Oil Panic Sets Stage For Worldwide Depression

The 4/20 Oil Panic is going to go down as the straw that broke the camel's back, the extremely potent shot of moonshine that woke the country up from the Fed Fantasy that we've been living in the past few weeks.

The sad fact is that American oil just has nowhere to go. All the land-based oil storage containers will be full up by mid-May when delivery of the most recently expired futures contracts will take place. Unlike OPEC, producers in the United States can't just plop their extra oil into an idle VLCC tanker.

😍Just think of all the oil you could fit in that bad boy! Just drive it on over!

But, sadly, things are not that simple in the United States. Most of the tankers have been commandeered by other oil producers already. American frackers, the real modern day wildcatters, just don't have the money to compete with sovereign oligarchs when it comes to this stuff. So it appears that the short-lived days of the good ol' USA being the world's top oil producer will soon be gone.

The simple fact is this problem is not going away any time soon. Demand for oil has fallen off a cliff and you can't just reboot the economy like a computer. Whenever we do decide to get up off our asses and get back to work, we're still going to need some time to ramp everything back up from the standpoint of economic activity. And we sure as hell aren't going to be building any storage tanks soon. How would the workers even work to install them?

So what is going to happen is that American producers are going to shut in their wells, which is what Saudi Arabia and Russia have wanted all along anyway. The closure of those businesses is going to have a ripple effect across the American economy like you wouldn't believe. It is going to be absolutely unprecedented.

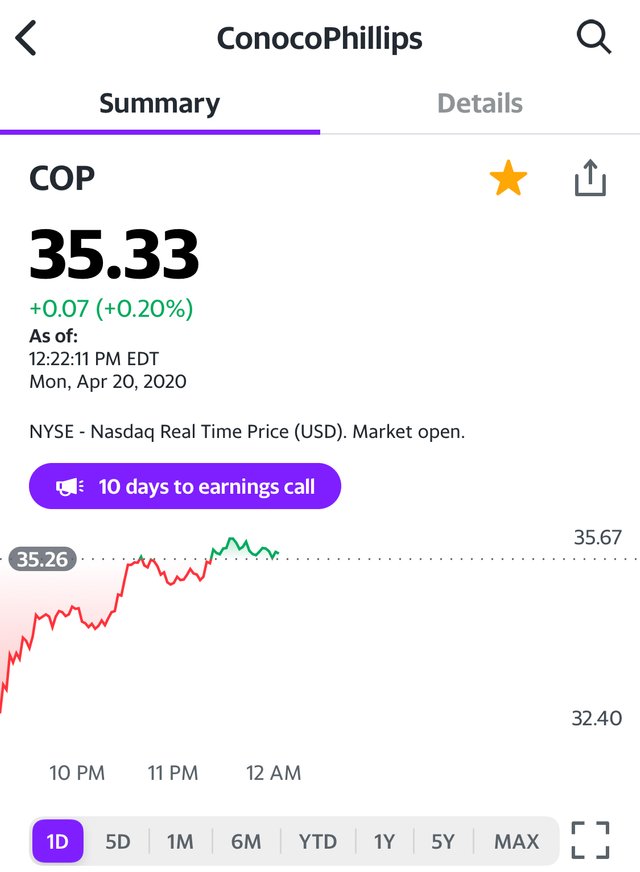

The following are screenshots from last night. I figured I might never again in my lifetime see single-digit oil prices, so I documented it. Boy was I wrong! Prices fell another $45 or so. I think they perfectly describe the idiocy of the moment that we are currently living in.

While oil prices were diving,

the price of leading oil giant ConocoPhillips (COP) was soaring:

I don't know about you, but in my opinion, these two things should not be happening at the same time!

The top chart is reality - the impact of the interaction of pure economic forces of supply, demand and storage constraints. The bottom chart is fantasy - the impact of the distorting ridiculousness that is quantitative easing on the scale of 1/5 of your economic output in a month.

It's time we woke up from this fantasy dream land and face facts.

This oil panic is the canary in the coal mine. The US economy is going down and it's going to go down hard.

Brace yourself!

Nice readable explanation! The best I've seen on a blog so far that isn't OMG OIL NEGATIVE, CRYPTO FTW! Anyway, I had forgotten about the American frackers... Their costs are higher as I understand, and OPEC would prefer them to be out of the game.

@bengy, I'm not sure how this affects crypto. In the short run, it's probably negative for prices as we've seen so much correlation between traditional assets and crypto lately. In the long run, it shouldn't affect it, I would think. But it's really hard to tell during these unprecedented times.

I think it is likely to be bad as well... However much people want crypto to be a safe haven, it just isn't at the moment.

I think lots of people seem to be confused about the futures price going negative and the current price of crude (which isn't the petrol they put in the car...).

Really a historic moment to have negative price... @shop