cryptocurrency 2020

Hello blogs,

Well most of us are still in some form of “locked down” one way or another due to the virus pandemic with not much to do and loads of spare time on our hands so I bring you another cryptocurrency blog to read.

But for those of you who have all of this free time now is probably the perfect time to start learning a new skill or getting back into studying something new, remember that the best investment that you can ever making is within yourself, why? Because no one can ever take it away from you. “Warren Buffet”.

So, starting off I must disclaim that I am not a financial advisor non do I claim to be one. If you are thinking of investing into a cryptocurrency you have to understand that investing is at your own financial risk. The same as investing into the stock market or buying an investment property is a financial risk. There is never any guarantee that any investment is going to be able to get you a good return on your investment (ROI) and even if I did know what the crypto market was going to do I most certainly would not be writing about it in a blog and announcing it to the whole world.

So, let’s go back to the bare basics, what is a cryptocurrency?

A Cryptocurrency is a digital coin (much like an email) that is able to be sent from one computer to another computer using a platform called a “Blockchain” and the word “crypto” means that it uses very clever mathematics called “Cryptography” which is well beyond the scope of this blog, but trust me it works. These types of digital coins can be used as a currency to pay for items as they possess intrinsic value hence the word “Cryptocurrency”.

How does this Cryptocurrency move on the blockchain?

The same way as how does an email move from one computer to the other it moves electronically however a cryptocurrency moves using a Blockchain platform which is internet based using its clever mathematics (Cryptography). Each block of data is stored on a node and whenever your computer uses the Blockchain your computer becomes a node much like an internet server.

How secure is the Blockchain?

As stated above any computer that uses the blockchain becomes a “node” so it becomes part of the blockchain its self. So if a hacker wanted to hack a blockchain the hacker would then have to basically hack into every single computer at the same time which is currently using the Blockchain. This method would be basically impossible even for the world’s fastest computer and to the best of my knowledge no blockchain has ever been hacked, expect for Ethereum Classic but that’s for a different blog.

Can a quantum computer hack a Blockchain?

Quantum computers have been seen as a Blockchains weakest link so theoretically yes, a quantum computer would be able to hack a blockchain due to its sheer computing power it would be able to hack every single node simultaneously and take down the whole system in theory. However, most computer scientists believe that a practical working quantum computer is still at least 20 years away so right now I would not consider a quantum to be any threat to a Blockchain.

What is Bitcoin?

Bitcoin was the first ever cryptocurrency launched 2009 by a computer programmer calling themselves “Satoshi Nakamoto”. Whether this person is a man, women or a group of people working together to this present day this person is “anonymous” with no true identity. Never the less this "person" published a white paper explaining the idea of using a Bitcoin which moved on a Blockchain and is credited with inventing the first every cryptocurrency (Bitcoin).

Why was Bitcoin invented?

It was invented in a direct response to the global financial crisis (GFC) of 2007. A time where world banks were basically lending out way too much money to their customers to buy houses. One of the main problems was that these loans were “interest only” loans meaning that the principal of the loans was not getting paid off at all, just the interest or the bear minimal payment to get by.

The idea was that at the time these houses were going up in value and it was thought that they would continue to keep going up and up in value. So it was in the banks best interest to keep on lending out money to people to buy more houses because the house prices kept on going up in value. However, when the time came for people to start paying back the principal of the loan as well as the interest people could not afford to pay both at the same time and so had no choice but to default on their home loans which then caused the price of these properties to crash as no body anymore were buying houses.

The banks would then repossess the houses, then what does a bank do with a house which is depreciating in value? The banks basically needed their money back which was impossible because it had all been spent on a house which is now worth a lot less than the original loan to buy it with. Banks filed for bankruptcy and the governments came to their aid and bailed them out all using tax payers money at the expense of all of us who pay taxes.

In my personal opinion it’s completely unfair what happened because the banks and the people who signed to take on the homes loans all had a responsibility to make sure that they could afford to pay back the loans, obviously they could not and so a houses crash occurred. So what was needed was a new currency that held its value.

What makes something valuable?

Whenever governments fall under hard economic times they have a number of opinions available. One opinion is the ability to print more of their local currency. This currency is refereed to as "fiat currency" because it is not back up by anything its just paper at the end of the day. The number of Bitcoins will always be capped at 21 million meaning that there will only ever be 21 million bitcoins in circulation in the world ever. This cap of 21 million is what gives Bitcoin its value over time because obviously if the market was flooded with billions of Bitcoins and every one had Bitcoin in their wallets then the price of Bitcoin would collapse overnight there has to be a finite number of Bitcoin.

How and where do you buy Cryptocurrency?

Its really simply, you go online and go to a cryptocurrency exchange. The exchange is a web page and there are many exchanges all over the world for you to choose from. Myself personally I use www.swyftx.com.au why? Because they are a local exchange for me and their fees are the lowest that I know in Australia. These exchanges sell many different types of cryptocurrencies it just depends on which one that you choose to invest your hard earn fiat currency into.

What do you do once you have brought a cryptocurrency?

That’s completely up to up? Are you going to trade it quickly when it goes up in value or are you going to HODL (Hold on for dear life)? If you choose to HODL then I strongly suggest that you take the coins off of the exchange and send them to a cold storage hardware wallet as this is the safest way that I know of to keep your cryptocurrency safe.

What is a hardware wallet?

A hardware wallet is a USB looking device which stores your “private keys”. What exactly are these private keys and why do they matter? Think of the private keys as a receipt or proof of purchase linked to your coins that you have brought.

Think of this scenario, let’s say that you just brought a new car and you kept the receipt for the car. Then one night the car gets stolen and you have also lost the receipt for the car. If you went back to the car dealership and approached customers services, they will not be able to refund you for a new car because you don’t have the receipt (the proof of purchase). This scenario shows up just how important it is to keep your private keys safe. If you lose your private keys then you have lost all of your coins and as all cryptocurrency’s coins are decentralized there is no customer service help desk for you to call up and complaint to. It is 100% your responsibility to keep your private keys safe as it is the only way to prove that the coins belong to you.

What happens if I lose my hardware wallet with the private keys on it or its been stolen?

The hardware wallet has your own personal pin code in order to open it up. So, the theft would have to know your pin number in order to open it. But even if the theft was able to crack your pin, they would then also have to know what types of coins that you have stored on the device then they would have to know what app pages you go to open them up using the ledger.

Unfortunately, you will have to buy another hardware wallet, but how would you restore it back to its original state and get all of your coins back? Before you open up any new hardware wallet or any wallet for that matter you will be given a list of phrase words. What are these phrase words? They are random selected words such as “HOUSE”, “CAR”, “RIVER”, “TREE”. These words are the backup words for your private key. Remember I said that your “private key” is basically proof of receipt that the coins belong to you. Again, it is your responsibility to make sure that these “phrase words” are written down on paper and stored in a safe place and kept off of the internet.

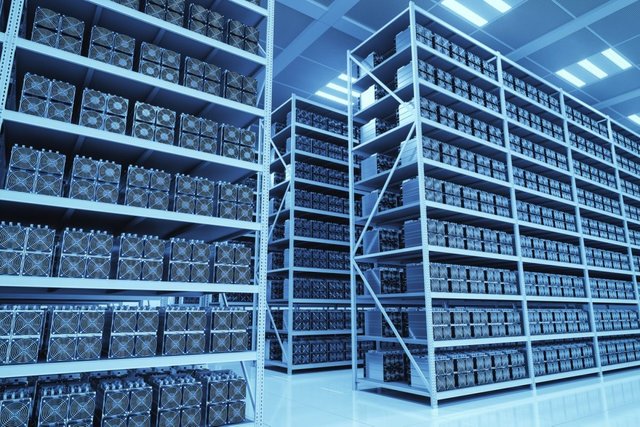

What is proof of work (POW)

POW means that in order to gain a bitcoin or any other coin which allows POW a person would have to show “proof” of work that has been done. In this case it means computer mining which means getting many very fast computers and putting the all into a cool room where they run 24/7 completing complex mathematical tasks. Once a computer miner solves a task they are then rewarded by being given a bitcoin because they have shown proof of doing work, their reward is a Bitcoin. For a first timer into cryptocurrency i would definitely not recommend POW. To this present day a person would have to spend huge amounts of money on buying computer hardware and then running the computers 24/7 would mean that the ROI would not be worth it and the costs of the huge electricity bills.

What is proof of stake (POS)

As POW demands a very high cost of energy to achieve, but POS is when a person holds a certain coin. They are then “staking” that coin, in other words they hold on to that coin in their wallet. Much the same as when a person buys certain shares on the stock market they will then get paid out in the form of a dividend. Only the cryptocurrency that are already in the POS phrase will pay out the stake holder normally in another cryptocurrency such as “GAS” which also has fluctuating intrinsic value.

What can a person do with this GAS?

Well if your smart with your finances you could use it to by more POS coins which in return will generate you more GAS. Much the same way as when a person leaves their money in a high interest savings account and lets the interest compound its self. Over time you will build more wealth.

Cryptocurrency scams

Unfortunately, where there are large sums of money there will always be scammers and the crypto world is full of scammers who just want to steal your money. If you choose to get involved in cryptocurrency you are going to be contacted at some point in time by a scammer. Most likely this scammer is going to contact you using the Facebook platform or WhatsApp.

Rule number 1: If it sounds too good to be true then it probably is. In other words, if a person contacts you claiming to be able to mine you 10 bitcoin per day which will equal to $10,000 every day for the rest of your life then its rubbish and stay well away, simply block them.

Rule number 2: NEVER EVER give out your 12 phrase words to anyone! I will say that again, NEVER EVER GIVE OUT YOUR 12 PHRASE WORDS TO ANYONE! Your 12 phrase words are the same as your BSB and Account number for your bank account, they are the only back up for your private key. They are for your eyes only, no one should be asking for them, even if the asking person claims to be from a bank, the police, the government or from your own private wallet. NEVER EVER give out your 12 phrase words to anyone. Write them down on a bit of paper and store the paper in a safe place off line. Never store your 12 phrase words online or on any other electronic device.

Rule number 3: Trust no one online who you have never met in person before. So many scammers use fake Facebook profiles and identities. They will contact you with the typical rubbish of wanting to help you make millions of dollars. Ask yourself the question, why would they be wanting to help you become a millionaire, It's all a scam.

Rules number 4: Stay away from Binary Options. In some countries Binary Options are illegal. The most likely case is that you will be taken to a fake website called a “Phishing” and asked to input all of your personal details which will then be stolen. Then credit cards and bank loans can be taken out in your name and you will pick up the bill for them at the end.

Rule number 5: Always do your own research on a cryptocurrency before you invest into it, read through its white paper, what is the project trying to achieve. But remember that no one really knows what the market is going to do. If a person claims that a certain coin is going to be worth a small fortune in the future approach it with caution. Always remember that nobody knows what the market is going to do and you only ever invest what you can afford to lose. At the end of the day this is just gambling. You would never go to the casino and bet your entire house on "Black". Be responsible with your finances.

Good luck trading.

Rob