ETHLend ICO -

The Edge of Our Financial Systems

The most important questions but never asked by us as human beings is how and where the money is created and distributed. Whether realized or not, our education period that we take for years only lead us to become robotic creature that only pursuing the money to achieve what people call as Happiness. But what? It never happened.

We often associate that money is identical with wealth, but it does not seem to be, wealth can stay in a certain community for a very long time, while money is not. This is because money as a medium of transactions always has certain limit, we are not talking about physical endurance, but more to the time limit for the money to stay in the community.

Do you remember what medium that used a long time ago to be money? Lets say various metals, gold, silver, stone, wood, paper and jsut like today, our money is in the form of digital numbers created by the Central Bank. Money will always evolve and the form of money will always change following the times, this is the reality, this is what we will faced in the near future.

Many of us are not taught that the money is created from the mechanism of the Bank creating credit. People believe that it is the country that entitled to print the money, but never thinks why the state should always be in debt if it wants to build infrastructure and manufactur development in its own country.

It’s ironic, when the individual fails to pay the debt to the bank, the bank will be entitled to take over the guaranteed collateral, whereas if the bank fails to pay its obligations to them, the banks will be injected by the government through the central bank with a kind of bailout mechanism. Where does the government fund come from? Of course, from debt to the world monetary institution or from the central bank of another country, then who will pay the debt? Tax! Yes Tax that shall be paid by the people of that country, really a smart and interesting system isn’t it?

It's been happened for hundreds of years, but humans easily diverted and already busy with the effort to climb the social status, improve their lifestyle, copying their favorite artist, defend his idol football club and other unimportant things.

It’s possible to be happen because the authority of the world's financial center is controlled by a centralized institution called the Central Bank. The world transaction records were keeping by them, they entitled to create money and they are entitled to withdraw money more than what they lend to the public or the state. They will always lend you some money to fulfill your wishes, as long as you are able to pay more than what they give.

Nevertheless, the Central Bank and the other Bank is only act as an intermediary institution between our needs and the money. But actually, it's not the money that we need, but more to the things that we can buy with the money, that’s what we actually looking for. The availability of food, clothing, soil fertility, shelter, education, health, entertainment, transportation, energy sources and so forth are true wealth!

The Bank and the big players such the goverment and big company will use the media, magazine, news, fashion advertisement and movie to ensure you to become the consumtive creatures that will ask for debt to fulfill your desire following those idol on the television. And if you cannot pay the debt, good bye, your are no longer needed for the systems.

I believe that all of us will be forced to learn the great lesson about the human nature in the coming years, a lesson that will explain to us that "the need of 7 billion people in this world is only food”.

YOU WILL NOT ENJOY THIS LESSON!

But wait, this things can be avoided if the billions of people in this poor pyramid sub-system has agree to change the rules of this rustic system before the day of the judgment comes. A system that didn’t need all of us to keep blowing the debt balloons.

And now, the system is already in front of our eye, the system is called Blockchain.

Blockchain and the Glimpse of Light

I’m not saying that this system will be 100% (one hundred percent) successful, because as this system is still in the world with all its dualities, the left and the right, the blacks and the whites will always accompany us, and we will still fighting with all its problabilities.

But a glimmer of light in front of the eye shows that the bank's – the centralized autonomy and the sole authority to regulate the money supply – will disrupted for sure by this system. The Banks can be replaced by another system by utilizing Blockchain as the distributed ledger technology. With blockchain, money is already available and will be distributed by the systems, the supply is governed by certain mechanisms, secured by password or cryptography and no authority can control or manipulate this system, all based on the CONSENSUS of the user community.

Blockchain can provide global access to every transaction in the world (block.explorer). Blockchain also enables someone to make uninterrupted and unmaniputalted transactions to anyone in all over of the world. There is no state boundary, no authority and beureucrazy that usually makes the things more difficult such as money transfer that involves 2 different countries.

By using blockchain technology applied by Ethereum for example, anyone can send valuable assets such as Ethereum (ETH). ETH is a symbol for Ethereum, one of the Cryptocurrency that used as compensation for sending transactions to the Ethereum network. By utilizing the smart contract mechanism, the Ethereum network can provides a sophisticated transaction in the most easy and secure way.

ETHLend - Democratizing Loans

Currently the Bank interest rates in various countries are vary based on its liquidity. In the high liquidity market, such as Europe, the interest rates are between 0.5-5 percent, in Russia 12-15 percent, in India 12 percent and in Brazil 32 percent. This shows a clear inequality in how to access the loan market. I believe that the inequalities between borrowers should also be equalized.

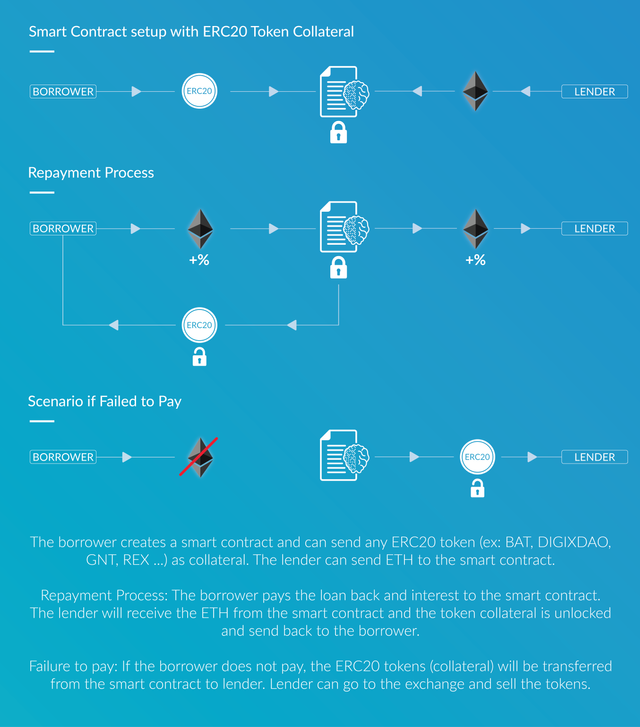

That equality may occur in the realm of Cryptocurrency economic market, it is possible to fix the unequal lending market. Everyone can freely lend and pledge its assets using the Ethereum platform, not without risk, but risk can be minimized by a collateral in the form of an ERC 20 token stated on the smart contract mechanism.

This is what ETHLend, a start-up company that utilizes the Ethereum and Decentralized Application (DAPP) network to provide peer to peer lending services, without any other third parties such as banks or government.

The mechanisms offered by ETHLend are as follows:

With such a decentralized lending mechanism, it will give direct benefit to the both borrowers and lenders from the system by design. First, trust is not required anymore because the system will guarantee the security of a transaction and automatically give a punishment for the bad guys and provide rewards for the good guys (based on the game theory).

Second, is about the transparency for each transaction, transparency can occur due to trustless benefits as mentioned above, every transaction is possible to be seen in blockexplorer system. Transparency brings more benefits to the financial industry. Today when you make transactions through the conventional banking system, you do not have access to the ledger. Therefore, you can’t check whether the counterparty has accepted the transaction or not. The current transaction method creates friction and uncertainty.

When it comes to lending, time becomes a crucial necessity. Loan capital must move between borrowers and lenders as quickly as possible on a global scale. Currently, the current banking system does not provide tools for the lending market. Cryptocurrency will answer the challenge.

In addition, ETHLend provides decentralized loans in the crypto world without the possibility of losing loan capital. The big book transparency that occurs due to the use of blockchain technology is very important for a complete working loan system of the banking system because a ledger makes a no trust loan possible. The lender can always confirm whether the borrower has received the loan and vice versa. No trust is needed.

Overall, after I tried to conduct due and dilligence of whitepapers provided by ETHLend, I have a complete picture of how the project will be developed. With a complete and experienced team, various needs such as UX (User Experience) highly paid applications, loan security by using Ethereum Name Service Domains (ENS), insurance, risk sharing and credit risk assessment (credit risk assessment) good.

Although the field of lending in the world of Cryptocurrency is still regarded as "the new kid on the block", it seems that this project will be the next star if the global community has adopted and implemented this Blockchain system. We hope and do our best to spread this decentralized spirit!

Goodluck ETHLend.

For those of you who are interested to learn more please study in the links below.

Website: http://ethlend.io/

Whitepaper: https://github.com/ETHLend/Documentation/blob/master/ETHLendWhitePaper.md

Bounty Information: https://bitcointalk.org/index.php?topic=2078686.0;topicseen

Reddit: https://www.reddit.com/r/ETHLend/

Telegram: https://t.me/joinchat/FWu2CQ0ZRCeWfey4eP8VhQ

By: hyadumadha

https://bitcointalk.org/index.php?action=profile;u=1082055

Congratulations @hyadumadha! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP