PNGME LENDING PLATFORM: HOW PNGME WILL GROW THE MSME SECTOR.

PNGME MARKETPLACE LENDINGMOBILE APP BLOCKCHAIN MSMES

INTRODUCTION

Every business or profit-making organization requires capital. Capital or funding can be sourced in many ways including personal savings, loans, etc.

MSMEs (Micro, Small and Medium-scale Enterprises) are businesses usually owned by upcoming entrepreneurs. These entrepreneurs, therefore, usually require funding or loans for captial to fuel their business ideas.

Traditionally, businesses who need loans usually get them from commercial banks and pay back with interest so high as to profit the banks and the depositors who put the money in those banks.

MSMEs sometimes find it difficult to apply for these loans given their credit history or even the high interest rates.

Eventually, there came Marketplace lending, which are financial establishments which are not banks, that link lenders to MSMEs who need to borrow. With just little charge, MSMEs can borrow.

PNGME is a new marketplace lending/borrowing platform with better prospects and provision of solutions to the current problems being faced in the MARKETPLACE LENDING

WHAT IS PNGME?

PNGME is an exhaustive (complete) financial mobile platform that serves as a medium for payment transactions, money savings, and a digital-footprint based credit-score. With PNGME mobile app, for instance, users or customers can easily access financial markets anywhere all over the globe, just from their phones and tablets.

PNGME is a universal lending/borrowing platform which provides well-established investors the priviledge of accessing another but improved type of Marketplace lending platform.

PNGME BUILT ON THE BLOCK-CHAIN

Through this, Pngme shall increase the adoption and acceptance of block chain through its revolutionary approaches.

PNGME is designed and built based on the BLOCK-CHAIN. When we talk of block-chain, we are talking of awesome transparency (openness), decentralization, and safety. With block-chain, PNGME is able to provide a platform that is highly transparent/open, provides easy accessibility, such that borrowers can get loans of low-interest or low-cost.

THE TRADITIONAL PNGME SYSTEM

The usual or common borrowing system involves commercial banks (lenders) lending money (loans) to customers (borrowers) who pay up the loans with interest high enough to profit the banks even after deducting from that profit, the interest generated on depositors' money. In essence, commercial banks receive money deposits from customers (depositors) with the agreement of paying them interest along at a given rate at the end of a given period of time. The banks then lend the money to borrowers who pay back at an interest rate higher than that which the banks pay the depositors. The difference in the two interests is the bank's profit. Therefore, one way or the other, the banks serve as intermediaries, links or channels between lenders (depositors) and customers who borrow (loan applicants) and the charge for their linking service is the difference in interest rate or amount.

This is known as the Traditional marketplace lending/borrowing.

MARKETPLACE LENDING PLATFORMS

Financial institutions that are non-bank are known as marketplaces lenders. They simply link lenders with borrowers, thereby eliminating the need for banks serving as intermediaries. By leveraging on technology, they administer loans after evaluating and processing loan requests. This way, the ensure streamlined loans processing from their initiation to approval.

The eccentricity of marketplace lending/borrowing is the fact that the managers or administrators of this platform, unlike banks, do not collect deposits or provide fund for borrowers from their own capital. Yet, they are a better link between lenders and those who borrow. They only match and connect borrowers to lenders and then collect a small, reasonable fee for this service and for operating this platform.

PNGME- A NEW LENDING MARKETPLACE

PNGME is a newly introduced lending/borrowing marketplace/platform that is built on/via the block-chain. It works on decentralized-rate-setting algorithmic system, and electronic credit-scoring.

Digital Bonds: Pngme capital source

Pngme platform funds and collateralize loans using liquid electronic assets and non-substitutable asset (for title ownership). Liquid digital assets include Bitcoin, Stable coins backed by USD, Property tokens, Security tokens, etc while the non-substitutable ownership assets include Fine Art, Plant/Machinery, etc. The collateralized loans are then sold out in form of DIGITAL BONDS on the platform to investors. In short, they source capital by issuing and selling bonds to investors on their lending/borrowing marketplace.

Credit-scoring of Borrowers

Pngme also credit-score customers (borrowers) using certain tools. With the hell of their Credit-scoring APIs,, borrowers are credit-scored and this includes borderless integration/incorporation of their platform with a borrowers payment app on the phone so as to provide credit default risk information (present and past). With this information, investors will be encouraged to provide greater affordable capital supply for borrowers by buying many more digital Bonds.

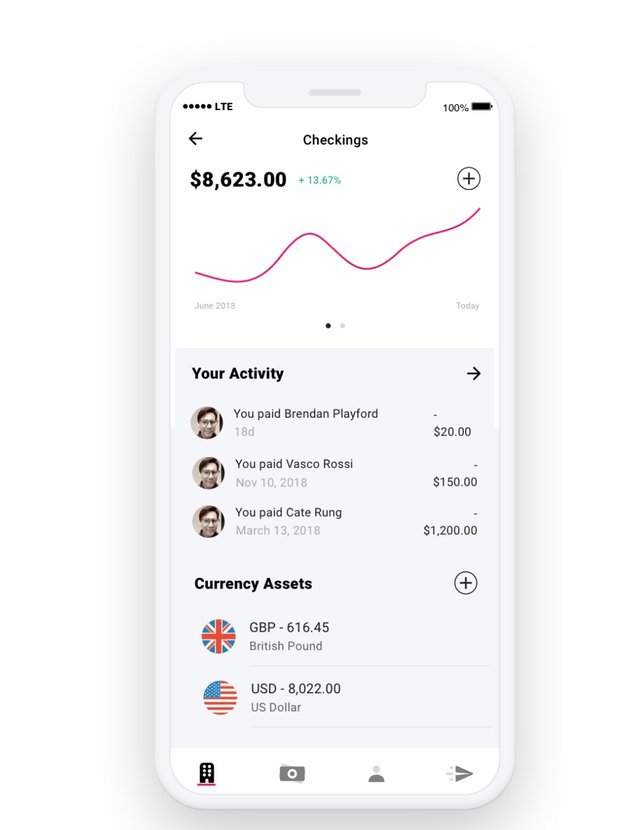

THE PNGMEMOBILE APP

There is also a mobile banking app that feature mobile payment transactions, savings (with interest) and the credit-scoring. The app gives users easy accessibility to perform transactions, save, and even get rewards such referral rewards, etc anywhere in the world using their mobile devices.

CONCLUSIVELY, PNGME is a platform that has come to serve as a low-cost, simple link between borrowers and lenders. Pngme does not receive deposits (unlike traditional lending platforms such as banks) and it does not lend from it's own 'purse' or capital. Instead, it sources capital by selling collateralized liquid assets as digital Bonds to investors. Pngme platform is built on block-chain, and so is transparent, safe and gives easy accessibility and usability.

For more information about Pngme, visit:

Website: https://pngme.com/

Whitepaper: https://docsend.com/view/x4ts5tm

Telegram: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook profile: https://www.facebook.com/pngme

WRITER'S Details

Bitcointalk username: Modanalee

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2491710;sa=summary

This is insightful. Thanks for this article good to know Pngme is accelerating the Msme sector.