Equity Options and Crypto Currencies: A Tale of Two Innovative Markets

In 1973 Fischer Black and Myron Scholes published an article titled "The Pricing of Options and Corporate Liabilities." This major the innovation in quantitative finance became the standard for options pricing and enabled the explosive growth of the listed options market. From a historical perspective, the Black-Scholes paper is analogous to Satoshi Nakamoto's 2008 white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" in its foundational significance.

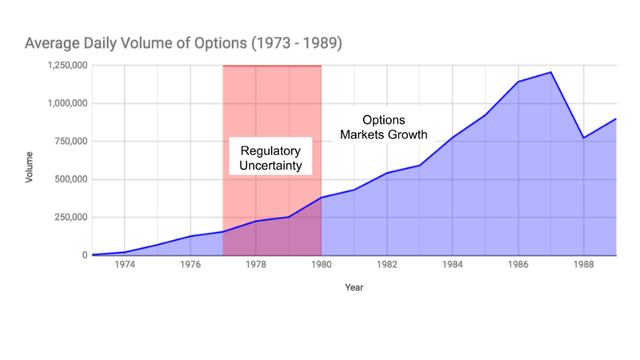

In 1973, the Chicago Board Options Exchange ("CBOE") began to trade listed options. This lead to explosive growth in volume. By June 1974, the CBOE average daily volume exceeded 20,000 contracts. In 1975 the Philadelphia Stock Exchange and the American Stock Exchange both began listing options. Due to this tremendous growth, in 1977 the SEC decided to conduct a complete review of all options exchanges.

The SEC began by placing a moratorium on listing options for additional stocks and discussed whether or not it was desirable or viable to create a centralized options market. By 1980 the SEC had lifted the moratorium and put new regulations in place regarding market surveillance at exchanges, consumer protection and compliance systems.

Data provided by the Options Clearing Corporation

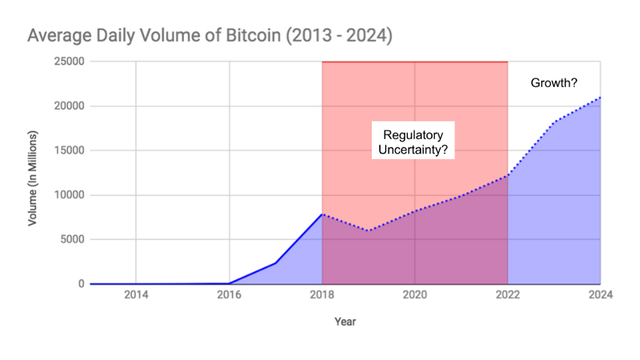

Data provided by coinmarketcap; post 2017 values are extrapolated estimates

Some may have preferred if the SEC had left the market alone and not imposed new regulations, however, unregulated markets had shown past examples of public harm. Following the Great Crash of 1929, Congressional and private studies during the early 1930s exposed widespread manipulative and fraudulent practices involving the trading of over-the-counter options. In light of these concerns, pressure arose to prohibit the expansion of options trading to the national securities exchanges. However, similar to the 70's and potentially similar to today with the crypto currency markets, regulators showed restraint from banning financial innovation. In recognition of the legitimate financial ends options might serve, Congress, in adopting the Securities Exchange Act of 1934, chose not to impose an absolute ban on exchange-traded options. As an example of progressive regulation, in 1975 the SEC approved the Options Clearing Corporation ("OCC") as the central clearing entity for exchange listed options. The OCC acts as a guarantor for listed options by acting as both a buyer for every seller and a seller to every buyer in all transactions. This guarantee greatly reduces the risk of default inherent in bilateral transactions.

We are at a similar pivotal point in today's crypto currency markets. The SEC is considering an array of new regulations, including regulating US based exchanges as Alternative Trading Systems ("ATS"), which would require them to register as broker-dealers. It is conceivable that the SEC could impose a moratorium on ATS listing of new crypto currencies. Many crypto investors oppose any additional regulation. In my view, enlightened regulation that reasonably balances the interests of market participants, the investing public and government maximizes the growth of markets.

When the SEC lifted the moratorium on new options contracts in 1980, the CBOE quickly added options on 25 more stocks. In 1982, the listed options market reached a milestone with 500,000 contracts traded in one day. The maturing of quantitative investing and the confidence institutional capital felt as a result of the new regulatory structure led to the development of the index options market in 1983. The first index options were traded on the S&P 100. Four months later, options began trading on the S&P 500. Today there are over 50 index options, and over 1 billion contracts have been traded since 1983.

Thoughtful regulation of crypto currencies would clarify the issues of fiduciary obligations. This would facilitate flows of institutional funds into blockchain assets. To give you a sense of what institutional flows could mean, Blackrock has $6.3 trillion AUM. One percent of that AUM is $63 billion, or about 24% of the $266 billion market value of all crypto currencies as of the time of this writing. Inflows of institutional funds would benefit intelligent dev teams and would allow the tech cycle to catch up to the hype cycle. From an investment perspective, the real beta (as opposed to liquidity driven volatility) will emerge as crypto currencies mature. At that point a thoughtful index product, such as Panda Analytics can be very useful (disclosure: I am an investor in Panda Analytics).

I believe the crypto markets are at a critical juncture today. Similar to the options markets in 1977. If the SEC and other regulators can craft prudent and productive regulatory structures, crypto markets can become much more widely accepted. This will lead to much greater acceptance and growth into a true asset class.

Sources:

The Options Playbook, Brian Overby

optionstrading.org

The History of Regulation of Clearing in the Securities and Futures Markets, and its Impact on Competition, Neal L. Wolkoff and Jason B. Werner

Flippening podcast (Ep. 0016) May 17, 2018

The Options Markets Come of Age: Their Past, Present and Future, Commissioner Barbara S. Thomas

✅ @puzzlefriendly, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Welcome!

Posted using Partiko Android

Congratulations @puzzlefriendly! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!