NFP US Rapid, Best Record.

The US economy managed to add more jobs in February, posting its biggest record since 2007 amid a soaring labor force participation. But the hourly worker wage rate was below expectations, indicating the trend of salary earlier in the year has not been so solid.

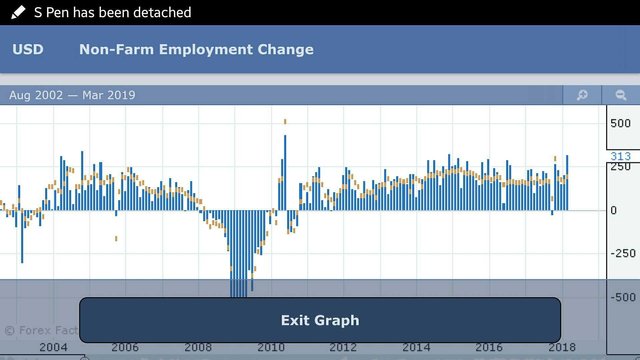

The non-farm payroll released by the Labor Department on Friday (9 / March) added 313k new jobs in February, well beyond the expectations of previous economists who predicted Payroll last month would increase by 205k. The previous NFP release was revised up quite significantly from 200k to 239k.

The unemployment rate was unchanged at a 4.1 percent rate in February. Whereas before the release, economists predict the US unemployment rate will drop to 4 percent. Please note, it has been five months in a row Unemployment Rate is in the same margin.

Wages of US Workers Grow Slower.

In a separate release, the relevant ministry also published Average Hourly Earnings or hourly hourly wages for February, which reportedly grew 0.1 percent or slower than earlier expectations of 0.2 percent growth. On an annualized basis, employee wage growth of 2.6 percent last month, or down 0.2 percent from 2.8 percent YoY growth through January.

The tonight's NFP nightly report is an indisputable proof that Uncle Job's market conditions are getting stronger in early 2018 that will boost economic growth. Despite a slowing wage release, economists agreed it was temporary over the impact of the financial turmoil that took place last month. "All factors have emerged for wages to rise, but (rising wages) still take time", says Ryan Sweet, an economist at Moody's Analytics Inc. in West Chester, Pennsylvania.

Before the report was released, Ryan said that there were still few more obstacles amidst the continuing decline in unemployment and rising wages of workers. Fed Policy Makers are almost certain to agree with the Fed's rate-hike discourse at its March 20-21 meeting, becoming the first FOMC meeting under the leadership of Jerome Powell. But the question for most market players is whether the Fed's top will keep their initial projection for the 2018 Hike Rate schedule three times, or turn it into four times, given inflation is forecast to hit the 2 percent target this year.

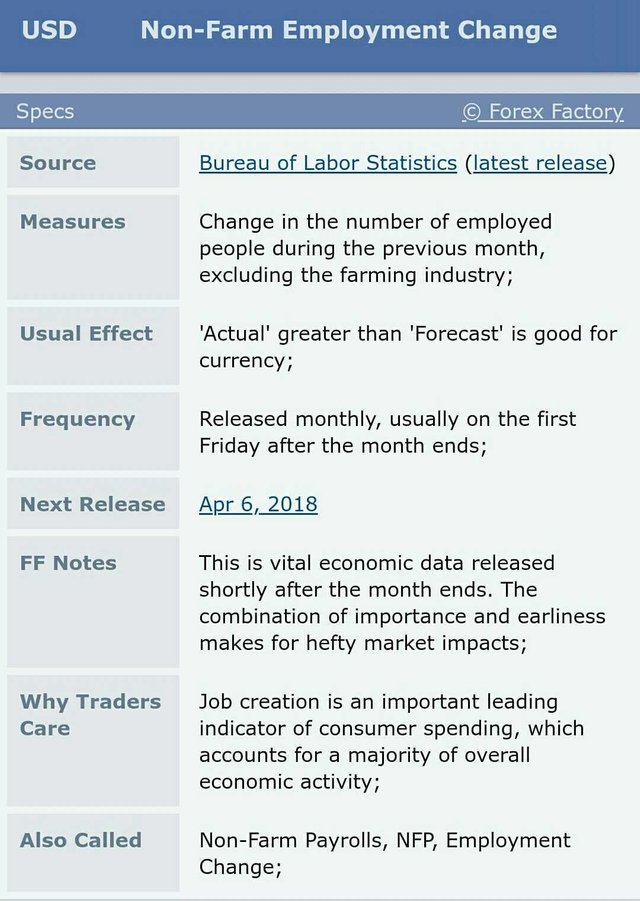

Next Release

NFP Graph

***Happy Trading All **

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bls.gov/news.release/empsit.nr0.htm

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by rizalfa from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.