The SEC Just Released Its Long-Awaited Crypto Token Guidance

The U.S. Securities and Exchange Commission (SEC) has published fresh regulatory guidance for token issuers, nearly half a year in the making.

The guidance focuses on tokens and outlines how and when these cryptocurrencies may fall under a securities classification, according to the document.

SEC Director of Corporation Finance William Hinman first revealed that the regulator was developing new guidance for crypto tokens last November, and other members of the agency, including FinHub head Valerie Szczepanik and Commissioner Hester Peirce, have repeatedly said that SEC staff was working on the document.

In November, Hinman said the “plain English” guidance would help token issuers easily determine whether or not their cryptocurrency would qualify as a security offering.

The guidance includes examples of both networks and tokens that fall under securities laws, as well as a project which does not.

DLT framework

The framework itself outlines a number of factors that token issuers must consider before evaluating whether or not their offerings qualify as securities. These factors include an expectation of profit, whether a single or at least central group of entities are responsible for specific tasks within the network, and whether a group is creating or supporting a market for a digital asset.

Referencing the oft-cited Howey test, the guidance highlights “reliance on the efforts of others,” reasonable expectation of profits, how developed the network is, what the tokens’ use cases might be, whether there is a correlation between a token’s purchase price and its market price and a host of other factors.

The guidance also details how issuers should look at tokens previously sold, both in evaluating whether they should have been registered as securities, as well as whether “a digital asset previously sold as a security should be reevaluated.”

The criteria for this reevaluation include whether:

The “distributed ledger network and digital asset are fully developed and operational” (meaning individuals can immediately use the token for some function);

The token is focused on a specific use case rather then speculation;

“Prospects for appreciation” in the token’s value are limited; and

If billed as a currency, the token actually operates as a store of value.

While this guidance has been a long time coming, and provides some legal clarity for token issuers, it is not a legally binding document, and should be seen more as a guideline.

Peirce has said in the past that staff-issued guidance does not carry the weight that guidance issued by the Commissioners would.

Speaking at New York University in March, Peirce explained:

“Now staff guidance is staff guidance. The Commission can go ahead and bring enforcement actions anyway but staff guidance does carry a bit of weight, but I would like to do something more formal at the Commission level so people have a little bit more certainty.”

Remaining questions

While the guidance discusses securities classifications, other questions remain unanswered. In particular, the SEC has yet to provide clarity around the idea of custody for broker-dealers holding cryptocurrencies.

The key issue around custody comes from the fact that while broker-dealers can easily verify that cryptocurrencies in any given wallet belong to them, it is harder to prove that no one else has access to the holdings.

Szczepanik said during a panel at the D.C. Blockchain Summit in March that these firms “need to show that they have possession and control and that could be hard to demonstrate with a digital asset.”

“A digital asset … is controlled by whoever possesses the private key, and it’s hard to prove a negative,” she explained.

Also Wednesday, the SEC issued its first-ever no-action letter authorizing a startup’s token sale to go forward (full story here).

Read the full guidance here:

DLT Framework by CoinDesk on Scribd

Valerie Szczepanik image via Tech Crunch

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

SECSecuritiesGuidance

Startup Behind Ethereum DEX Releases Lightning Developer Tools

Alyssa Hertig

Apr 5, 2019 at 19:00 UTC

Updated Apr 5, 2019 at 19:36 UTC

The startup Radar, which raised $10 million in a series A funding round last year, has revealed a new suite of tools for developers working on the lightning network, bitcoin’s second layer for scaling payments.

To be released at the Boltathon hackathon, the developer tools include a configuration helper for setting up a lightning node and an invoice “playground,” where users can test if their lightning node can connect to other nodes. Then, there’s a liquidity tool for making sure users can send and receive payments, a feature that’s not as easy as it might sound as the technology is still under development.

The tools are a part of Radar ION, Radar’s site for onboarding lightning users. Participants in this weekend’s virtual Boltathon conference, featuring a hackathon dedicated solely to lightning, are invited to use these tools.

While Radar is best-known for creating Radar Relay, a decentralized exchange for trading tokens without a middleman over ethereum, this is the team’s public debut branching out into the bitcoin realm by focusing on lightning technology.

Radar product lead Brandon Curtis told CoinDesk:

“We’re constantly scanning the horizon for groundbreaking technologies, last year our R&D team identified lightning as promising technology, with the potential for more than just payments. While an ethereum [decentralized application (dapp)] was our first product, our parent brand Radar is focused on building products for our next financial system.”

They have plans to keep building out this functionality. Developers have made all sorts of apps on top of the lightning network, such as Y’alls for paying for articles using lightning and a game of monetized chess. Radar’s next goal is to make it even easier for developers to create these types of apps.

“Next we’re focused on building tools to support developers creating apps on the network,” Curtis added.

Code image via Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

MicropaymentsBitcoinLightning NetworkRadar Relay

Tron Dapps Saw $1.6 Billion in Volume in Q1 2019, Driven By Gambling

Leigh Cuen

Apr 5, 2019 at 16:11 UTC

Updated Apr 5, 2019 at 17:14 UTC

Gambling is becoming a primary use case for the Tron blockchain, new data shows.

Revealed exclusively to CoinDesk by analytics firm Dapp Review, dapps on the tron network facilitated $1.6 billion in activity in the first quarter of 2019, with more than 432,000 estimated users. In total, 64 percent of dapps on the tron network now facilitate gambling, the study said.

These days, tron gambling apps range from digital dog racing to a “farm investment game” that promises players up to 100 times their initial token investment.

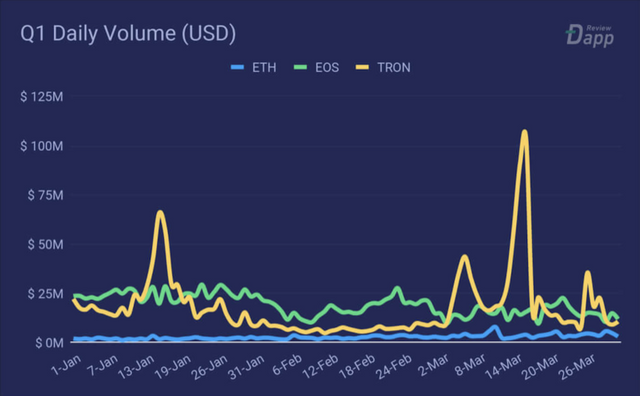

On the strength of such games, tron dapp volume surged to a new high in March 2019, according to Dapp Review’s data, with more than $102 million worth of transactions on March 15 alone – compared to roughly $16 million worth of volume the same day on EOS dapps and just under $4 million in daily volume on ethereum dapps.

Stepping back, Tron became independent from ethereum in June 2018 after the namesake Tron Foundation ran a $70 million token sale in 2017. Dapp Review CEO Vincent Niu told CoinDesk that EOS – another ethereum-inspired blockchain that also went live in June 2018 – surpassed ethereumwhen gamblers deterred by ethereum’s high fees flocked to EOS in late 2018.

The tron community took notice and began courting ethereum developers as well.

“In October 2018, we were contacted by representatives from the tron network and they asked us to participate in their accelerator,” Moscow-based Ruslan Marinov, founder of the casino dapp 888tron, told CoinDesk.

Tron gained its market advantage thanks to the popularity of such online gambling sites, Niu said.

Dapp Review’s Q1 2019 report estimates that 27 percent of tron dapps are casino games, with another 36 percent deemed “high risk” gambling games. The report found that just 37 percent of ethereum dapps that fall into both categories combined. (“High risk” gambling involves very little gameplay and a smart contract that determines payouts.)

Daily volume on Tron (yellow), EOS (green) and Ethereum (blue). (Chart courtesy of Dapp Review)

Attracting developers

Tron founder Justin Sun, in particular, has been a catalyst to the growth of this sector.

Although the Tron Foundation released a statement in March discouraging unlawful gambling dapps in Japan, the founders of several global gambling dapps told CoinDesk they received $10,000 or more worth of the stablecoin Tether as rewards for building their games for the Tron Acceleratorhackathon in December 2018.

According to a Tron spokesperson, those funds came from Sun’s personal accounts and not the company itself.

It’s unclear how involved the Tron Foundation is in financially bolstering this gambling sector, beyond listing the games on the company’s official websites. A Tron spokesperson declined to comment on dapp gambling. We will update the story if we hear back.

“The blockchain itself brings a lot of freedom to people from, for example, China,” 888tron’s Marinov said. “By using a VPN they can gamble or use many other services.”

While developers across the ecosystem continue to make gambling portals on many blockchains, Sun’s recruiting strategy appears to have been particularly effective.

Dapp categories on the Tron network. (Chart courtesy of Dapp Review)

According to data provided to CoinDesk by the blockchain analytics firm Flipside Crypto, the price of tron tokens surged in early January, when these gambling dapps launched, and developer contributions have remained stable ever since.

However, Dapp Review’s Niu was less optimistic regarding overall engagement.

“Actually most of the users are just fake accounts,” he said. “If you look to the future, I’d say ethereum has more potential because a lot of people are working on token standards and other infrastructures.”

That said, Niu told CoinDesk that dapp transaction data suggests some players are merely using dapps to get tokens, especially in jurisdictions that forbid purchasing TRX with fiat.

On the other hand, EOS advocate and Sense CTO Ben Sigman told CoinDesk:

“People whose businesses and services are limited by governments are going to seek new areas to expand to where those limitations and laws aren’t present yet. That’s why gambling was a big part of the early internet too.”

Tokenized income

Niu said it’s still difficult for open-source developers to monetize their contributions to the blockchain ecosystem. Gambling dapps provide a conduit for such earnings, he said.

Marinov, for example, leads a team of 15 contributors. His token-fueled casino has an average of 1,500 daily users, which solely identify themselves with crypto wallet addresses. 888tron players bet TRX tokens and receive dapp dividend tokens for each bet, of which Marinov says $9 million worth of TRX dividends have already been paid out in the three months since launch.

“We have plans to organize a company, to set up an entity with the necessary licenses, all the legal stuff, starting in July of this year,” Marinov said. “We are investigating the best jurisdiction.”

Overall, Marinov estimated $300 million worth of TRX passed through the 888tron dapp alone.

In return, offering these developers prize money pays off tenfold for the Tron Foundation. Players cashing out 888tron dapp tokens contributed significant volume to the March 15 spike in tron dapp volume.

“Blockchain is the best solution for gambling and for gaming,” Marinov said. “Tron is a great blockchain. We were actually choosing from three blockchains, ethereum, EOS and tron. … They [the Tron Foundation] support developers.”

Posted using Partiko Android

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://dailythenews.net/crypto-currency/tron-dapps-saw-1-6-billion-in-volume-in-q1-2019-driven-by-gambling

Congratulations @rodolfolindo! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!