Debt Rattle July 19 2018 by Raúl Ilargi Meijer

Félix Vallotton The balloon 1899

| - Is Goldman Sachs Really a Bank? Really? (Whalen) |

| - Everyone Is Smart Except Trump (Fischer) |

| - Russiagate Is Like 9/11, Except It's Made Of Pure Narrative (CJ) |

| - Kudlow: US Expecting Significant Trade Offer From EU Soon (CNBC) |

| - Mega Tech's Trillions Of Market Value In Eye-Popping Perspective (MW) |

| - Amazon Now Accounts For 49% Of US Online Retail (ZH) |

| - EU Commissioner On $5 Billion Fine: Google Has To 'Stop This Behavior' (CNBC) |

| - How Can We Reverse Brexit When Europe Doesn't Want Us Back? (Münchau) |

| - Police 'Identify' Skripal Suspects (PA) |

| - Cali High Court Orders Proposal To Split Up State Removed From Ballot (R.) |

| - The Cashless Society Is A Con -- And Big Finance Is Behind It (G.) |

| - The Most Unbelievable Tax Break Ever (F.) |

No, it's not.

Most of the largest US banks that reported earnings this week saw interest expense rise by mid-double digits even as interest earnings rose by single digits. Goldman Sachs, for example, saw its funding expenses increase 61% year-over-year (YOY) in Q2'18 while interest income rose just 50%. Citigroup (C), on the other hand, being already positioned in the world of institutional funding, saw interest expense rise only 28%. But the Q2'18 earnings seem to confirm a rising trend in funding costs that could see NIM flatten out and decline by 2019. When Solomon's ascension to the top spot was announced at Goldman Sachs, our friend Bill Cohan commented on CNBC that this amounted to a takeover of GS by alumni of Bear, Stearns & Co. God does have a sense of humor.

He also reminded Andrew Sorkin et al on Squawk Box that the freewheeling Goldman of old is long gone and that GS is now run and regulated as "a bank." Well, no, not really. Goldman Sachs is basically a broker-dealer with a small bank in tow. When you compare the net interest margin of GS with its peers, for example, the other members of Peer Group 1 defined by the FFIEC reported NIM of 3.28% vs 0.41% for GS in Q1'18. Because the bank unit of GS is so small, the overall NIM for the group is 1/10th of its peers compared with total assets. Goldman makes less than 2% on earning assets vs almost 4% for its asset peers. So to paraphrase the wisdom of Josh Brown, GS does not make money on interest rates, up or down, but rather earns fees from trading and investment banking. GS profits from the spread, both in terms of price and volume.

The basic problem confronting David Solomon and his colleagues is that GS really is not a bank. It is regulated like a bank and therefore constrained in terms of business activities, but it does not earn the carry on assets that most banks take for granted when they turn on the lights each morning. Talk of expanding the banking side of the business (aka "Marcus") is fine, but progress in this regard is very slow indeed. Of the $9.4 billion in net revenues reported in Q2'18, just $1 billion represented net interest earnings.

My Twitter account risks becoming unreadable because of this. I like diverse points of view, but there's just too much nastiness. People retweeting factoids dozens of times a day.

It really is quite simple. Everyone is smart except Donald J. Trump. That's why they all are billionaires and all got elected President. Only Trump does not know what he is doing. Only Trump does not know how to negotiate with Vladimir Putin. Anderson Cooper knows how to stand up to Putin. The whole crowd at MSNBC does. All the journalists do. They could not stand up to Matt Lauer at NBC. They could not stand up to Charlie Rose at CBS. They could not stand up to Mark Halperin at NBC. Nor up to Leon Wieseltier at the New Republic, nor Jann Wenner at Rolling Stone, nor Michael Oreskes at NPR, at the New York Times, or at the Associated Press. But --- oh, wow! --- can they ever stand up to Putin! Only Trump is incapable of negotiating with the Russian tyrant.

Remember the four years when Anderson Cooper was President of the United States? And before that --- when the entire Washington Post editorial staff jointly were elected to be President? Remember? Neither do I. The Seedier Media never have negotiated life and death, not corporate life and death, and not human life and death. They think they know how to negotiate, but they do not know how. They go to a college, are told by peers that they are smart, get some good grades, proceed to a graduate degree in journalism, and get hired as analysts. Now they are experts, ready to take on Putin and the Iranian Ayatollahs at age 30. That is not the road to expertise in tough dealing. The alternate road is that, along the way, maybe you get forced into some street fights.

Sometimes the other guy wins, and sometimes you beat the intestines out of him. Then you deal with grown-ups as you mature, and you learn that people can be nasty, often after they smile and speak softly. You get cheated a few times, played. And you learn. Maybe you become an attorney litigating multi-million-dollar case matters. Say what you will about attorneys, but those years --- not the years in law school, not the years drafting legal memoranda, but the years of meeting face-to-face and confronting opposing counsel --- those years can teach a great deal. They can teach how to transition from sweet, gentle, diplomatic negotiating to tough negotiating. At some point, with enough tough-nosed experience, you figure out Trump's "The Art of the Deal" yourself.

Well, it sells. Bigtime.

[..] the current administration has actually been far more aggressive against Russia than the previous administration was, and has worked against Russian interests to a far greater extent. If they wanted to, the international alliance of plutocrats and intelligence/defense agencies could just as easily use their near-total control of the narrative to advance the story that Trump is a dangerous Russia hawk who is imperiling the entire world by inflicting insane escalations against a nuclear superpower. They could elicit the exact same panicked emotional response that they are eliciting right now using the exact same media and the exact same factual situation. They wouldn't have to change a single thing except where they place their emphasis in telling the story.

The known facts would all remain exactly as they are; all that would have to change is the narrative. Public support for Russiagate depends on the fact that most people don't recognize how pervasively their day-to-day experience is dominated by narrative. If you are intellectually honest with yourself, you will acknowledge that you think about Russia a lot more now than you did in 2015. Russia hasn't changed any since 2015; all that has changed is the narrative that is being told about it. And yet now the mass media and a huge chunk of rank-and-file America now view it as a major threat and think about it constantly. All they had to do was talk about Russia constantly in a fearful and urgent way, and now US liberals are convinced that Vladimir Putin is an omnipotent world-dominating supervillain who has infiltrated the highest levels of the US government.

Juncker to visit Trump next week.

Top White House economic adviser Larry Kudlow said the administration expects a significant trade offer to come from the European Union soon. In an interview at CNBC's Delivering Alpha conference in New York on Wednesday, Kudlow said a lot of discussions are being held with individual countries. EU President Jean-Claude Juncker is coming to Washington next week, Kudlow said. "We will be in discussions," he said. "I am told he's bringing a very important free trade offer." Kudlow added he couldn't confirm that.

President Donald Trump has opened trade discussions on numerous fronts, using tariffs on products like steel and aluminum imports and the threat of tariffs on automobiles to get people to the negotiating table. The tariffs have rankled long-time allies in Europe and elsewhere, and tensions elevated after Trump's visit to the NATO summit last week. That hasn't deterred progress, however. "I am told through sources, including our ambassadors, that [German Chancellor Angela] Merkel has been working on that, shaking up the EU," Kudlow said. "The president has put things on the table. The Europeans are looking at them, okay? And we may be pleasantly surprised."

"Value".

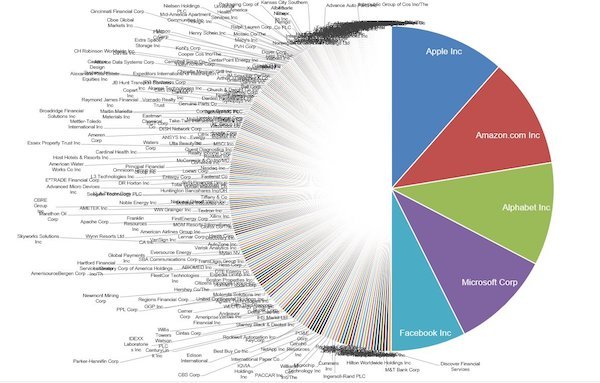

A picture is worth a thousand words but a pie chart may be more eloquent, especially when it comes to sizing up the giants of the tech industry. Michael Batnick, director of research at Ritholtz Wealth Management, on Wednesday tweeted out a chart that underscored how absolutely dominant tech companies have become in a world where size seems to increasingly matter. Batnick, in his tweet, noted that the top five S&P 500 companies --- Apple, Amazon.com, Alphabet Inc., Microsoft and Facebook --- combined are worth $4.095 trillion versus $4.092 trillion for the bottom 282 companies.

As mind-boggling as that may be, Batnick told MarketWatch that this sort of concentration is normal, pointing out that AT&T and General Motors represented 14.5% of the S&P 500 during their heyday in 1965. What is different today, however, is that all the big players are uniformly tech names. "The gains have been extraordinary over the past five years, with Facebook, Apple, Amazon, Microsoft and Google growing from $1.2 trillion to near $4 trillion," wrote Batnick in a recent blog entry.

At what point do we call it a monopoly?

Amazon will account for 49.1% of all online retail sales, up from 43% the year before, if they clear an expected $258 billion in sales this year. The stunning figure provided by research firm eMarketer is tempered by the fact that Amazon's near-majority share of online sales accounts for just 5% of all retail sales. Amazon is set to rake in $258.22 billion in US retail sales in 2018, while annual growth has jumped 29.2% year-over-year, reports Tech Crunch. Fueling Amazon's rise is a robust network of third-party sellers and a rapidly expanding range of goods from groceries to fashion -- made all the more attractive for subscribers of their Prime services.

Now, it is fast approaching a tipping point where more people will be spending money online with Amazon, than with all other retailers --- combined. Amazon's next-closest competitor, eBay, a very, very distant second at 6.6 percent, and Apple in third at 3.9 percent. Walmart, the world's biggest retailer when counting physical stores, has yet to really hit the right note in e-commerce and comes in behind Apple with 3.7 percent of online sales in the US. -TC

And more fines coming. But who pays in the end?

The EU's commissioner for competition, Margrethe Vestager, said Google has to "stop this behavior" in an interview with CNBC on Wednesday, after a record antitrust fine against the company. "The thing that Google has to do now is of course to stop," Vestager told "Squawk on the Street." "This of course will free up the market to allow mobile manufacturers to use other Android systems." Regulators hit the Alphabet unit with a $5 billion fine for abusing the dominance of its Android mobile operating system -- by far the most popular smartphone OS in the world. The EU says Google pushed device makers to bundle Google apps like the Chrome web browser and Gmail, which harms competition. The European Commission, the EU's executive body, threatened additional fines if Google didn't put an end to illegal conduct within 90 days.

"They have products that we all like and like to use," Vestager said. "The only thing we don't like is when they get to misuse their success and put in place illegal restrictions." Wednesday's fine is the largest ever issued to Google, dwarfing even the $2.7 billion penalty from the EU last year for favoring its shopping service over competitors. The company plans to appeal the ruling, according to a statement. The commission is still investigating a third antitrust case against Google's search advertising service, AdSense. "This is not about Apple, this is not about Android, this is about Google behavior --- a behavior that's illegal for a dominant company because it's locking down competition and disabling innovation and choice that we would all like to enjoy," Vestager said.

Good question. But first more mayhem at home.

What strikes me most about the Brexit discussions in the UK is not the usual Eurosceptic xenophobia, but the lack of understanding of the EU's position by those who campaign in favour of a Brexit reversal. The leaders of the EU are officially disappointed that Britain is headed for the door; secretly they will be relieved when it goes. In truth, the EU does not really want Brexit to be reversed. Why? Britain has a reputation as an obstreperous "partner" in the institutions, and in the past has sometimes made it harder for Europe to move forward---most notoriously in 2011, when David Cameron used the euro--crisis to try and extract concessions on other things. In the event of a reversal, the Europeans would rightly assume that the ghost of Brexit would never go away.

Ukip would be back in the European Parliament, adding strength to the Salvini and Le Pen factions. Brussels, Berlin and Paris could all do without that. Let's imagine---and it's more of a leap than many Remainers acknowledge---that all the legal questions could be swept out of the way. I suppose the EU would ultimately accept a reversal, but without enthusiasm---and with conditions. If a UK prime minister wrote a letter to Donald Tusk, president of the European Council, asking for Brexit to be reversed, he would immediately invoke a special EU summit, in which the other leaders would make at least three demands: the first is an end to the British budget rebate for the next budget period, and perhaps also an end to certain other instances of special treatment, such as on the Charter of Fundamental Rights.

Secondly, the EU would insist that the UK could not block decisions they have taken since the UK announced its intention to leave. The third ask would be for a political commitment by the big political parties not to trigger Brexit again after the next elections. Just let that sink in for a minute. And in any second referendum, the Brexiteers could reasonably argue that the UK was not simply remaining, but doing so on much less advantageous terms. Britain, in other words, would inject a whole new wave of political instability and unpleasantness into its own politics, and those of the continent, if---after all the turmoil---it tried to remain. It would become harder, not easier, for Europe to grapple with the really big challenges it faces with the UK back on board.

No they haven't. An unnnamed cources alleges the police say it's the Russians. And that is presented as news. Because waiting for proof is so last century.

Police are believed to have identified the suspected perpetrators of the Novichok attack on Russian former spy Sergei Skripal. Officers think several Russians were involved in the attempted murder of the former double agent and daughter Yulia in Salisbury and are looking for more than one suspect. A source with knowledge of the investigation told the Press Association: "Investigators believe they have identified the suspected perpetrators of the Novichok attack through CCTV and have cross-checked this with records of people who entered the country around that time. They (the investigators) are sure they (the suspects) are Russian."

The news comes as an inquest is due to open on Thursday for Dawn Sturgess, 44, who died earlier this month, eight days after apparently coming into contact with Novichok from the same batch used in the attempted murder of the Skripals in March. Her partner Charlie Rowley, 45, was left fighting for his life after also being contaminated by the chemical weapon. It is understood Sturgess was exposed to at least 10 times the amount of nerve agent the Skripals came into contact with. Investigators are working to the theory that the substance was in a discarded perfume bottle found by the couple in a park or somewhere in Salisbury city centre and Sturgess sprayed Novichok straight on to her skin, the source said.

Some rich guy's hobby.

The California Supreme Court on Wednesday ordered the November ballot purged of an initiative that seeks to split California into three states, citing significant questions raised about the proposal's validity. State election officials certified last month that supporters of the so-called Cal3 measure, also known as Proposition 9, had collected enough signatures to qualify it for the ballot in the country's most populous state. An environmental group, the Planning and Conservation League, challenged the measure in court, arguing it posed a "revision" of the state constitution -- as opposed to an amendment -- that is too sweeping to be legally subjected to the direct consent of the voters.

Siding with opponents for the time being, the court directed state election officials to keep the measure off the upcoming November ballot to allow the justices sufficient time to review and decide the merits of the case. The court left open the possibility of allowing the initiative to be put before voters in the future, saying the "potential harm in permitting the measure to remain on the ballot outweighs" the harm of its delay. The initiative was launched by billionaire Silicon Valley venture capitalist Tim Draper, who has argued that California's size makes it ungovernable. He failed in two previous bids to qualify a six-way split of California for the ballot.

Nudging.

All over the western world banks are shutting down cash machines and branches. They are trying to push you into using their digital payments and digital banking infrastructure. Just like Google wants everyone to access and navigate the broader internet via its privately controlled search portal, so financial institutions want everyone to access and navigate the broader economy through their systems. Another aim is to cut costs in order to boost profits. Branches require staff. Replacing them with standardised self-service apps allows the senior managers of financial institutions to directly control and monitor interactions with customers. Banks, of course, tell us a different story about why they do this.

I recently got a letter from my bank telling me that they are shutting down local branches because "customers are turning to digital", and they are thus "responding to changing customer preferences". I am one of the customers they are referring to, but I never asked them to shut down the branches. There is a feedback loop going on here. In closing down their branches, or withdrawing their cash machines, they make it harder for me to use those services. I am much more likely to "choose" a digital option if the banks deliberately make it harder for me to choose a non-digital option. In behavioural economics this is referred to as "nudging". If a powerful institution wants to make people choose a certain thing, the best strategy is to make it difficult to choose the alternative.

We can illustrate this with the example of self-checkout tills at supermarkets. The underlying agenda is to replace checkout staff with self-service machines to cut costs. But supermarkets have to convince their customers. They thus initially present self-checkout as a convenient alternative. When some people then use that alternative, the supermarket can cite that as evidence of a change in customer behaviour, which they then use to justify a reduction in checkout employees. This in turn makes it more inconvenient to use the checkout staff, which in turn makes customers more likely to use the machines. They slowly wean you off staff, and "nudge" you towards self-service.

Looks like a good story. But is it?

Success Street in North Charleston, South Carolina, might be the most misnamed place in America, a path through a weedy, desolate neighborhood with 20% unemployment and a 40% poverty rate. Its biggest claim to fame strolls past the gritty brick apartment buildings and tumbledown bungalows on a muggy morning in late June: Timothy Scott, a local product who grew up to become the first black Republican U.S. senator in more than three decades. Joining Scott is another success story: the frenetic, peripatetic tech billionaire Sean Parker, who flew in by private jet from Los Angeles' ritzy Holmby Hills for a personal tour of the senator's hometown.

"I remember so many kids with amazing potential who died on the vine," Scott says as he surveys the shuttered Chicora Elementary School, where weeds climb the walls and graying plywood shields shattered windows. "The frustration, irritation and low expectations were so pervasive here that I always wanted to make a difference." He now may get his chance. Today's visit is less a grim walk down memory lane than a legislative victory lap for Scott and Parker. The unlikely pair are core members of an even more unlikely group of conservatives and liberals, capitalists and philanthropists, U.S. lawmakers and small-town mayors who have successfully created one of the greatest tax-avoidance opportunities in American history, in the service of underperforming American cities and neighborhoods.

For all the focus on drastic tax-rate cuts, the fate of the state and local tax deduction and the exploding federal deficits, it's the least-known part of last year's tax-cut law that could be the most consequential. Officially called the Investing in Opportunity Act, it promises to pump a massive amount of cash into America's most impoverished communities by offering wealthy investors and corporations a chance to erase their tax obligations. [..] The heart of this new law: Opportunity Zones, or "O-zones," low-income areas designated by each state. Investors will soon be able to plow recently realized capital gains into projects or companies based there, slowly erase the tax obligations on a portion of those gains and, more significantly, have those proceeds grow tax-free. There are almost no limits.