Making money from a Donald Trump Presidency

Donald Trump currently has a 27% chance of becoming the next President of the United States. How do you turn those into odds worth betting on?

‘If Trump were to become president, gold prices will likely perform well, because we expect that his policies will be inward looking and will weaken the fundamentals of the U.S. economy.’ Georgette Boele, ABN Amro.

Some analysts are projecting a gold price of US$ 1850 if Donald Trump becomes president. Are the odds worth taking considering the current price of US$ 1330? (http://www.marketwatch.com/story/how-donald-trump-could-spark-a-huge-gold-rally-2016-07-22). A 39% increase considering a 27% chance? Not really worth the risk and at those returns I would almost prefer betting odds and evens a roulette wheel where I could double my money for a 50% risk. mmm - at this point statisticians will be pointing out that investing in gold has very low risk of loosing capital whilst with roulette the chance is 50% of loosing everything (actually slightly higher considering the casino always takes all bets if the ball lands on zero).

So how does one make money by betting on Donald becoming president with acceptable risk?

In January I gave the following question to my MSc students doing Mine Financial Valuation: Access the company websites for Harmony as well as Sibanye Gold Mining Companies. Download the last Annual as well as most recent Quarterly reports.

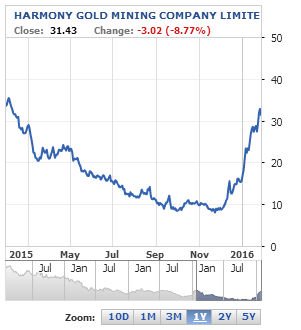

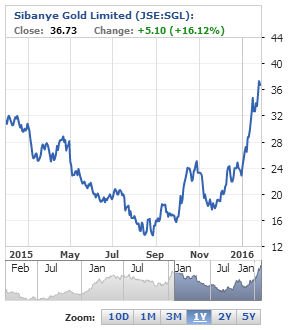

Figure 1 and 2. Harmony and Sibanye Share Price for the last 12 months as on 29 January 2016. Fin24.com

An investor has approached you and is very excited by the positive share price moves displayed recently by these two companies. He has made the decision to buy shares for one of them but is undecided as to which is the better share currently. You are required to compile a report on whether the investor should buy the Harmony Gold or Sibanye Gold share (be specific as to which of these two shares you feel is the better option). Please substantiate your viewpoint with valuation calculations to support your argument by including a section on valuation and key valuation metrics. In addition, you are required to comment on the outlook for the gold sector in South Africa, as well as comment on the gold prices and exchange rates as drivers of the stock price.

These two companies are both purely gold miners with the bulk of their operations based in South Africa. Harmony does have mines in Papua New Guinea and Sibanye is moving into the platinum sector of late, but both can be considered viable alternatives to buying gold metal for investment purposes. The share prices are quoted in South African Rand (ZAR) and the prices are from the Johannesburg Stock Exchange (JSE). Both shares are listed on the London and New York Stock Exchanges. At the time of the assignment, Harmony had risen from less than ZAR10 to ZAR30 in a two month period, whilst Sibanye had risen from ZAR17 to ZAR34 over the same period. The driver of this change had been a gold price rise of 7.5% in US$ coupled with a 11.5% drop of value of the ZAR against the US$. This resulted in a 27% change in the gold price in ZAR (Figure 3).

Figure 3. 12 Month Gold Price (September 2015 to September 2016) in US$ (red) and ZAR (blue). www.kitco.com

Using the traditional investment metrices, most of the students selected Sibanye as the better share to invest in. Information on investment metrices can be found on Investopedia:

http://www.investopedia.com/articles/fundamental-analysis/09/five-must-have-metrics-value-investors.asp.

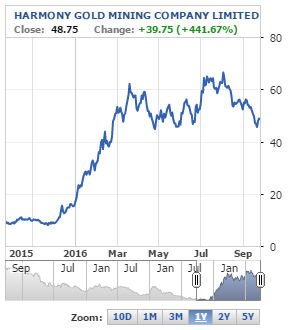

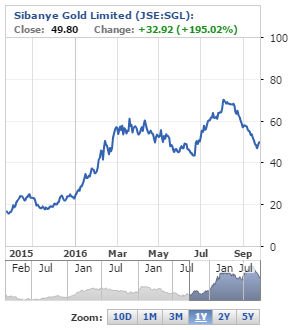

However, the share price of Sibanye had doubled for the 27% change in ZAR gold price whilst Harmony had tripled. If we fast forward 6 months and consider the students recommendations, we find Harmony is currently trading at ZAR50 (Figure 4) while Sibanye is also trading at ZAR50 (Figure 5).

Figure 4. 12 Month Harmony share (September 2015 to September 2016). Fin24.com

Figure 5. 12 Month Sibanye share (September 2015 to September 2016). Fin24.com

So in retrospect, Harmony out performed Sibanye over the same period. This shows that gold shares cannot be considered using the same investment metrices as traditional shares. What the investor is betting against is the marginality of the company. A company that is barely profitable or even loss making at a certain gold price, becomes significantly more profitable for an increase in the metal price. The fairly profitable company does not increase its profitability percentage to the same degree. This is reflected in the share prices where the company which scores poorely in the traditional investment metrices out performs the company with higher scores.

So how do you make money betting on a Trump presidency? Find a poorly performing gold mining company and bet that the ensuing chaos will drive the gold price up, causing a significant turnaround in the company's share price. Using technical trading indicators, the downside risk can also be protected using the buy-sell indicators.

Chamber of Mines building at the University Witwatersrand, Johannesburg.

The author is a lecturer in Mine Financial Valuation and Mineral Resource Management and is reading for a PhD considering cut-off grade optimisation.

perhaps a short index like the VIX? There may be temporary volatility even if a poll shows him up right before...and after any win. Although I'm pretty sure things will settle down soon after.

Gold is where investors put their money in times of chaos. It effectively goes up when everything else is going down - and also doesn't drop as quickly in good times because then things like jewelry are also in favour :-)

Gold prices are going up with or with out Trump. The federal reserve whom has not right to print currency by away, (congress is the only entity to print money by law according to the constitution." by keeping interest rates as low as they are, will cause bonds to rise up which in turn the dollar will loose its value. More people will seek to attain gold and silver as means to preserve their capital.

Then the benefit in investing in gold mine shares is even more ensured. Basically betting against the US$ and the overall economy

@clint01 - very good article, upvoted, but i think that this is not a right strategy...

I am convinced that next year is the start of the Great Depression. If you look there, none of the companies, including gold miners, increased in price. In fact, everything will fall anyways: with Trump quicker and less severe. WIth Clinton, couple of years later but MUCH worse.

I tried to explain were we are in my today's article:

https://steemit.com/money/@conspi-theorist/why-global-crisis-is-inevitable-part-4-finale-the-2nd-great-depression-will-start-in-2017

Thanks. The world is still trying to recover from '08 - although looking at all the new cars driving around Washington DC you would never have guessed that. Maybe those in employ of governments are just blissfully unaware as to how bad things really are for the average man in the street.

@clint01 - that's actually very interesting... whether those government officials are or aren't aware of the current situation. When they keep saying that unemployment is going down.... clearly they should understand that something is going wrong when unemployement is going down, at the same time Labour force participation is going down - it's them who are pulling this stats together!