Precious Metals – Short Term Trading Update

Not Easy, But There Remains Potential

As equities continue to gyrate over respective medium term support levels I do not feel particularly tempted to get sucked into placing any haphazard directional plays.

Precious metals are not making it easy for us either but appear to be more promising as there remains significant upside potential.

1-goldGold (GC), hourly and daily

I’m still in both my gold campaign but as you can see yesterday’s paper gains have been unceremoniously eroded overnight. What works in our favor here is the increasing accumulation of short and medium term context above the 1270 mark – which is where I would try another long position if my current campaign is stopped out. More long term a key level to keep an eye on is near 1260 (June contract) which absolutely needs to be held.

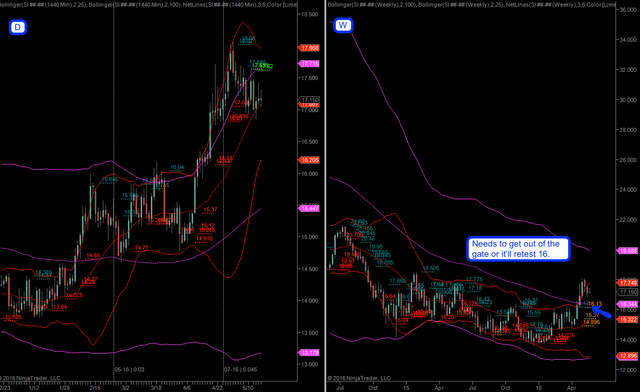

2-silverSilver (SI), daily and weekly.

Silver is a bit more complicated as we don’t enjoy a particularly clean formation on either the daily or weekly panels. What the latter has going for itself however is the 100-week SMA which has settled near the 16 mark.

A reversal to that point seems like a natural LKGB opportunity to me and thus worth dipping into a few long positions with stops below 15.5.

Addendum by PT:

This missive is a trading update penned by the Mole over at the Evil Speculator, who has lately begun to eye the precious metals for short term opportunities.

Charts by Ninja Trader/ Evil Speculator

Originally published as “Precious Metals Update” at evilspeculator.com.