Economic abstraction? Penta don’t have to worry!

Introduction

Recently, Bitcoin core developer Jeremy Rubin published the “The collapse of ETH is inevitable” article on TechCrunch, the largest technology media in the United States. The article proposes that due to the economic abstraction of the design of the Ethereum network, ETH value as a currency will be equal to zero, causing an uproar in the circle, and also triggered a sharp market volatility of ETH prices.

Subsequently, Vitalik Buterin responded to the article on Reddit, acknowledging that there is indeed an economic abstraction in the Ethereum network. If you don’t change it, the situation described by Jeremy Rubin is also possible, but real economic abstraction is very difficult. So, what is the economic abstraction of Ethereum? Why is it possible that ETH value as a currency return to zero? The Penta team combine their own experience in public blockchain project to explain them in detail.

What is economic abstraction?

One of the ETH functions is named “Gas”, which is designed as a transaction fee. Gas is paid to the miners who package transaction to maintain the normal operation of ETH network. When building a new smart contract, in general, every transaction on the smart contract has a cost, in Gas. When the miner packages a block, it will preferentially package the transaction with the highest Gas price. This mechanism ensures that ETH has enough application scenarios, which is also the source of ETH’s value.

However, Jeremy Rubin found that instead of paying for Gas in ETH, a transaction could deposit an ERC20 instead of consuming ETH. The user who executes the contract can directly deposit the ERC20 token he owns into the account address of the miner and set the Gas price to 0 to avoid using ETH. When dealing with such a transaction, the miner can pre-check the value of the received ERC20 token, and if it is higher than the normal Gas handling fee, it will be packaged. This use of non-ETH asset payment fees is the economic abstraction of the Ethereum community. The economic abstraction will lead to the continuous decline of ETH’s market demand, and its market value will be correspondingly reduced. When all transactions use this method without paying ETH Gas fees, the ETH price will be equal to zero.

Opposing opinion

The economic abstraction of Ethereum has also sparked heated debates in the community, and there are also many refutations. There are currently four main points of view that it is difficult to achieve: (1) lack of software support for economic abstraction (2) no effective market pricing (3) non-token contract (4) Proof-of-Stake. But these four views currently seem to be lack of persuasiveness.

(1) Lack of software support

Vitalik believes that considering the benefits of the ETH ecosystem, the increase in complexity may not be worth the gain. This view is very untenable, and any software and applications should be iterated as the needs of users change. For example, the wallet software of any particular ERC20 Token, the functional design is much more complicated than an ETH wallet.

(2) No valid market pricing

This is the view of Vlad Zamfir, the core developer of Ethereum. The need to monitor price market information can make economic abstraction difficult. In fact, a rational miner is pursuing the maximization of interests, so the miners are very sensitive to the price of the transaction fee. They may need only a tool to exchange the tokens included in the transaction fee according to the market conditions. The value is dynamically converted and sorted, and a perfect income model is established under the condition of cost control. On this basis, the mining union can reasonably package the transaction and pursue the maximum profit as much as possible.

(3) Non-token contract

Users who do not have a token contract can choose to pay in any token. If a miner receives an asset that he does not want to hold but has a higher market value at the time, he can exchange it for the desired asset through exchanges.

(4) Proof-of-Stake

Not to mention that the current ETH POS consensus still does not land on the main network. Even with POS, we can assume that a POS node with multiple assets in the Ethereum network chooses a weight vector for the voting rights of its assets. If the weight vectors are sufficiently like each other, the consensus can still be achieved. This idea is called a heterogeneous margin equity certificate, referred to as HD-PoS. Although the conditions under which HD-PoS can maintain consensus remain to be studied, the possibilities exist. This is also a problem that all POS projects will face.

Although the Ethereum community has also proposed some countermeasures, they are all palliative. The origin of ETH’s economic abstraction lies in the design of the basic framework of ETH’s smart contract. Looking at the API documentation for the Smart Contract Solidity version, we can see that the block-related parameters are introduced in the global variables of the smart contract.

One of the parameters is block.coinbase. It is through this parameter that an ERC20 token can be directly deposited into the address of the block miner to pay for the execution cost of the contract instead of the ETH payment fee. More broadly, for ETH networks or POS networks, since the miners in each block of Ethereum are unique, then this part of the token will eventually be obtained by the miner, and the miner can accept this. The transaction does not have to consider the price of the gas.

Penta’s thinking and countermeasures

Although the Penta project uses a similar fee mechanism like Ethereum, due to the unique DSC consensus algorithm and governance mechanism, there is no economic abstraction. This can be analyzed from two aspects:

(1) Fee allocation

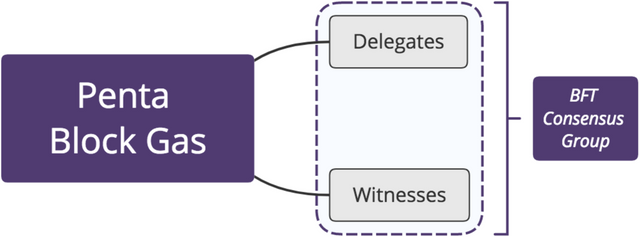

Since Penta adopts the DSC consensus algorithm, there is no single miner. The BFT consensus group consisting of randomly selected delegates and witnesses to create a block, so it is impossible to predict who will come out in advance. The block.coinbase variable in the Penta smart contract represents the hash value of all signature nodes in the consensus group. In this way, it is impossible to pay non-PNT tokens to a miner through block.coinbase to replace PNT as a fee.

In addition, in the design of the Penta fee model, the fee reward is shared by the delegates and witnesses are responsible for the BFT consensus group and is allocated by Penta’s incentive allocation algorithm. The transfer in the smart contract will not be available inside a consensus group. If a bribe is given to a certain member in the above-mentioned way, other nodes will naturally refuse to accept such a transaction, and naturally it is impossible to reach a broad consensus.

Penta fee allocation model

(2) Governance mechanism

In the governance mechanism, Penta introduced the voting mechanism of delegates, witnesses, and members of the consensus membership. Through these means, it will be possible to lock and maintain a considerable number of PNT tokens that can be controlled, which plays a role in regulating the economic ecology of Penta. In addition, all Penta users can also use PNT tokens to participate in voting and in the governance. It provides a wide range of usage scenarios for PNT tokens, and rich application requirements can guarantee the value of PNT.

Conclusion

In this paper, the Penta team conducted an in-depth analysis of the current economic abstraction issues faced by ETH, and introduced how Penta evaded economic abstraction through advanced technology architecture, demonstrating that PNT value will not collapse like ETH might. Of course, we believe that the economic abstraction of blockchain is not a savage beast, which just reflects the fact that blockchain technology tends to mature in evolution. The Penta team is more eager to provide more advice and inspiration for the future development of the public chain through the research and attention of this issue.