Global Crypto Markets Review: January 2020

January has been one of the best performing months for the broader crypto space in half a year, that came after a sluggish and torturing 4Q19. The OKEx’s BTCUSD Index rebounded 29.85% in January after a 5% drop in December, which came after a 10% drop in the last quarter. Markets have continued to focus on the upcoming bitcoin block reward halving. OKEx Quant earlier that while January could be one of the ideal entry points for a halving setup, this market cycle is not expected to complete until 2022.

On the other hand, macro uncertainties have continued to drag down on equities and commodities; the surging demand for safe havens could continue to benefit the prices of bitcoin and the broader crypto market.

Despite the price increase in BTC, bitcoin’s market dominance has slightly retreated from 68.21% at the beginning of the month to 66.02% at the end of the month. In contrast, the total ex-bitcoin market cap has surged from USD 60.41 bln to USD 89.2 bln in the period.

Although bitcoin’s market dominance so far has been soft since the beginning of this year, the current number is still significantly higher than 2019 lows of under 50%. However, the recent bitcoin market dominance drop could signal some of the capital has been moving away from the leading cryptocurrency and moved toward the altcoin space. That could partly explain why ETH rallied more than 40% in January, while EOS rose 62%.

Looking ahead, the situation of the coronavirus outbreak could remain the dominant factor for both traditional and crypto-assets. The safe-haven needs alongside with the bullish expectations of the reward halving could continue to show high correlations with bitcoin prices, at least for short/medium-term perspective. At the same time, crypto watchers would like to keep a close eye on the bitcoin/altcoin market dominance numbers, which could provide a clue of the capital flow within the crypto space.

Mid-Caps led the Altcoin Rally

Major altcoins have posted strong performances in January, practically BSV and BCH. However, OKEx Technicals the overbought situation by analyzing its MVRV ratio and believed that BSV prices might not be able to maintain at 300 levels solidly before its Genesis Hard Fork. Since then, BSV’s volatility has picked up, and the price has retreated to as low as 240.

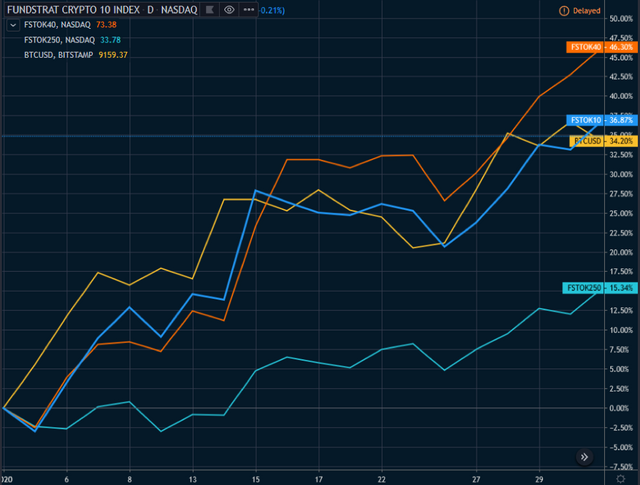

We would also like to highlight the outperformance of mid-cap altcoins in relative to small and large caps. Figure 3 shows the monthly performance of Fundstrat’s crypto capitalization-weighted indexes. The FS Crypto 40 Index (orange line), which tracks the top 11 to 50 digital currencies by market value and liquidity, surged 46% in January. In comparison, the FS Crypto 10 Index — the large-cap index (blue line), only rose 36%, while BTC added 34% of value in the same period.

We believe that low valuation could be one of the reasons behind the mid-cap strong performances. Tokens such as ETC, XLM, and ADA have reached or plummeted near their yearly lows in late 2019, and that could attract some of the value-driven investors to buy the dip. However, as the bitcoin reward halving event approaches, markets could expect to see some of the capital being reallocated back to BTC and perhaps other large-cap names in the first quarter of this year.