EurekaTrading, $100M+ AUM Asset Manager, to Balance OpenPredict Options

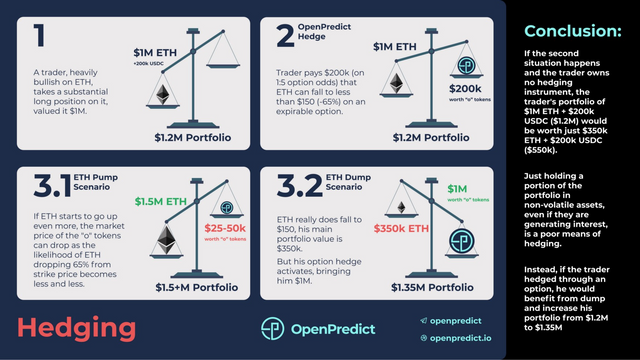

One of the core products of OpenPredict is options for hedging against asset price risk. This offers a powerful financial instrument to those concerned with short- or mid-term volatility in the assets they hold.

Specifically, OpenPredict offers a means for insurance against the price risk of steep falls in assets used in #DeFi protocols. The initial focus of the price insurance is on options that offer high returns in case ETH price faces a sharp fall. The function of such a product is portfolio insurance for the billions of dollars in ETH that are locked up in DeFi.

OpenPredict x EurekaTrading

Market making is an essential part of centralized markets. While automated market makers, such as those used in swap pools like Uniswap, can be effective in rolling out a market maker on the spot for any asset, dedicated markets have the opportunity for specialized resources.

OpenPredict’s #ETH price-protection options are a dedicated market. While these options are not siloed to trading within OpenPredict, making them the first liquid price insurance assets, their primary market (creation stage) is taking place on OpenPredict.

This makes room for advanced institutional traders to play a role in the price discovery of such options and the balancing of prices. EurekaTrading, the pioneer of leveraged cryptocurrency ETFs, is one of the largest crypto-focused institutional traders in Asia. The company manages the creation and liquidity of ETFs on many of the top 100 exchanges and is highly skilled at maintaining a liquid market.

OpenPredict’s partnership with EurekaTrading brings the ability for the ETH price-protection options to hit the market with effective price discovery and strong primary market liquidity.

About OpenPredict Protocol

OpenPredict Protocol creates liquid options for hedging against the price risk of assets staked in DeFi protocols. These options are minted into tokens, enabling first-ever options that are not siloed to a single exchange. This adds a powerful new “money lego” to the DeFi market, one that brings a financial instrument for security against market volatility.

The project’s product-focused roadmap merges the three most successful product markets in the crypto market: predictions, DeFi, and trading.

Website: https://openpredict.io/

Overview: https://daomaker.com/sho/openpredict

Telegram Chat: https://t.me/openpredict

Telegram Announcements: https://t.me/OpenPredictAnnouncements