't it be nice to know how our entire portfolio is performing relative to the entire crypto market? We'll see some more examples in next posts. Stay networked! Keep Steeming!

Code

This is the code that generates our intended plot. It takes less than a quarter-minute to read web chart and generate the plot with realtime market data. Save the script, for example, as pietop20.R, and run from terminal with R pietop20.R command to get the realtime market pie chart. In R console, run install.packages(package-name) to install package <package-name>.

# Load required packages and find price table URL

url_cmc <- "https://coinmarketcap.com/currencies/views/all/"

library(rvest) # for data fetching

library(plotrix) # for 3Dplot

library(dplyr) # for data manipulation

# Read the price table

url_cmc %>%

read_html() %>%

html_nodes(css = "table") %>%

html_table() %>%

as.data.frame() -> "tbl_cmc" # save table to variable <tbl_cmc>

# Clean data

tbl_cmc[] <- lapply(tbl_cmc, gsub, pattern = "\\\n|\\s|[%*$,?]", replacement = "")

tbl_cmc$X. <- NULL

names(tbl_cmc) <- c("name", "symb", "mcap", "price", "supply", "vol", "ch1h", "ch24h", "ch7d")

# Prepare data for mathematical operations

num_tbl_cmc <- lapply(tbl_cmc[-c(1:2)], as.numeric) %>%

as.data.frame()

tbl_clean <- cbind(tbl_cmc$name, tbl_cmc$symb, num_tbl_cmc)

names(tbl_clean) <- c("name", "symb", "mcap", "price", "supply", "vol", "ch1h", "ch24h", "ch7d")

# Select top 100 by market cap

top_100_mcap <- arrange(.data = tbl_clean, desc(mcap))[1:100, ]

# Add a column named <mcap_prcnt> which percentage of a crypto assets market share

top_100_mcap$mcap_prcnt <- top_100_mcap$mcap/sum(top_100_mcap$mcap)

# 1h growth, highest, then 2h highest and 7d

perf <- arrange(.data = top_100_mcap, desc(ch1h), desc(ch24h), desc(ch7d))

head(perf, 10) # Display first 10 rows

sum(top_100_mcap$mcap) # coin market cap, aggregate

# Top 20

top_20_mcap <- arrange(.data = top_100_mcap, desc(mcap))[1:20, ]

# Actual plot

lbls <- paste0(top_20_mcap$symb, " : ", # Create labels for plot

sprintf("%.2f", top_20_mcap$mcap_prcnt*100), "%")

pie3D(top_20_mcap$mcap_prcnt, labels = lbls,

explode=0.1, main="Top 20 cryptocoin market share")

# Export collected data to Excel, SPSS, etc. `table_clean` variable contians data on 756 coins in analyzable format.

# We export the whole data set:

library(xlsx) # for Excel

library(foreign) # for SPSS and more including Excel

R> write.xlsx(tbl_clean, "clean_chart.xlsx")

# The above line of code saves our table in a file <clean_chart.xlsx> in your

# current working directory. Run getwd() to display working directory.

R> write.csv(x = tbl_clean, file = "clean_chart.csv", sep = ",", row.names = FALSE)

# This saves the table in a comma-separated CSV file

References and R resources

It should list more materials. Later.

- An Introduction to R on CRAN

- Quick-R

- package rvest by Hadley Wickham

- package plotrix

Nice post. Thanks.

Wow, this is great man.

Thanks for sharing!

You're more than welcome! Looking forward to putting some more useful stuff.

Hi! I am a robot. I just upvoted you! Readers might be interested in similar content by the same author:

https://steemit.com/cryptocurrency/@cryptovest/eth-rising-with-33-market-cap-btc-at-40-top-100-crypto-add-up-usd102bn-trading-with-r-programming-part-1-fetch-web-chart

Nice write up. Very clear instructions (a non R-user could even follow this).