How pngme can help financial inclusion.

While there are many culture in the world generally, there's a culture that has a great attention on a large scale but with the attention dwindling as you move down from corporate bodies to individuals. Finance is a way of life for people of every race and age because it involves the way money is being used and handled, but this hasn't really catered for the young man trying to establish his own venture, a farmer trying very hard to keep up with the changing weather, a trader who has discovered a new business but doesn't have the means to pursue it. And the list goes on. We see government establish budgets with lots of zeroes running behind them and just little of that which is most times not enough is what is allocated for an individual in a group. That is the average individual is not financially included in which the world bank asserted is a proven way of reducing poverty if not eradicate it.

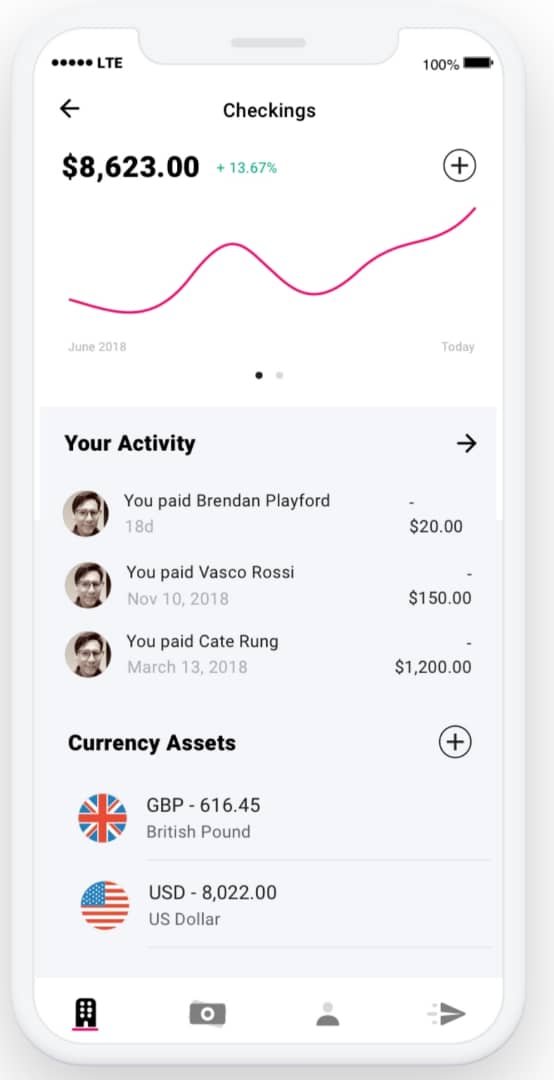

Financial inclusion is the ability of an individual (you, me, that friend of your's struggling to get a steady source of income for his startup business) to access financial services and incentives that are affordable and easy to access so their needs can be met. The needs that should be met include:

• a safe place to hold your money.

• receiving credits or loans

• sending and receiving payments

• transacting &

• insurance, which covers you when you money is lost.

Marketplace lending has really grown from peer-to-peer to a more sophisticated form where you have to do lots of other stuffs and bring lots of documents too and this has really limited and reduced greatly the amount of people that would be able to get the loans, even at a rate that is mostly not friendly and difficult for the borrower to pay. Pngme has therefore created a more decentralized market place for loans with the use of a blockchain infrastructure layer integrated with banking infrastructure that facilitates transactions, asset settlement and collateralization of loans using digital and tokenized physical assets. This means that anyone anywhere is financially included and can access loans wherever in the world and whenever they want it as well.

Blockchain is a new infrastructure that is built for holding bitcoin and it is an independent infrastructure that is it doesn't rely or answer to anybody and as well borrowers can access their funds anytime and more importantly, with the integrated banking infrastructure you it is even more lovely because blockchain is a safe way of keeping your funds and with the banking infrastructure it helps to heighten the security.

The blockchain feature and the banking infrastructure makes it that anyone with a smart phone and internet connection would get access to the financial services not only borrowers but the lenders as well which is what financial inclusion is, the easy access to financial services such as saving and transaction, sending and receiving payments. Blockchain does all this possible and brings a new way of finance to your finger tips and your business idea closer to actualization.

For more information about Pngme and latest updates, visit the following links:

Website: https://pngme.com/

Whitepaper: https://docsend.com/view/x4ts5tm

Telegram Chat: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook: https://www.facebook.com/pngme/

Instagram: https://www.instagram.com/

Author Username: Ucheman

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2528525