"Liquidity Network": Potential exchange of crypto-digital liquidity

At the same time, digital coins and blockchain technology have reached the Internet (digital network), creating a extraordinary revolution that changed the way of seeing immediate or mediate reality.

Nowadays, it is easier to carry out commercial operations through online electronic platforms and interfaces. It is about electronic commerce, in other words, the marketing of services or products worldwide, using the Internet and high-tech devices, to the reach of large numbers of people in developed or underdeveloped countries.

However, due to the dizzying pace of time, multiple activities and personal or professional commitments responsibly acquired by citizens on a daily basis, Internet users need websites that ensure the shortest possible time for online operations, especially when it comes to digital assets.

In the modern era, with the emergence of digital coins and blockchain technology, liquid networks are widely usable. ¡Many people know this, but others do not!

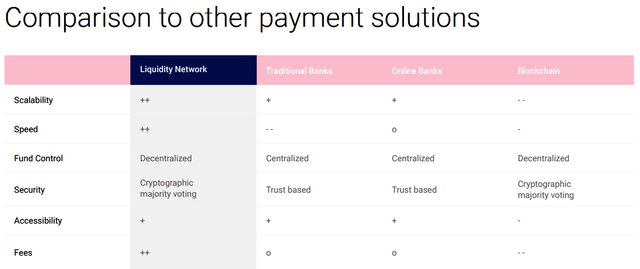

Therefore, it is convenient to comment that they allow and facilitate the respective exchange of digital assets, taking advantage of the benefits of centralized computational technology and, at the same time, the benefits of blockchain technology, characterized mainly by being decentralized.

So far, everything seems to indicate the nature and beneficial character of computer technology, Internet, digital coins, blockchain technology. This undoubtedly represents a economic advance for modern society. On the contrary, there are also numerous cases of dissatisfied users with the services offered on various digital platforms, with one common denominator: the exchange of liquidity. This represents a problem that affects millions of users of blockchain technology, beneficiaries of digital coins, along with existing, in different countries of the world.

.- What is the solution to ensure reliable liquidity exchanges?

.- What is the right platform-interface for executing liquidity exchanges?

LIQUIDITY NETWORK

.- What is a Liquidity Network?

Liquidity Network: Presentation

Attributes of the Liquidity Network (basic characteristics):

Immediately, the main attributes or basic characteristics of the previously mentioned platform are stated:

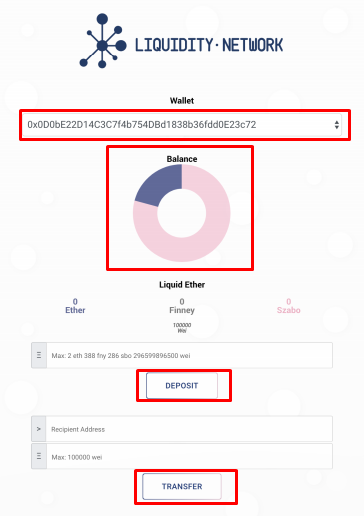

.- Simplicity: This is a platform with a user-friendly digital interface. Users can manipulate this web tool easily and without technical-computational complications.

It is only essential to have a minimum of knowledge in the manipulation of the Internet, digital coins, electronic wallets, and blockchain technology. But it's not limiting.

.- Scalability: The platform interface has the ability to adapt to changes brought about by its functionality and growth, reacting and adapting without losing operational quality.

.- Traction: It is the functional capacity that determines the progress of the platform's interface, based on determining factors, such as the validation in the virtual and real world of the operability and exponential growth.

.- Privacy: It is the condition that determines the access and control of digital information, giving way to web security.

.- Transparency: It is a characteristic that conditions the operativity of the interfaces in the digital platforms, granting it a credibility character. It also allows the visibility of transactions or liquidity exchange.

On the other hand, the operation outside the block chain, leads to the execution of transactions not directly registered in it, without depending on the validation of the respective network in use.

It is worth mentioning that transactions are carried out continuously and after a certain period of time, they are officially registered, without representing any type of problem for the users of the tacit platform. This avoids threats to the scalability of the Liquidity Network.

As can be seen, the massive use of Liquidity Network does not induce setbacks or operational limitations. The execution of transactions or exchange of liquidity does not represent overwhelming costs in commissions, and the registration of these, is not formalized directly in the chain of blocks, but after a prudential period (time).

Thus, everything indicates that Liquidity Network is the platform with the perfect interface for the execution of liquidity exchanges, in the shortest period of time and with satisfactory results for users.

Liquidity Network functionability:

How does Liquidity Network work?

The liquidity of the exchange network has no funds while atomic swaps are made outside the chain, so it is scalable and secure. (Source: @originalworks Blog).

Liquidity Network: Nocust Hub

Information of Interest

It should be noted that a Custody Service is an innovation in the field of digital coins. In essence, it is a third party solution (action), whose purpose is the secure storage of digital actives.

In the digital market, and specifically in the virtual scenario of electronic coins, custody services based on "hot" and "cold" protocols are common. It is understood that when it comes to "hot" storage, digital coins have access to the Internet network.

On the contrary, i.e. with "cold" storage, some or all of the electronic coins do not have access to this network. It should be noted that "hot" and "cold" storage systems can alternatively be combined without any functional difficulties. An example is when a user stores their digital assets offline, and then uses a private key to access the system.

In the specific case of Liquidity Network it is a service of transactions or exchange of liquidity, without custody. But, does this represent a problem or danger in the storage of digital currencies? No, not really! The only thing that is achieved is the execution of transactions (without custody) outside the chain of blocks, and in this way, the operating costs (per transaction) are waived.

¿And the procedure in general, is positive? ¡Yes, indeed! since it represents a favorable point for users of the Liquidity Network.

Previous experience indicates that all digital ecosystems based on non-custodial system protocols are adapted to computational criteria and interests, plus the basic needs of blockchain users, including, of course, electronic money. (Source of support).

Revive: An alternative to Liquidity Network:

Information of public interest

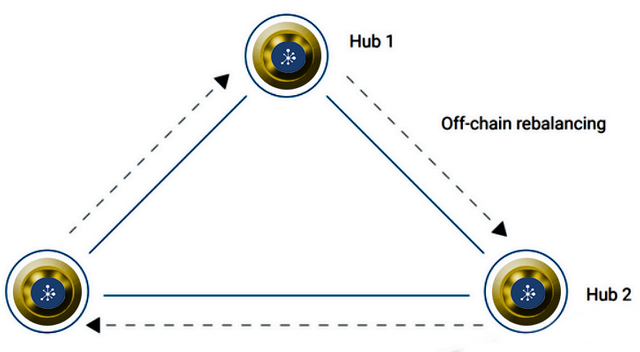

Within the platform interface corresponding to Liquidity Network, the rebalancing of payment channels outside the block chain is a priority requirement. This process, defined as Revive, is executed by the hubs. In short, it is an algorithm in charge of the physical process that conditions the operation and stability of the implicit network, where the hub fulfills a highly determining function.

Once the process is executed outside the block chain, it does not cause congestion in the Liquidity Network, and apart, it increases scalability and decreases operating costs. In the image projected below, the process indicated in advance is graphically visible: (see image)

Settlement of transactions outside the chain: ¿How does the process occur in the network?:

The settlement of transactions outside the chain is a process that is unfailingly carried out in the network in the following way:

Category 1: Bipartite transactions: that occur between two users; and Category 2: N-Party transactions, where more than two users participate.

Within the first category, when it comes to bipartite channels, they are subdivided in the manner indicated here: (a) unidirectional transaction; (b) bidirectional transaction; (c) linked payments; and (d) two-party payment hubs.

.- Unidirectional transaction: occurs between two interacting parts. In this type of process, one of the parties carries out the transaction. The deposit moves through the channel, out of the chain; and the funds are sent through a single address.

.- Bidirectional transaction: it materializes between two parts that interact at a certain moment. It allows the sending of funds in two directions. This type of transaction presents a risk, when one of the nodes can invalidate the transaction.

.- Linked payments: occur when pairs (users) are not connected to the network. It is estimated that each party involved must deposit some guarantee. Colaterally, this type of transaction predisposes to route search, channel maintenance, transaction security and congestion balancing.

.- Two-party payment hubs: represents an alternative that groups together the above types of transactions, including more than two persons as direct participants in the transfer of funds.

- Less costly transfers.

- Faster transfers.

- Greater user participation.

Along the same lines, Liquidity Network Hub offers certain benefits that contribute to the good operational development of the platform/interface; for example:

- Free registration of offline channels.

- Simple routing (As opposed to two-part payment channels, which require complex routing).

- Guarantee of funds between users, without retention on a server.

- Use of a server to calculate transactions (induces the speed and low cost of transactions in the ecosystem hub).

- The server calculates the transactions, while the users retain the funds.

- Funds are not compromised.

Decentralization in Liquidity Network:

Interesting data

Let us remember that on the Internet, there are centralized, decentralized and distributed ecosystems

In simple words, a centralized ecosystem is where all actions depend on a single person, a single node, a single part.

The decentralized ecosystem put simply, works under the parameters of different people, several nodes and different parts.

For its part, the ecosystem known as distributed allows the duality of users, to interact as senders or receivers on the Internet network, chain of blocks or Liquidity Network.

Consequently, it is logical to think this: each of the ecosystems mentioned above has its own level of ease and complexity, attributing digital personality to the interfaces of the platforms that proliferate on the Internet.

Liquidity Network, is governed by an ecosystem entrenched in decentralization, allowing this:

1.- Interconnection as in Lightning Network and Raiden.

2.- Users with funds accessible through a private key.

3.- Elimination of funds, by the users, without any type of impediments.

4.- Allows all users to join different hubs, without any technical-operational limitations.

5.- Sending funds from different hubs, using the Revive protocol correctly.

6.- Efficient management of payment centers.

7.- Among other benefits, it is emphasized that Liquidity Network allows having a server outside the block chain, making use of an intelligent contract. Any user can run his own central server, with full control of the funds, by having a private key.

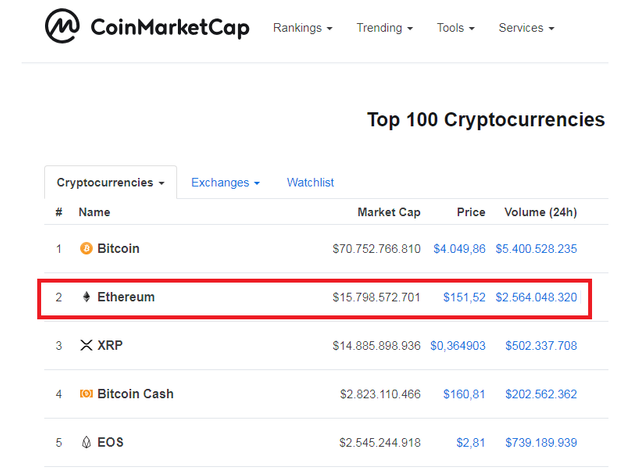

Web positioning of the Liquidity Network:

Every online platform seeks to profile itself as one of the most viewed and used on the Internet. The good content, functioning and usefulness of web pages are indicators that help the implicit purpose.

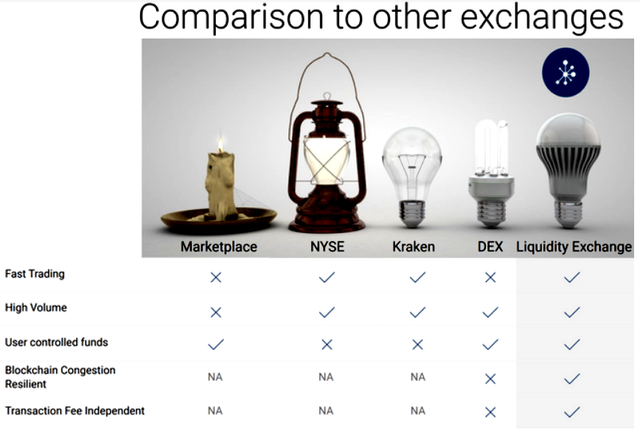

The web architecture, protocols used, and the ability to provide a large number of liquidity (exchange) transactions make Liquidity Network a platform with an avant-garde interface, which has been adequately positioned on the Internet network.

The images that is exposed, reflects in a punctual way, the way as Liquidity Network is positioned in the market of the digital coins, the chain of blocks, for satisfaction of the interactive parts (see images):

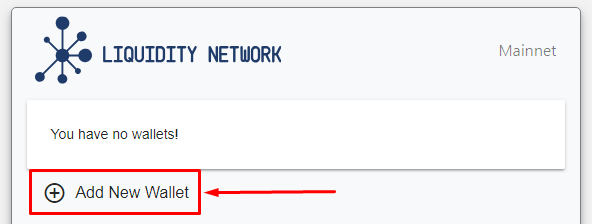

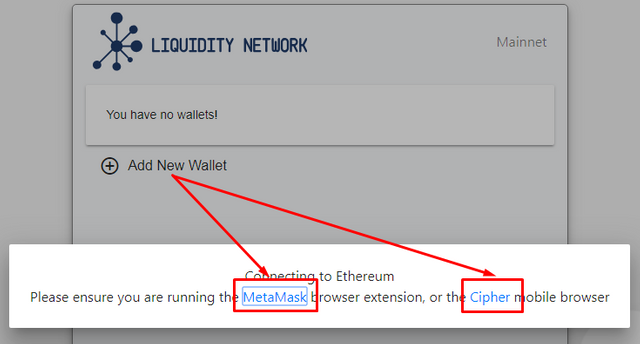

Usability of Liquidite Network:

The projection and usability of Liquidity Network will depend on its web positioning, and in the same way, on the quality of service offered to users with the exchange (transaction) of liquidity, under the conception and contextualization of the chain of blocks of Ethereum.

It has already been expressed that the greater the number of users on the platform, the greater the number of liquidity transactions (exchanges) consummated at the interface.

From there, it is understandable and vital that Liquidity Network the greatest number of social organizations and people, as in the following cases:

.- Governmental organizations: incorporated into the actions in the Internet, use of digital coins and the chain of blocks.

.- Banking entities: public and private that adopt financial systems that have emerged in a timely manner with the progress of blockchain technology (based in Ethereum.

.- Offline exchange houses: which are responsible not only for the materialization of fiat money transactions, but also for digital money.

.- Online exchange houses: with a high presence on the Internet, allowing transactions (exchange) of fiat money and digital coins.

.- Business organizations: with small, medium or large operational capacity and financial resources to invest in digital ecosystems based on digital currencies and the Ethereum chain of blocks.

.- Traders: because they are people specialized in the market of crypto currencies and their ability to reach a large number of users, to teach, help and guide in the consolidation of activities in online trading.

.- Common users: using digital coins and the Ethereum block chain to trade with digital coins.

Uses cases of Liquidite Network:

First case:

A group of entrepreneurs decided to create a bank in the city where they live, in order to offer a good service to potential customers.

Due to the boom of electronic currencies and blockchain technology, they decided that in addition to trading fiat money, they will also do so with resource economic-digital.

However, in order to do so, it was necessary to have a platform with a suitable digital interface for the execution of transactions (exchanges), specifically with digital currencies.

One of them, through the @originalworks team's contest, learned about the existence and functioning of Liquidity Network, reviewed the platform's interface and, considering it ideal, proposed its inclusion in the bank's activities. They have considerable time using the platform interface from Liquidity Network.

They have achieved extraordinary job performance. The users of the bank are satisfied and so are the owners of the bank. ¡The success is indisputable!

Second case:

Sthefany created an online exchange house, to facilitate the exchange (transaction) of digital coins for Venezuelan users who use the interfaces of platforms, specialized in the marketing of digital coins.

She knows that Venezuela, due to the social reality and country situation, in the middle of the crisis is becoming a market of opportunities in the digital field. Because of that, she decided to undertake in this very productive sector.

Sthefany needed a platform with a user-friendly interface for the execution of transactions (exchanges) of digital currencies, considering that those used until now did not satisfy its interests and needs.

His personal friend @jessfrendcor told him about Liquidity Network She started using it as a platform and interface for her company's online transactions, and was very satisfied. He now recommends it to all users.

Ethereum: Protagonist in Liquidity Network:

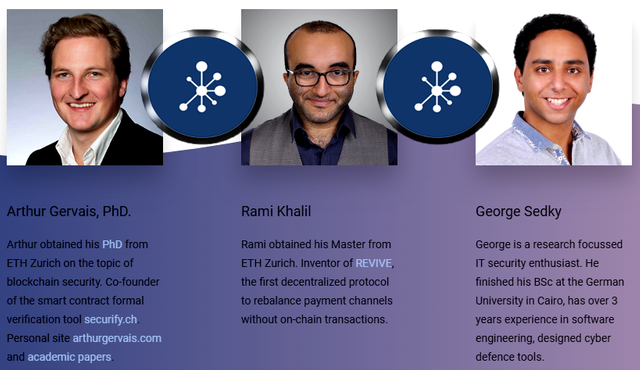

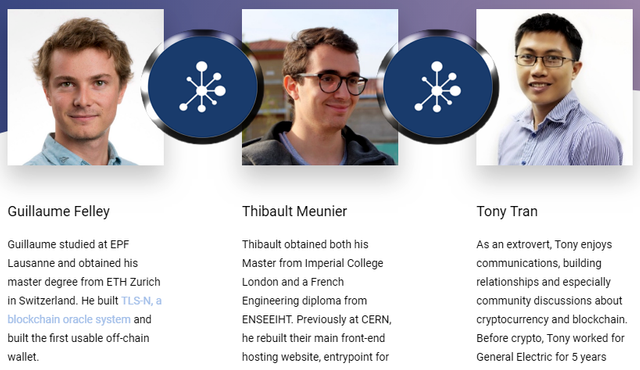

Liquidite Network Team:

Behind every online platform/interface that stands out for its quality and excellence, there is always a work team, made up of people trained in different professional areas.

Liquidity Network is no exception, and has a high-performance team. With constancy, dedication, willingness, disposition and passion, it fulfills its daily functions and is synonymous with success.

Next, each one of the members of the working team of the platform/interface of Liquidity Network is visualized:

"Honor, whom honor he deserves."

Varieties of Liquidite Network:

The platform interface can be accessed from the desktop of a desktop computer, laptop, tablet or from a smart phone. It is also accessible from conventional operating systems such as Android, IOS, among others.

Undoubtedly, having access to Liquidity Network by means of all the electronic devices mentioned, is an advantage that orients towards the usability and positioning of the platform/interface. They are technological resources that can be exploited from the proposed perspective. They must be used in a conscious and intelligent way, with responsibility and respect towards other users. ¡Say no to electronic delinquency!

Another variety is an Airdrop driven by the Liquidity Network, being a popular tool that leads to the construction of the community Airdropping Token, for millions of users, which has other beneficial features.

Brief integrative synthesis:

Links to Liquidity Network:

lqd2019

2500 STEEM ~ Sponsored Writing Contest: Liquidity Network

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!