A Comparative Review of CRYPTOPANG and STRADLE: Which Crypto Option Arbitrage Platform Comes Out on Top?

Hello everyone! In this post, I’ll provide a brief overview of options arbitrage between exchanges and share my personal experience using two platforms that can help you make the most of this strategy: CRYPTOPANG and STRADLE.

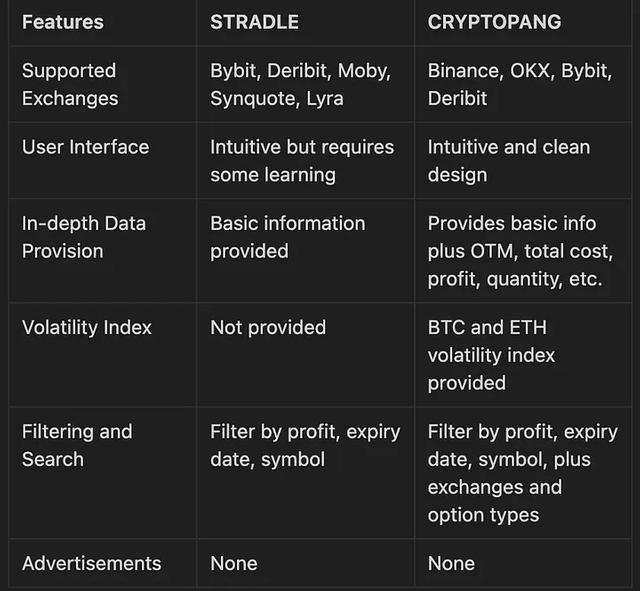

If you’re only interested in a quick summary, I personally recommend CRYPTOPANG. It’s my go-to platform, and here’s why: it offers real-time updates, supports major exchanges like Binance and OKX, provides volatility indexes and in-depth data, and has excellent filtering and search features. Below is a simple comparison table based on my experience. Both sites are free to use.

Key Features Comparison

What is Crypto Options Arbitrage?

Crypto options arbitrage is a strategy that takes advantage of the price differences of identical options traded on multiple exchanges, allowing investors to make a risk-free or low-risk profit. For instance, if a Bitcoin call option with the same expiration date and strike price is trading at $100 on Exchange A and $110 on Exchange B, you could buy the option on Exchange A and simultaneously sell it on Exchange B to realize a $10 profit.

This strategy is particularly appealing to investors as it allows them to pursue stable returns even in highly volatile markets.

Comparing CRYPTOPANG and STRADLE for Options Arbitrage

So, how should you monitor options arbitrage opportunities? Manually visiting each exchange to compare prices would be highly inefficient. That’s where options arbitrage platforms like CRYPTOPANG and STRADLE come into play.

Here’s a comparison of two major options arbitrage platforms: CRYPTOPANG and STRADLE.

STRADLE

Website: https://stradle.xyz

STRADLE offers real-time options arbitrage opportunities across multiple exchanges, helping users easily compare and analyze various options. It includes intuitive and useful features that help traders maximize their profits.

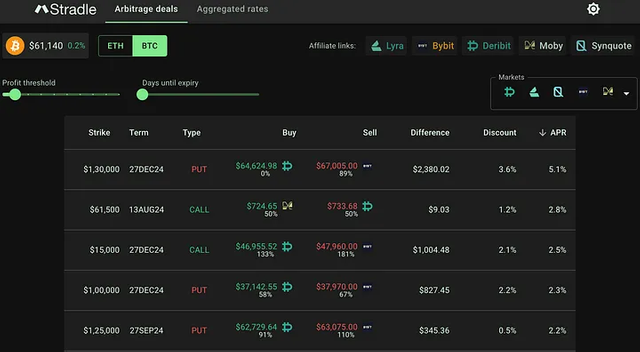

STRADLE’s Arbitrage Deals Page: This page provides users with the following information:

Option Type Selection: Choose between BTC and ETH options.

Option Expiration Date: Check the expiration date of the selected options.

Strike Price: Displays the strike price for each option.

Price Difference Between Exchanges: Shows the real-time price difference between exchanges, allowing you to compare the buy and sell prices and calculate the arbitrage profit.

Profit and Discount Rate: Displays the profit from the price difference and the discount rate for each trade.

APR: The Annual Percentage Rate (APR) is calculated and displayed so you can assess the profitability of the trade at a glance.

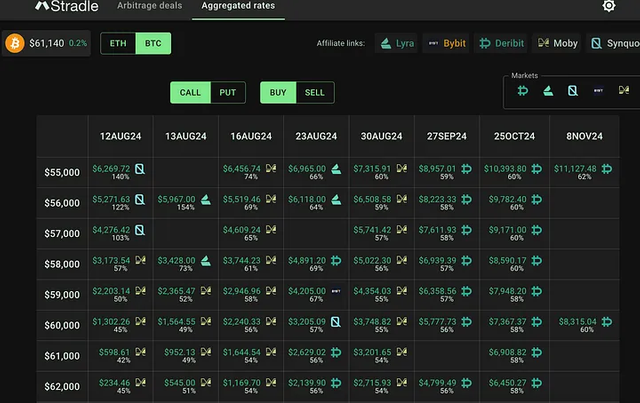

STRADLE’s Aggregated Rates Page: The main features include:

Option Search: Choose between CALL and PUT options and select either Buy or Sell.

Price Difference Visualization: Easily visualize the price differences between exchanges for each strike price by expiration date.

Exchange Comparison: Compare option prices across different exchanges to find the best trading opportunities.

Sorting and Filtering: Filter and sort options based on specific criteria, such as expiration date or strike price.

Drawbacks of STRADLE:

Limited Exchange Support: While STRADLE supports several exchanges, it does not include major global exchanges like Binance or OKX, potentially causing users to miss out on significant arbitrage opportunities. This limitation can be frustrating for those looking to optimize their trades across a wide range of markets.

Lack of In-Depth Information: While STRADLE provides essential data for options arbitrage, it lacks advanced analytics or historical volatility data, which may require users to conduct additional research before making trading decisions.

Risks of Decentralized Exchange (DEX) Support: STRADLE supports DEXs, which generally have lower liquidity, slower transaction speeds, and less intuitive interfaces compared to centralized exchanges (CEXs). The increased risk due to market volatility should be considered when trading on these platforms.

CRYPTOPANG

website : https://www.cryptopang.com

I was introduced to CRYPTOPANG by an experienced trader who frequently uses the platform for options arbitrage. After trying it myself, I understand why they recommended it.

Key Features of CRYPTOPANG:

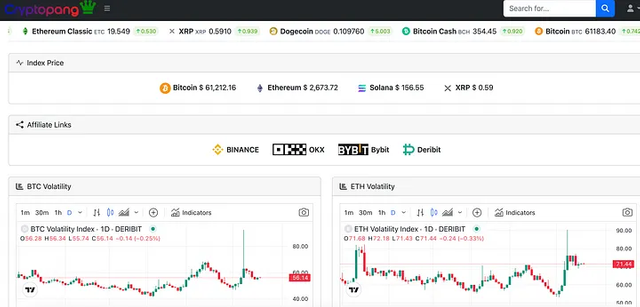

Clean Design: Despite not having a dark mode, CRYPTOPANG’s clean design makes the interface easy to navigate and the information easy to read.

Support for Major Exchanges: Unlike other platforms that support only a few exchanges, CRYPTOPANG includes Binance, OKX, Bybit, and Deribit. The filtering feature allows users to easily obtain price difference information between selected exchanges. In comparison, while STRADLE also supports multiple exchanges, it is more focused on specific exchanges like Bybit and Deribit, limiting its scope. The absence of major global exchanges like Binance or OKX might be disappointing for some users.

Robust Filtering: CRYPTOPANG offers a wide variety of options, with many expiration dates and strike prices to choose from, allowing users to find trades that meet their specific criteria. It’s rare to find a platform that offers such a diverse range of options.

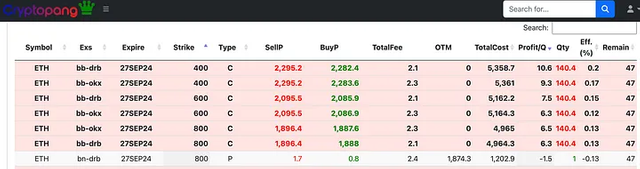

In-Depth Information: In addition to the buy/sell prices, CRYPTOPANG provides total cost, profit, quantity, and OTM (Out of The Money) data, which are extremely helpful for making informed trading decisions.

Volatility Indexes: CRYPTOPANG provides real-time volatility indexes for Bitcoin (BTC) and Ethereum (ETH), allowing users to better manage risks associated with market volatility. In contrast, STRADLE does not offer volatility indexes, which may be a drawback for users who rely on understanding market volatility for their trading strategies.

Volatility Indexes:

BTC and ETH Volatility Indexes: Graphs showing the volatility indexes for Bitcoin and Ethereum help evaluate investment risk based on market volatility.

Timeframe Selection: Users can view volatility over various time intervals (e.g., 1 minute, 30 minutes, 1 hour, 1 day), making it useful for both short-term and long-term strategies.

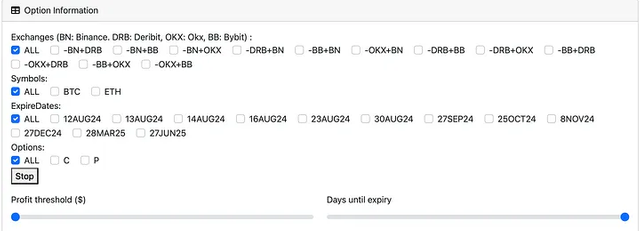

Option Information Settings:

Exchange Selection: Choose from various exchange combinations to analyze specific price differences.

Symbol Selection: Select between BTC and ETH options to focus your analysis.

Expiration Date Selection: Filter data based on the expiration dates of your chosen options.

Option Type Selection: Choose between Call © and Put (P) options or select both.

Profit Threshold Setting: Set a profit threshold to only view trades that meet your desired profit level.

This table helps CRYPTOPANG users analyze the details of their options trades, facilitating efficient and profitable decision-making. The ability to compare buy/sell prices, total costs, expected profits, and trade quantities in one place is incredibly useful.

For those who are new to options arbitrage or traders looking for a convenient way to monitor price differences, I highly recommend checking out this site.